(Reuters) - Oil producer Guyana could resume talks with India for a deal to sell the government's share of crude as output rises next year, the South American nation's vice president told Reuters. Earlier this year, Indian refiners bought at least two test cargoes of Guyana's Liza light sweet crude. But government-to-government negotiations on a... Continue Reading →

With record 2.85 million boed, the pre-salt production hits a 74.19% share of the national total in September

In September, pre-salt oil and natural gas production totaled 2.85 million barrels of oil equivalent per day (boe/d), representing 74.10% of the national total (3.84 million boe/d) . It was the biggest historical record of monthly production in the Pre-salt, both in absolute terms and in percentage of participation in the country's total production. The... Continue Reading →

EXCLUSIVE U.S. slows down oil and gas mergers-sources

(Reuters) - U.S. antitrust regulators have extended the approval process for at least five oil and gas mergers and acquisitions in the last three months, as President Joe Biden's administration scrutinizes deals in a bid to tackle soaring energy prices, according to regulatory filings and corporate lawyers. The slowdown comes amid growing pressure on policymakers... Continue Reading →

Petrobras – Highlights on production and sales in 3Q21

Petrobras - In 3Q21, we continued to operate safely and with a solid performance, still with a differentiated regime and special protocols due to the pandemic scenario, but with a gradual increase in the number of people on board. The average production of oil, LGN and natural gas reached 2.83 MMboed, 1.2% above 2Q21, mainly... Continue Reading →

Big fossil fuel producers’ plans far exceed climate targets, U.N. says

(Reuters) - Major economies will produce more than double the amount of coal, oil and gas in 2030 than is consistent with meeting climate goals set in the 2015 Paris accord to curb global warming, the United Nations and researchers said on Wednesday. The U.N. Environment Programme's (UNEP) annual production gap report measures the difference... Continue Reading →

TOTALENERGIES IS STILL ATTRACTED BY BRAZILIAN OIL AND GAS MARKET

(Valor) TotalEnergies (formerly Total) promises to intensify investments in renewables, but, at the same time, it is looking closely at the Brazilian oil and gas market. The French oil company, which changed its name to symbolize its migration towards the energy transition, sees Brazil as a strategic player in the search for projects with increasingly... Continue Reading →

IBAMA GRANTS OPERATING LICENSE FOR THE SECOND EARLY PRODUCTION SYSTEM IN MERO

The Brazilian Institute for the Environment (Ibama) granted Petrobras the operating license for the second Early Production System (SPA-2) in the Mero field, located within the Libra block, in the pre-salt of the Santos basin. As well as the first SPA in the area, this new project will also be carried out with the FPSO... Continue Reading →

How to Ensure Oil & Gas Infrastructure Still Has Value

(OE) By David Linden Head of Energy Transition at Westwood Global Energy Group If we want to reach net zero by 2050, there is an increasingly high risk that some of the oil and gas infrastructure investments (i.e. in platforms, pipelines, processors, storage sites etc) made today will result in stranded assets. In other words,... Continue Reading →

Occidental sells stakes in two Ghana fields for $750 million

Houston-based Occidental has agreed to sell its interests in two Ghana offshore fields for $750 million to Kosmos Energy ($550 million) and Ghana National Petroleum Corporation (GNPC) ($200 million). The sale to Kosmos closed upon signing and the sale to GNPC is expected to close in the fourth quarter of 2021. The transaction includes Occidental’s... Continue Reading →

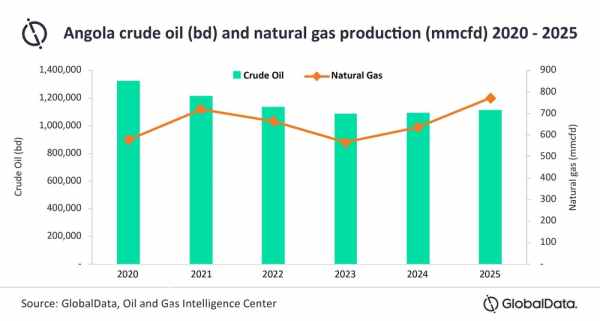

Angolan oil production down, gas up

(OM) Angola’s crude oil production has declined almost 30% in just six years, from 1.7 MMb/d in 2015 to just shy of 1.2 MMb/d in 2021, according to GlobalData. The company now expects further decline for the country through to 2025, which is forecast to see about 1.1 MMb/d – despite the multiple expansion projects that... Continue Reading →