Feb. 18 (oilprice.com) A slew of high-quality oil discoveries in offshore Block 58 by TotalEnergies and its 50% partner, APA Corporation, has seen the tiny South American country of Suriname touted as the next Guyana. While Suriname’s offshore waters hold considerable petroleum potential, the country’s oil boom has been fraught with delays. Conflicting geological data, high gas-to-oil ratios, poor drilling results and economic headwinds are weighing heavily on the former Dutch colony’s oil boom. There is no certainty that Suriname will ever enjoy the economic windfall that petroleum has delivered for neighboring Guyana.

In the latest news, the International Monetary Fund (IMF), which in 2021 bailed Paramaribo out with a $572 billion loan package, expressed concerns about Suriname’s economic stability. The IMF went on to assert, “Fiscal and monetary slippages in 2025 have eroded earlier stabilisation gains.” The fiscal slippage was due to excessive government spending and insufficient revenue, which were draining Paramaribo’s coffers. Those concerns were triggered by gross public debt rising to 106% of gross domestic product (GDP) during 2025 and inflation returning to double figures, hitting a worrying 13% by the end of the year.

For these reasons, the IMF is concerned that Suriname is unable to weather any further financial shocks after a tumultuous decade marked by crises. After a decade of endemic corruption, malfeasance and maladministration at the hands of President Dési Bouterse, a former military strongman who was convicted of narcotics trafficking and murder. Toward the end of Bouterse’s presidency, Suriname faced a severe economic downturn, with GDP shrinking by 3.4% in 2015 and by 4.9% in 2016. This culminated in a steep 16% drop in GDP for 2020 as the global COVID-19 pandemic hit developing countries hard.

Suriname is among the world’s most heavily indebted countries. IMF data show gross government debt is nearly 83% of GDP. While that number may be lower than many large,r more developed economies, it is especially worrying because Suriname’s small economy has stagnated over the last decade. Even IMF-mandated neoliberal economic reforms, including reining in fiscal spending, substantially devaluing the Suriname dollar and ending costly energy subsidies, failed to spark a major recovery. This is weighing heavily on the economy while sharply impacting the quality of life for everyday people.

There are concerns about Paramaribo’s lack of preparedness to manage the massive influx of fiscal income from a major petroleum boom, with poor governance and corruption recurring themes in Suriname’s modern history. After a decade of economic stagnation, which sparked violent protests during 2021, Paramaribo is hungry for the tremendous economic growth that petroleum production can deliver. While Suriname’s economy is picking up, with the IMF forecasting 3.7% GDP growth for 2026, that figure is only a sixth of the 23% projected for neighboring Guyana, where rising oil production is driving GDP growth.

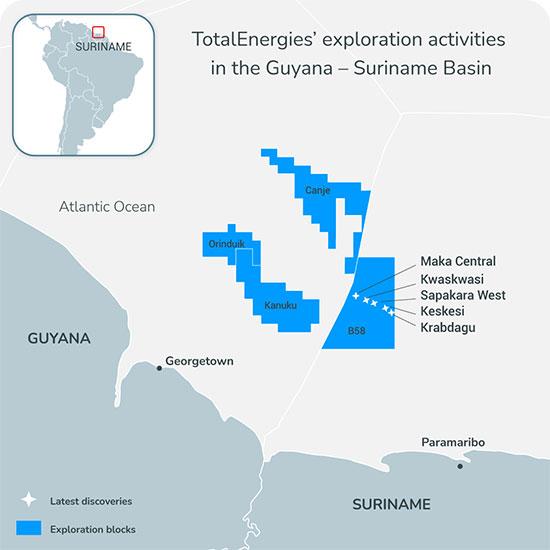

In less than a decade, Guyana went from first oil to becoming the world’s seventh-wealthiest country by GDP per capita, measured by purchasing power parity. Suriname’s economic future hinges on offshore Block 58, where French supermajor TotalEnergies is the operator and 50% partner with Houston-based APA Corporation. Since 2020, the drillers have made 5 major oil discoveries in the 1.4-million-acre block.

It is in offshore Block 58 that TotalEnergies is developing the GranMorgu petroleum project, located 93 miles offshore from Paramaribo. The $10.5 billion project is developing the Sapakara and Krabdagu discoveries, targeting a reservoir estimated to contain around 760 million barrels of crude oil. It is anticipated that GranMorgu will be commissioned during 2028, meaning it will take Suriname roughly 8 years or double the 4 years for Guyana’s offshore Stabroek Block to go from first discovery to first oil. The facility will have a capacity to lift 220,000 barrels per day and is expected to generate $26 billion in revenue for Paramaribo over its operational life.

According to TotalEnergies, GranMorgu will be a world-leading low-emission crude oil producing operation with carbon emissions of less than 16 kilograms of carbon dioxide per barrel of oil lifted. This is less than the estimated global average of 18 kilograms per barrel lifted and significantly lower than the carbon emitted by heavy oil operations in Venezuela and Canada. Heavy oil operations in Venezuela’s Orinoco Belt are some of the most carbon-intensive in the world, with top export blend Merey ranked as a major carbon emitter. Canadian heavy crude production is also responsible for considerable greenhouse gas emissions, making it the world’s most carbon-intensive crude oil to extract.

TotalEnergies’ push to make the GranMorgu project a world-class, low-emission oil-producing facility hints at the considerable potential of Suriname’s territorial waters. Indeed, like the oil discovered in nearby Guyana, the oil discovered in offshore Suriname is light and sweet, with an API gravity of around 35 to 40 degrees and asulfur content of less than 0.6%. Those attributes make the crude oil produced cheaper and easier to refine into high quality low emission fuels, which is an important characteristic at a time when there is a major global push to cut carbon emissions. While there will be further glitches ahead for Suriname’s oil boom, the commissioning of GranMorgu will deliver a solid economic windfall for one of South America’s poorest countries.

By Matthew Smith

Leave a comment