(Reuters) - Brazilian state-run oil company Petrobras significantly increased the amount of carbon dioxide it re-injected into its offshore oilfields in 2021, a major step forward in the firm's emission-reduction goals. According to a release provided by Petrobras, formally Petroleo Brasileiro SA (PETR4.SA), the company re-injected 6.7 million tonnes of carbon dioxide produced in the oil... Continue Reading →

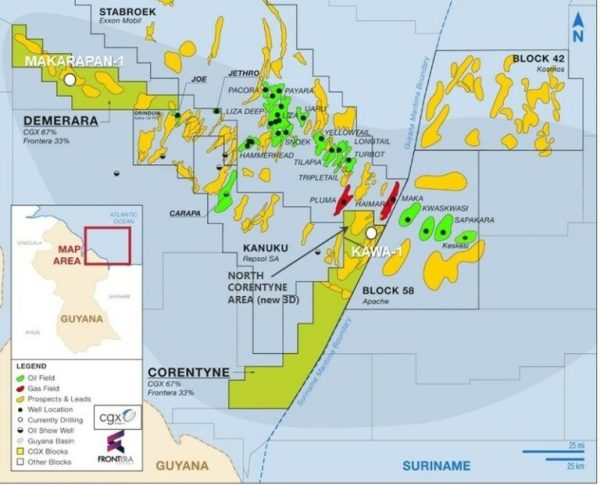

CGX Energy moving forward with demobilisation activities off Guyana

Canadian oil and gas company CGX Energy will continue with the demobilisation of exploration drilling offshore Guyana, according to the Guyanese Maritime Administration Department. In its notice to mariners on Friday, the department confirmed CGX Energy’s demobilisation of exploration drilling is underway within the CGX-operated Corentyne block – where the Kawa-1 well is located – in Guyana’s Exclusive Economic... Continue Reading →

Boosting production from ageing wells and oil & gas discoveries to propel growth in well intervention market

(OffshoreEnergy) Fortune Business Insights, a market research company, expects the increased number of initiatives to boost production from ageing wells and oil and gas discoveries to drive growth in the global well intervention market. The firm reported on Thursday that the global well intervention market is set to gain traction from the increasing demand for energy and... Continue Reading →

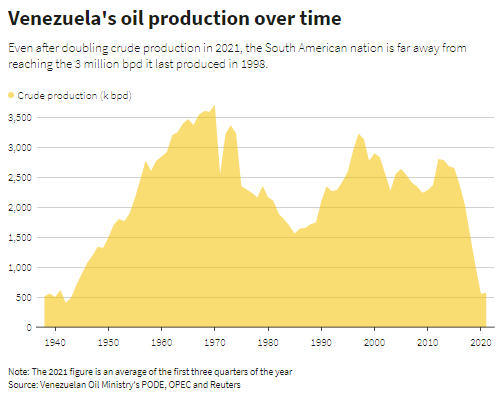

How Venezuela pulled its oil production out of a tailspin

(Reuters) - Venezuela this year almost doubled its oil production from last year's decades-low as its state-owned company struck deals that let it pump and process more extra heavy crude into exportable grades. The surprising reversal began as state-run Petroleos de Venezuela (PDVSA.UL), known as PDVSA, won help from small drilling firms by rolling over... Continue Reading →

Brazil: The end of the large pre-salt auctions

(Valor) The auction of the surplus volumes from the transfer of rights in Sépia and Atapu, carried out by the National Petroleum Agency (ANP) on Friday, marked the end of the large pre-salt auctions. A survey shows that, eight years after the bidding for the Libra area (today Mero), the first round under the country's... Continue Reading →

Yinson, Enauta Pen LoI for Atlanta Field FPSO

Malaysian FPSO contractor Yinson has signed a Letter of Intent with the Brazilian oil company Enauta Energia for the provision, operation, and maintenance of an FPSO at Enauta's Atlanta field in the Santos Basin, offshore Brazil. Enauta has been producing oil from the field using the FPSO Petrojarl I as an Early Production System, and has... Continue Reading →

Chevron agrees to transfer part of offshore Suriname field to Shell

(Reuters) - A unit of U.S. oil producer Chevron Corp (CVX.N) on Friday transferred one-third of its 60%-equity interest in an offshore Suriname block for which it has a production sharing agreement to a unit of Royal Dutch Shell (RDSa.L), Suriname's state oil company said. Paradise Oil Company, a subsidiary of Suriname's state-run Staatsolie, retains its 40% stake... Continue Reading →

Petrobras on Results of the 2nd Bidding Round for the Transfer of Rights Surplus in the Production Sharing Agreement

Petróleo Brasileiro S.A. – Petrobras informs that it has acquired the exploration and production rights of the volumes exceeding those of the Transfer of Rights in the Atapu and Sepia offshore fields in the 2nd Bidding Round for theTransfer of Rights surplus under the Production Sharing Regime, held today, by the National Agency of Petroleum,... Continue Reading →

Enauta approves drilling of new well in Atlanta Field

Enauta announces that it has approved the drilling of an additional well in the Early Production System (SPA) of the Atlanta Field. The new well, scheduled to start production in early 2023, will allow for a significant increase in production and will add a spare to the wells' pumping system. The estimated value of the... Continue Reading →

Petrobras reached US$4.8 billion in asset sales in 2021

The active portfolio management developed by Petrobras in 2021 resulted in the company's cash inflow of approximately US$4.8 billion by December 7th. These resources, which are essential for the company to be able to invest in assets that provide greater returns, are the result of the signing of the sale of 17 assets and the... Continue Reading →