(Reuters) - A Peruvian judge on Tuesday admitted a $4.5 billion lawsuit against Spanish oil firm Repsol SA (REP.MC), eight months after an underwater oil pipeline owned by the company caused a spill of over 10,000 barrels into the Pacific Ocean. The civil lawsuit seeking $3 billion for environmental damage and $1.5 billion for damages to... Continue Reading →

Venezuelan man indicted in U.S. for money laundering linked to Petropiar oil venture

(Reuters) - A Venezuelan man has been indicted for allegedly laundering the proceeds of inflated procurement contracts obtained via millions of dollars in bribes to officials at Venezuelan oil venture Petropiar, the U.S. Department of Justice said on Wednesday. Rixon Moreno, 46, allegedly received benefits including over $30 million in payments on contracts from Petropiar... Continue Reading →

Exxon, Shell, Chevron end lawsuits against Nigeria’s state-owned oil company

(Reuters) - Four major oil companies have agreed to end U.S. lawsuits that together sought to enforce multi-billion dollar arbitration awards against Nigeria's state-owned oil company, after reaching new deepwater oil production sharing agreements. Two federal judges on Aug. 22 granted requests by Exxon Mobil Corp (XOM.N), Royal Dutch Shell Plc , Chevron Corp (CVX.N) and Norway's state-owned... Continue Reading →

U.S. court upholds Conoco’s $8.7 bln award for loss of Venezuela assets

(Reuters) - A U.S. court upheld a tribunal's $8.75 billion award to U.S. oil producer ConocoPhillips over the expropriation of its Venezuelan oil assets, granting a default judgment in the case on Friday. The decision gives the U.S. company new authority to collect on a 2019 award by a World Bank tribunal. The award includes... Continue Reading →

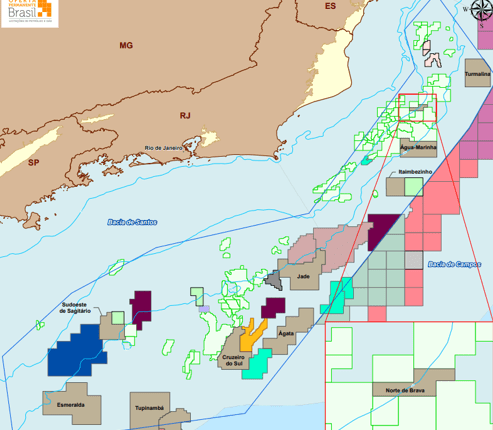

Brazil sets date for new pre-salt bid round using open door nomination

(U) The Brazilian National Petroleum Agency (ANP) has set a date for 16 December to receive proposals in the country’s first auction featuring pre-salt acreage under the so-called permanent offer initiative. In a meeting held on 16 August, the regulator has approved the calendar for the upcoming bid round. According to the proposed timeline, companies... Continue Reading →

Altera Infrastructure enters Chapter 11 to tackle its debt

UK-based Altera Infrastructure has entered a Chapter 11 bankruptcy process in the U.S. to address its debt of over $1.5 billion. Formerly a part of Teekay, Altera Infrastructure is based in Westhill, Scotland and it is a supplier of infrastructure assets to the offshore energy industry. In a statement on Monday, the company said that it has executed... Continue Reading →

Eneva confident in resuming negotiations of the Bahia Terra Cluster

(PN) Eneva expects to be able to resume, in the third quarter, negotiations with Petrobras for the purchase of the Bahia Terra Cluster. The information was disclosed today by Eneva's CFO, Marcelo Habibe, during a conference call with investors. The conversations with Petrobras, according to the executive, were already at an advanced stage, when a... Continue Reading →

Mexico Oilfield Dispute Is an Industry Warning, Talos Chief Says

(Bloomberg) -- When Talos Energy, a Houston driller, made the biggest private oil discovery in Mexico’s history in 2017, it enthusiastically led a $350-million investment in its new-found Zama field. Mexico had declared itself open to international business in energy, and Talos would help lead the way. What Talos didn’t know -- couldn’t know --... Continue Reading →

EXCLUSIVE Mexico’s Pemex in talks with Vitol, eyes resuming business after bribery scandal

(Reuters) - Petroleos Mexicanos (Pemex) has made progress in talks with global energy trader Vitol about resuming trading ties that broke down last year during a bribery scandal, and the companies must iron out some issues such as compensation for damages Mexico's state oil company suffered, two sources at Pemex said. The sources at Pemex... Continue Reading →

Capricorn Investor Palliser Calls on Management to Abandon Tullow deal

(Reuters) Capricorn Energy should ditch its proposed merger with Tullow Oil, investor Palliser has said in a letter seen by Reuters, describing it as "one-sided" and short of "meaningful strategic rationale." "The Proposed Merger appears to us to be a poorly disguised nil-premium takeover of Capricorn by Tullow," said the letter which was dated Aug.... Continue Reading →