Petróleo Brasileiro S.A. – Petrobras informs that it has started the opportunity disclosure stage (teaser), referring to the sale of its entire 51% stake in Transportadora Brasileira Gasoduto Bolivia-Brasil (TBG) and 25% in Transportadora Sulbrasileira de Gás S.A. (TSB). The teaser, which includes key information about the opportunity, as well as the eligibility criteria for... Continue Reading →

Petrobras starts binding phase of Potiguar Cluster

Petróleo Brasileiro S.A. - Petrobras, following up on the press release disclosed on August 28, 2020, informs the beginning of the binding phase regarding the sale of the totality of its stakes in a set of 26 onshore and shallow water production field concessions, located in the Potiguar Basin, in the state of Rio Grande... Continue Reading →

MARKET REACTS WITH INDIGNATION PETROBRAS’ DECISION TO CANCEL TENDER A FEW DAYS BEFORE DELIVERY OF PROPOSALS

The decisions of Petrobras management, led by the current president Roberto Castello Branco, look like aimless ship. The biggest example of this was the cancellation of the tender, announced on Friday night , 25 days before the submission of proposals. The company decided to stop the development of the infrastructure adaptation project of the Monteiro... Continue Reading →

Petrobras, Equinor stake out opposite renewables strategies in Brazil

(Reuters) - Petrobras does not expect to invest in renewables over the next five years, Chief Executive Roberto Castello Branco said on Tuesday, adding that the Brazilian state-controlled company will instead put money into technologies to reduce the carbon footprint of its oil extraction activities. Castello Branco has repeatedly said Petroleo Brasileiro SA, as the... Continue Reading →

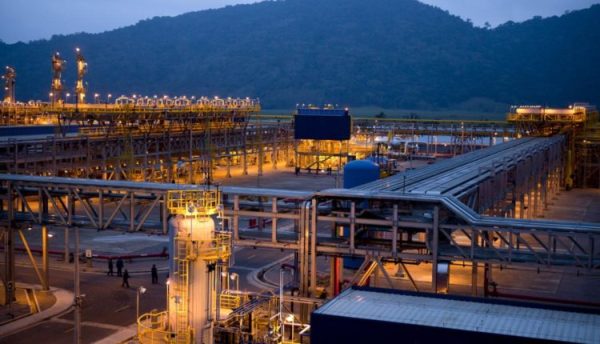

EnP intends to develop an offshore gas hub to meet pre-salt and post-salt production volumes in the southeastern region of Brazil

In the last 8 months, since March 2020, when the EnP Energy Platform was launched, our company has been dedicated to designing and articulating a competitive solution, contributing to the commercial viability of the gas produced on the coast of the Southeast of Brazil, both in the Pre-Salt and Post-Salt. Throughout this period, the project... Continue Reading →

Mitsui evaluates to sell its 49% stake in Gaspetro

Mitsui evaluates to sell its 49% stake in Gaspetro, a holding company with a stake in 19 gas distributors in the country. Gaspetro is controlled by Petrobras, with 51%, a stake that is being sold by the state oil company. Value Information. - As a partner, Mitsui has preemptive rights in the purchase, but would... Continue Reading →

PETROBRAS CEO SEES OPPORTUNITY TO CREATE A MIDSTREAM COMPANY THAT WILL BUILD NEW GAS PIPELINES

Petrobras and some of its partners see an opportunity to create a spin-off company, with resources from the private sector, to work on the construction of new gas pipelines in the country. The information was revealed by the president of the Brazilian state-owned company, Roberto Castello Branco, during a conference call with investors. As a... Continue Reading →

SPECIAL REPORT: ANALYSIS OF BRAZIL’S O&G SECTOR: All-in for the Brazilian oil and gas industry

In November 2007 Brazil’s national oil company, Petrobras, shocked the E&P world by announcing a 5-to-8-Bbbl discovery in a completely unknown geological play: carbonate reservoirs below a 2-km layer of salt, offshore Brazil, in a 2,000-m water depth. This announcement marked the beginning of a complete turnaround in the history of Brazil’s oil and gas... Continue Reading →

Cosan makes offer to buy control of Gaspetro

Cosan presented a proposal to buy the 51% stake in Gaspetro, a Petrobras subsidiary, which operates in the natural gas distribution market. The offer will be made through Compass, a company created by Cosan to concentrate investments in the gas and power generation market. Gaspetro holds stakes in 19 gas distributors, which exclusively operate local... Continue Reading →

Lower Mexican output in 2021 will raise Canadian heavy oil prices

(Bloomberg) --Canadian oil prices are poised to strengthen next year as Mexican heavy crude exports to U.S. Gulf Coast refineries dwindle, according to BMO Capital Markets. Heavy Western Canadian Select’s discount to the West Texas Intermediate benchmark could narrow to $5 to $7 a barrel next year, BMO said in a report Wednesday. Oil sands... Continue Reading →