Jan 19 (Reuters) - Swedish investment platform Maha Capital is seeking approval from the United States to acquire an indirect minority stake in a PDVSA-controlled oil firm, Maha's chairman of the board, Paulo Thiago Mendonca, told Reuters on Friday. The firm has until May to exercise an option for a majority stake in a Novonor subsidiary... Continue Reading →

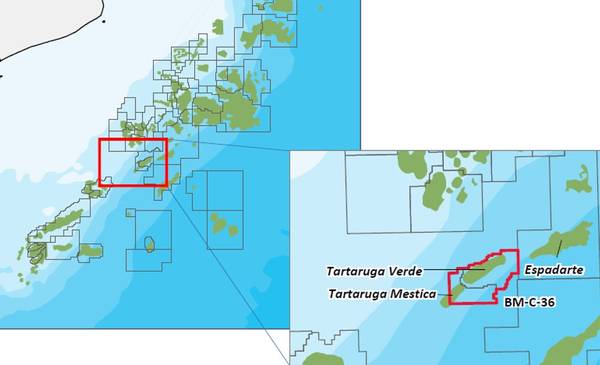

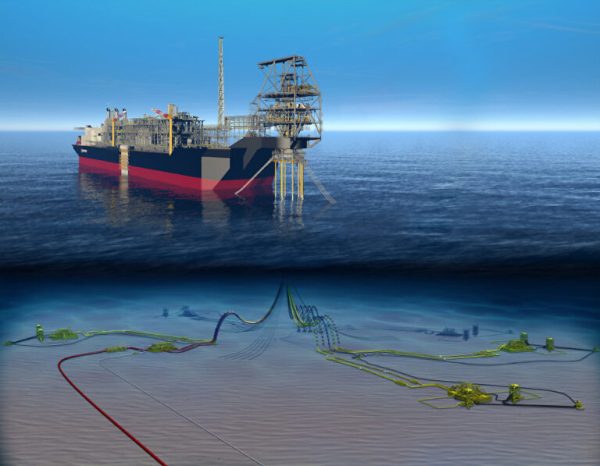

Brava Energia signing of acquisition of interesst in Tartaruga Verde nd Espadarte – Module III

Jan. 16 - BRAVA ENERGIA S.A. (“Brava” or “Company”) (B3: BRAV3), pursuant to CVM Resolution No. 44, hereby informs its investors and the market in general that, on January 15, 2026, it has entered into an agreement for the acquisition of the entire 50% equity interest currently held by PETRONAS Petróleo Brasil Ltda. (“PPBL”) in... Continue Reading →

Peru opens state-owned Petroperu to private investment after reorganization

Jan. 2 (Reuters) - Peru issued an emergency decree late Wednesday approving the reorganization of state-owned oil firm Petroperu, allowing private investment in key company assets. The decree signed by Peru's President José Jerí says the company could be separated into one or more asset blocks, including the state-of-the-art Talara refinery that the company spent... Continue Reading →

Petrobras Launches Online Auction of Platforms P-26 and P-19

Dec. 29 (TN) In another modernization process and commitment to the market, Petrobras announces the online auction of two deactivated offshore platforms following a decommissioning plan. Platform P-26 (pictured), located in São João da Barra (RJ), has a starting bid of R$ 1.5 million, while P-19, located in Macaé (RJ), starts at R$ 1.6 million.... Continue Reading →

BP Sells Majority Stake in Castrol to Stonepeak for $6B

Dec. 24 (OE) BP has agreed to sell a 65% stake in its Castrol lubricants business to infrastructure investor Stonepeak at an enterprise value of about $10 billion, as the energy major presses ahead with its divestment program and balance sheet repair. The transaction is expected to generate net proceeds of around $6 billion for... Continue Reading →

Petrobras announces update on Braskem

Dec. 23 - Petrobras, following up on the announcement dated December 15, 2025, informs that, in light of the progress in negotiations related to Braskem and in order to expedite the necessary authorization procedures, Shine I Fundo de Investimento em Direitos Creditórios de Responsabilidade Limitada (FIDC) submitted today the potential transaction to Brazil’s Administrative Council for Economic Defense (CADE), with... Continue Reading →

Orsted sells 55% of Taiwan wind farm to Cathay

Dec 23 (Reuters) - Danish offshore wind developer Orsted has agreed to sell a 55% stake in its Greater Changhua 2 offshore wind farm in Taiwan to life insurance company Cathay in a deal worth around 5 billion Danish crowns ($788.74 million), it said on Tuesday. Orsted, the world's largest offshore wind developer, is trying... Continue Reading →

Petrobras informs about Braskem

December 15, 2025 – Petróleo Brasileiro S.A. - Petrobras informs that it has been notified by Novonor S.A. – Em Recuperação Judicial (“Novonor”) and NSP Investimentos S.A. (“NSP Inv.”), a subsidiary of Novonor, regarding the execution of an “Exclusivity Agreement with Shine I Fundo de Investimento em Direitos Creditórios de Responsabilidade Limitada (‘FIDC’), a credit... Continue Reading →

Shell Seeks Buyer for 20% Stake in Brazilian Oilfield Cluster

Dec. 9 (Reuters) Shell is seeking a buyer for a 20% stake in its Brazilian oilfield cluster to help fund a multibillion-dollar offshore development, Bloomberg News reported on Tuesday, citing sources. Shell declined to comment on the report, when contacted by Reuters. Shell held a 50% stake in Gato do Mato, which is a deepwater project offshore Brazil, and... Continue Reading →

Lukoil’s international assets and potential buyers

Dec 9 (Reuters) - Russia's Lukoil has until December 13 to negotiate the sale of the bulk of its international assets after the U.S. imposed sanctions on the company and rejected its initial buyer, Swiss commodity trader Gunvor. Lukoil's international assets, spanning upstream oil and gas projects, refining, and more than 2,000 filling stations across Europe, Central Asia, the Middle... Continue Reading →