Challenger Energy, the company previously known as the Bahamas Petroleum Company, has formally signed a license agreement for the AREA OFF-1 petroleum license offshore Uruguay. The AREA OFF-1 license has a total area of approximately 15,000 km2 and is situated in water depths from 20 to 1000 meters, approximately 100 kms off the Uruguayan coast.... Continue Reading →

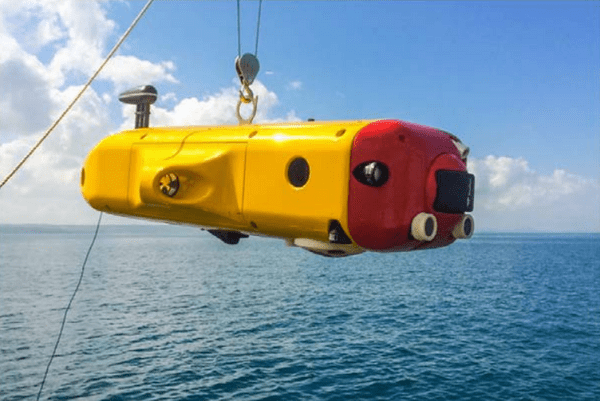

Shell, Petrobras assign inspection duty to Saipem subsea drone

Saipem has been contracted by Shell and Petrobras for the utilisation of its FlatFish subsea drone in two pilot projects involving the inspection campaigns of two ultra-deepwater fields offshore Brazil, operated by the two energy companies. The two projects with Shell and Petrobras are pilots within the framework of the research and development program of... Continue Reading →

Talos Energy Pauses Mexico Oil Arbitration Bid Amid High-level Talks

(Reuters) U.S.-based oil producer Talos Energy has temporarily suspended pursuit of an arbitration claim against Mexico amid high-level talks over one of the country's flagship offshore projects, five people close to the matter said. The dispute erupted after Mexico selected state-run Petroleos Mexicanos (Pemex) as the operator of their shared 850-million-barrel Zama field ahead of Talos,... Continue Reading →

Westwood: Offshore Drilling Rig Utilization Much Higher Than Typically Reported

(OE) Utilization is one of the key barometers of the health of the offshore rig market, as it identifies what percentage of the usable fleet is available versus what is not. While there has been much excitement over the past year regarding rapidly increasing offshore rig utilization (and dayrates), it appears the true extent of... Continue Reading →

TotalEnergies launches sale of stake in Nigerian oil joint venture

(Reuters) - TotalEnergies (TTEF.PA) has launched the sale of its 10% stake in Nigerian joint venture SPDC, with Canada's Scotiabank leading the sale as financial adviser, a sale document tendering for interest showed. TotalEnergies announced the sale in late April. Scotiabank declined to comment. TotalEnergies declined to comment on the financial adviser. TotalEnergies confirmed it was selling... Continue Reading →

3R Petroleum: Reserves Report Update

3R PETROLEUM ÓLEO E GÁS S.A. (“3R” or “Company”) (B3: RRRP3) communicates to its shareholders, investors and the market in general the result of the updates of the reserves reports of the Macau and Recôncavo Clusters, prepared by the independent consultancy DeGolyer and MacNaughton, and of the Rio Ventura, Fazenda Belém and Pescada and Arabaiana... Continue Reading →

Petrobras begins the binding phase of E&P assets in the Sergipe-Alagoas Basin

Petróleo Brasileiro S.A. – Petrobras, following up on the release disclosed on 04/11/2022, informs that today it started the binding phase regarding the sale of its total participation in the Tartaruga field, located in shallow waters of the Sergipe-Alagoas Basin, state of Sergipe. Potential buyers qualified for this phase will receive a process letter with... Continue Reading →

3R Petroleum to approach global trading companies about partnerships in the Potiguar Cluster

(epbr) 3R Petroleum is approaching global trading companies interested in joining the Potiguar Cluster as partners. The company intends to deepen the studies on the financial evaluation of the cluster's infrastructure assets, before taking a decision on a potential partnership. In January, the company signed a contract with Petrobras, in the amount of US$ 1.38... Continue Reading →

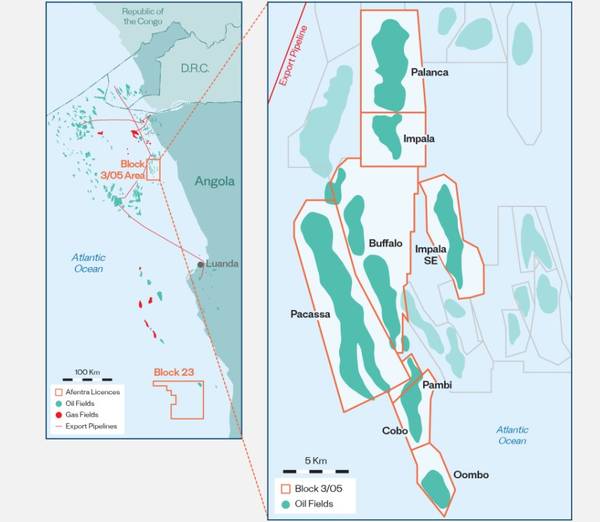

Afentra to Buy Into Two Offshore Blocks in Angola

Oil and gas company Afentra plc, led by former Tullow CEO Paul McDade, has signed an agreement with Angola's Sonangol to buy interests in Block 3/05 and Block 23, offshore Angola. Afentra will pay $80 million and could also pay contingent payments of up to $50 million in aggregate in the case of Block 3/05, with... Continue Reading →

The last barrel: Offshore activity to rebound

Craig Fleming (WO) With the havoc created by the war in Ukraine and the hard push to convert to renewables, operators are once again focusing on the high ROI that offshore prospects offer. There is an onslaught of good news and positive indicators that suggest operators are poised to significantly increase offshore development in 2022. ... Continue Reading →