BRAVA ENERGIA S.A. (“BRAVA” or “Company”) (B3: BRAV3) informs its investors and the market in general of the preliminary and unaudited production data for the month of December 2025.

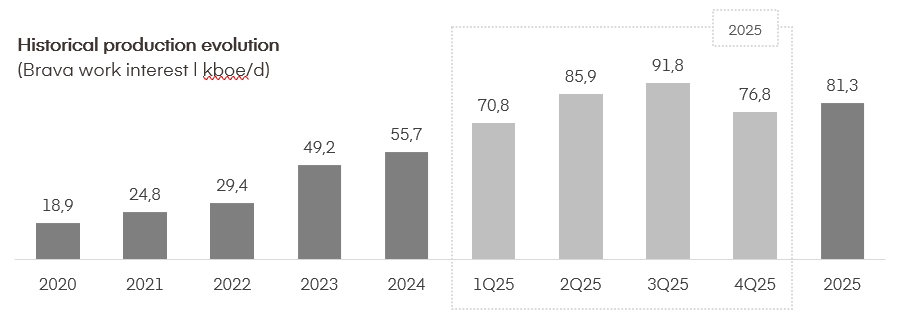

The Company ended 2025 with an average production of 81,3 kboe/d, a 46% increase when compared to the previous year, with Papa-Terra and Atlanta standing out, registering their best historical annual production and operational efficiency results. In 4Q25, Brava recorded an average production of 76,8 kboe/d. The result for the quarter was impacted by scheduled maintenance on portfolio assets and does not reflect the Company’s current production capacity.

In December, the Company recorded an average production of 74,6 kboe/d, +6.0% compared to the previous month. The month’s result is justified by the return of Atlanta and Papa-Terra to normalized production levels, after successful scheduled maintenance and interventions during November, partially offset by the scheduled shutdown at Parque das Conchas, the temporary closure of facilities in Potiguar, and the reduction in gas demand at Manati.

Manati – The Manati field produces non-associated gas, allowing production to vary according to market demand and needs. Production is expected to resume in January.

Potiguar – The monthly result reflects part of the impact of the temporary closure of facilities in the region, resulting from an audit conducted by ANP in September, and regular interventions in production systems that occurred during the month of December.

Parque das Conchas (BC-10) – Production was halted for scheduled maintenance in the second half of November. The operator’s updated estimate is that production will resume sometime in January.

Brava operates the Potiguar, Recôncavo, Papa-Terra, Atlanta, and Peroá Clusters, and holds a non-operated stake of 35% in Pescada, a 45% stake in the Manati Field, both operated by Petrobras, and a 23% stake in Parque das Conchas, operated by Shell. The production breakdown by asset is updated monthly in the valuation guide, available on the Investor Relations website, click here to access.

Leave a comment