October 1, 2025 – PRIO S.A. (“Company” or “PRIO”) (B3: PRIO3), informs its shareholders and the market in general that PRIO Luxembourg Holding S.à r.l., its subsidiary, incorporated under the laws of the Grand Duchy of Luxembourg (“PRIO Lux”), has begun efforts for the issuance of a new series of debt securities, in the form of senior notes (“Notes”), to the international market, in an offer subject to market conditions and the completion of a bookbuilding process with the Notes’ potential investors (“Offering”). The Notes will be guaranteed by the Company, PRIO Bravo Ltda., PRIO Forte S.A., PRIO Tigris S.A., and PRIO Comercializadora Ltda. (“Guarantors”).

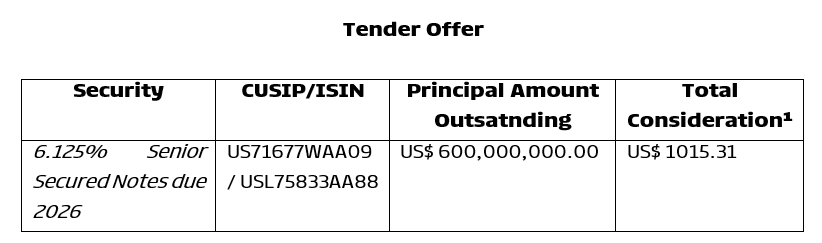

The Company also informs that PRIO Lux has initiated efforts to conduct a tender offer, in the international market, for the 6.125% Senior Secured Notes due 2026 (“Notes Subject to Tender Offer”), up to a principal amount of US$600,000,000.00 (six hundred million U.S. dollars) (“Tender Offer”), as follows:

¹ Per US$ 1000

The Tender Offer will expire at 5:00 p.m. (New York City time) on October 7, 2025 (“Expiration Date”). Holders who validly tender their notes by such date, without subsequent withdrawal, will be eligible to receive the consideration set forth above, subject to the terms and conditions described herein.

PRIO Lux has engaged financial institutions to act as Underwriters for the Offering and the Tender Offer, it being understood that the Offering will not be registered under the Securities Act of 1933, and that both will be carried out in accordance with Rule 144-A of the Securities Act of 1933 and Regulation S, both issued by the Securities and Exchange Commission of the United States of America. If the Offering is completed, the net proceeds from the issuance of the Notes will be used, in part, to repurchase the Notes Subject to Tender Offer under the Tender Offer, and any remaining balance will be allocated to (i) general corporate purposes, including the payment of a portion of the purchase price relating to the acquisition of the Peregrino field from Equinor Brasil Energy Ltda.; and (ii) redeeming any Tender Offer Notes that remain outstanding, in the event they are not fully acquired in the Tender Offer, subject to the terms and conditions of the relevant indenture.

This material fact notice does not constitute (i) an offering to sell the Notes; (ii) a solicitation of an offering to buy the Notes; and/or (iii) a public offering aimed at the general public, and there shall be no sale thereof in any state or jurisdiction in which this offering is prohibited, in accordance with the securities laws of that state or jurisdiction, including Brazil. The Notes Offering is being made exclusively to investors in the foreign market and will not be registered with the Comissão de Valores Mobiliários (“CVM”), nor distributed in Brazil, in accordance with Brazilian laws and regulations. Any public offering or distribution of securities in Brazil, as defined in applicable Brazilian laws and regulations, requires prior registration or must be expressly exempt from registration with the CVM, pursuant to Law No. 6,385, of December 7, 1976, as amended. The Notes will not be offered or sold in Brazil, except in circumstances that do not constitute an offer or distribution in accordance with Brazilian laws and regulations. The Company will keep its Shareholders and the market informed about the development of the Offering through the disclosure of a Notice to the Market or a Material Fact on the CVM’s website (www.cvm.gov.br) as well as the Company’s website (http://ri.prio3.com.br). Additional information can be obtained at the Company’s Investor Relations Department, in the city of Rio de Janeiro, State of Rio de Janeiro, Praia de Botafogo, 370, 13th floor, Botafogo, CEP 22250-040, or in the Company’s website (http://ri.prio3.com.br).

Leave a comment