(Reuters) – Two U.S. investment funds on Tuesday said they formed a joint venture with a Venezuelan firm to pursue oil and gas exploration and production projects in the U.S.-sanctioned South American country.

Gramercy Funds Management and Atmos Global Energy said their joint venture would work with an arm of Inelectra Group, a Caracas-based firm that holds a stake in the Gulf of Paria East oil project off Venezuela’s eastern coast, where it found oil in 2001.

U.S. companies are barred from doing business with Venezuelan state-run oil firm PDVSA, a policy begun in 2018 by the Trump administration and continued under U.S. President Joe Biden.

The companies did not disclose the size of their investment in the oil venture. Spokespeople did not immediately reply to requests for comment.

Any effort is subject to approvals by the United States and Venezuela, the companies said.

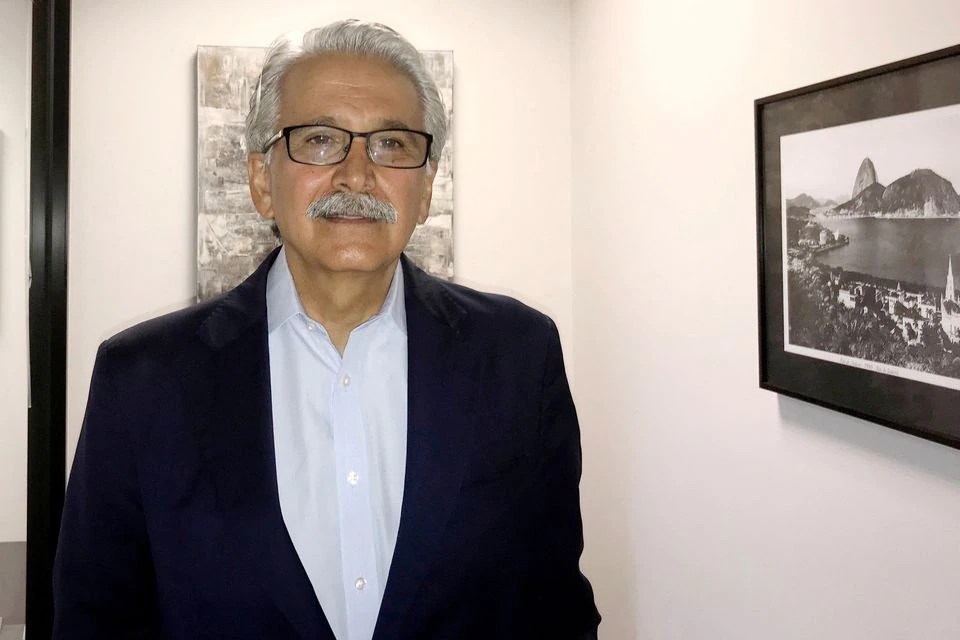

Ali Moshiri, a U.S. executive and former chief of Chevron Corp’s Latin American operations, set up an investment fund in 2019 to pursue energy projects in Venezuela. The partners aim to “contribute to balancing oil supply and demand,” he said in a statement.

The oil effort “will be beneficial to U.S. interests in the region and the U.S. economy by lowering fuel prices for American consumers,” said Matt Maloney, a partner at Connecticut-based emerging market investor Gramercy.

I am looking for a reliable and trustworthy overseas investment partner to manage my funds provided we can reach an agreement on percentage for Return On Investment or do you have any good business idea in mind that requires funding or do you need a personal loan to fund your business for as low as 3% interest per annum.

Kindly contact me, if interested, so that we can deliberate further.

Email: herbert.h@hiltonmachineries.com

Website: https://hiltonmachineries.com

Mr. Herbert Hilton

LikeLike

Would you have interest in US based mature onshore upstream assets?

LikeLike