Royal Dutch Shell Plc said its record takeover of BG Group Plc will still deliver value to investors even in a prolonged oil-industry downturn and reshaped its business in preparation for the acquisition.

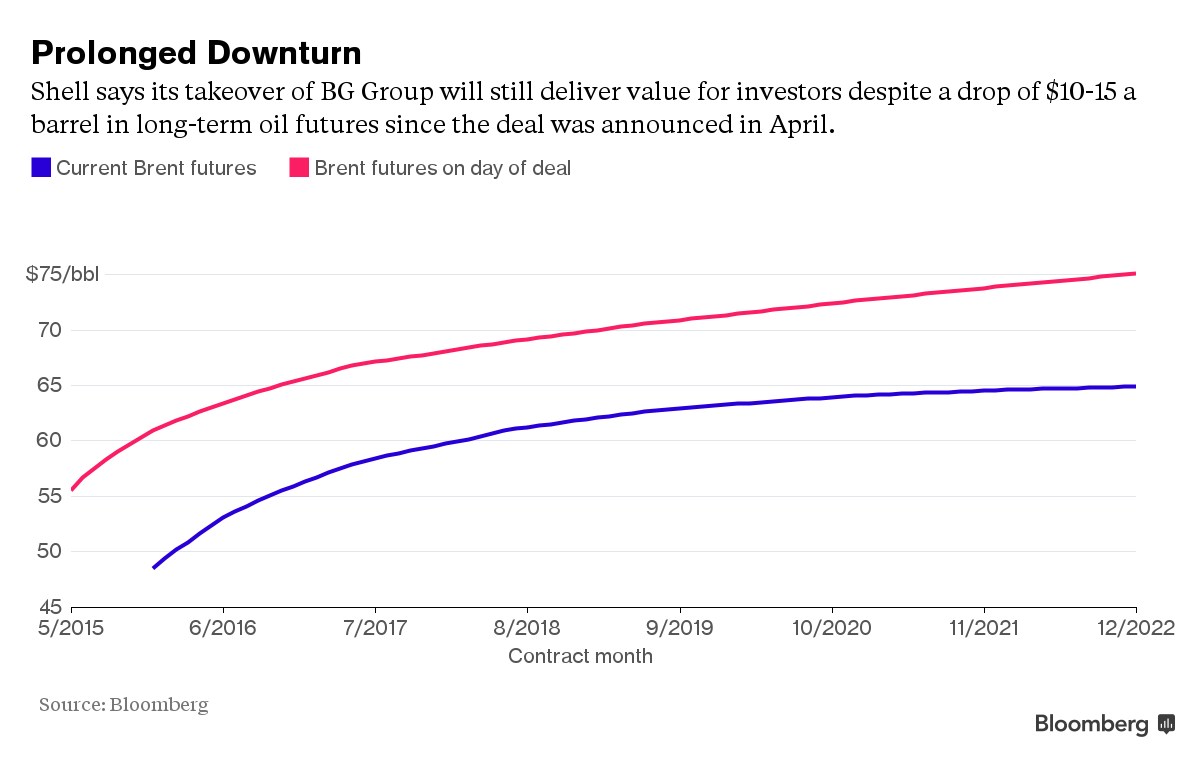

Europe’s biggest oil company will save an addition $1 billion in operating costs from the combination with BG, bringing the total estimate of synergies from the deal to $3.5 billion, Shell said in a statement on Tuesday. The takeover will still add to the company’s earnings per share and cash flow from operations even after the outlook for Brent crude prices to 2018 dropped by $10 to $15 a barrel since the deal was announced in April.

Oil’s renewed slump to a six-year low in August prompted some investors to question the logic of the acquisition, valued at $70 billion when it was announced. Shell expects the deal to expand its access to oil reserves in Brazil, gas projects from Australia to Tanzania, and its global liquefied natural gas transport and marketing infrastructure. The company’s gas business will be separated into a stand-alone unit to be led by Maarten Wetselaar.

Leave a Reply