(WO) Oil headed for its worst trading day in almost three months as recession fears iced markets, outweighing a fundamentally tight supply market. West Texas Intermediate crude futures dropped as much as 10%, the most since March 9. Risk off sentiment spread throughout markets on escalating concerns that a global economic slowdown will ultimately hobble... Continue Reading →

Exclusive: OPEC sees global oil demand growth slowing in 2023, sources say

(Reuters) - World oil demand growth will slow in 2023, OPEC delegates and industry sources said, as surging crude and fuel prices help drive up inflation and act as a drag on the global economy. Fuel use has rebounded from the 2020 pandemic-induced slump and is set to exceed 2019 levels this year even as... Continue Reading →

Goldman raises Brent price outlook on unresolved supply deficit

(Reuters) - Goldman Sachs increased its Brent oil price forecasts by $10 to $135 a barrel for the period between the second half of 2022 and the first half of next year, reasoning that a structural supply deficit was still unresolved. Prices would need to rise to the forecast level for supply to normalize by... Continue Reading →

Brent Climbs Above $120/bbl after Saudi Arabia Hikes Crude Prices

(Reuters) Oil futures jumped on Monday, with Brent rising above $120 a barrel after Saudi Arabia hiked prices for its crude sales in July, signaling tight supply even after OPEC+ agreed to accelerate output increases over the next two months. Brent crude was up 91 cents, or 0.8%, at $120.63 a barrel at 0343 GMT... Continue Reading →

Oil Prices Extend Gains after EU Bans Most Russia Oil Imports

(Reuters) Oil prices extended gains on Tuesday after the EU agreed to slash oil imports from Russia, fueling worries of a tighter market already strained for supply amid rising demand ahead of peak U.S. and European summer driving season. Brent crude for July, which expires on Tuesday, rose $2.19, or 1.8%, to $123.86 a barrel... Continue Reading →

Oil prices climb above $120 a barrel ahead of EU meeting on Russia sanctions

(Reuters) - Oil prices climbed above $120 a barrel on Monday, hitting their highest in more than two months, as traders waited to see whether a European Union meeting would reach an agreement on banning Russian oil imports. The Brent crude futures contract for July, which will expire on Tuesday, was up 59 cents, or... Continue Reading →

Analysis: How the Ukraine conflict is reshaping global oil markets

(Reuters) - Russia's invasion of Ukraine has reconfigured the global oil market, with African suppliers stepping in to meet European demand and Moscow, stung by Western sanctions, increasingly tapping risky ship-to-ship transfers to get its crude to Asia. The reroutings mark the biggest supply-side shakeup of the global oil trade since the U.S. shale revolution... Continue Reading →

Oil snaps inverse dollar link leaving little to check its bull run

(Reuters) - Oil's bull run is taking little notice of the strong U.S. dollar, breaking crude's historical inverse link to the greenback and giving analysts confidence it has further to go based on current market fundamentals. A strong dollar typically weighs on oil prices because it makes the commodity more expensive for holders of other... Continue Reading →

Oil hedge funds caught between sanctions and recession

(Reuters) - Portfolio investors have left their petroleum positions essentially unchanged for the last nine weeks as loss of production from Russia is matched by loss of consumption from China and Europe. Hedge funds and other money managers held a net position in the six most important petroleum-related futures and options contracts of 548 million... Continue Reading →

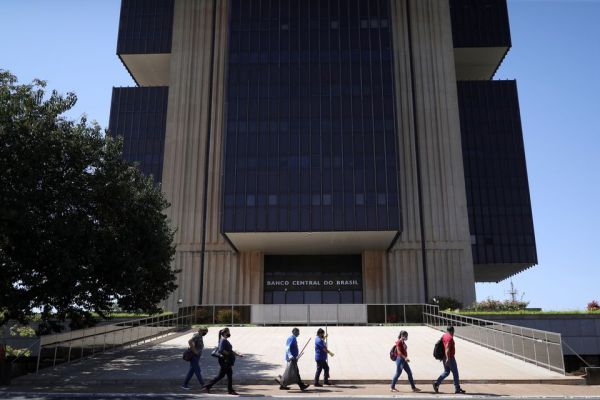

Brazil’s inflation hits highest for April in 26 years, +12.1% in 12 months

(Reuters) - Brazil's inflation slowed in April but still posted the steepest rise for the month in 26 years, pushing the 12-month figure to over 12% amid continued pressures on food and fuel, official figures showed on Wednesday. Consumer prices as measured by the benchmark IPCA index rose 1.06% in April, slightly above the 1.0%... Continue Reading →