August 6, 2025 – Brava Energia (“Brava” or “Company”) (B3: BRAV3) herein presents its results for the second quarter of 2025 (“2Q25”). The 2Q25 quarterly information is presented in comparison with the pro forma quarterly information for the 2Q24, considering the combined results of Brava (formerly 3R Petroleum) and Enauta prior to the effective date of the merger.

The pro forma results are based on the available information attributable to the combined businesses and are intended to illustrate the impact of the merger on the financial and operating track record. There is no assurance from the independent auditors or the Company itself that the results of the transaction would have been as presented, had it been completed on January 1, 2024. The operating data was not within the scope of the auditors’ review.

The figures are presented on a consolidated basis and in Reais (R$), except where otherwise stated, in accordance with the accounting practices adopted in Brazil (CPC) and the international financial reporting standards (IFRS).

HIGHLIGHTS OF THE QUARTER AND SUBSEQUENT EVENTS

Operational highlights: successive production records

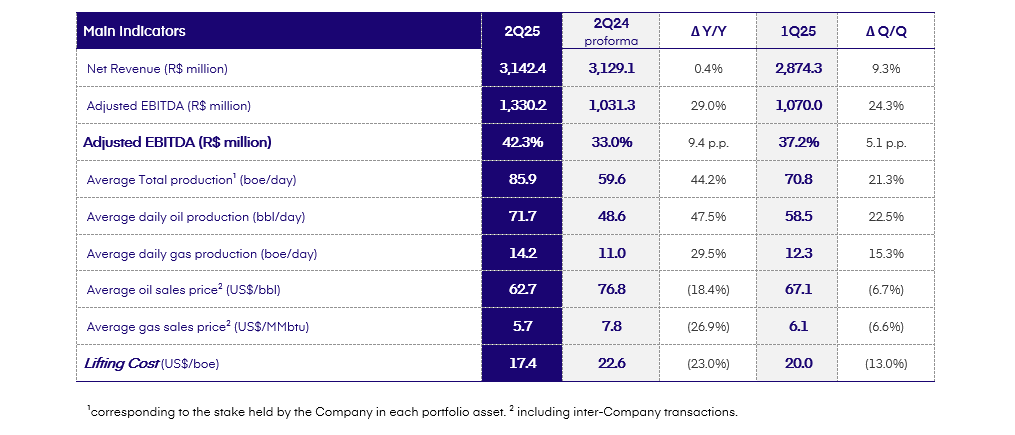

– Repeated quarterly production record in the 2Q25, attaining 85,9 boe/d, +21.3% Q/Q, followed by another monthly production record in July, with a daily average of 90,9 thousand boe/d, +6% compared to the 2Q25.

– Operational progress in Atlanta: connection of four wells, two (4H and 5H) initiated in the 2Q25 and two (2H and 3H) in July, bringing the total to six wells connected to the FPSO. In July, the asset attained production level at 37.0 thousand boe/d in July (100% of the asset), +3% compared to the 2Q25.

– Economies of scale and operational efficiency at Papa-Terra: during the first half of 2025, the asset achieved its highest operational efficiency level, since it was acquired in December 2022. In July, the asset recorded its highest monthly production level since the 2Q21, reaching 19.6 thousand boe/d (100% of the asset), an increase of 3% compared to the 2Q25.

– Brava assumes operations of the Guamaré Waterway Terminal (Rio Grande do Norte) in the 2Q25. This change will enable cost reductions, as well as optimizing the management of the Downstream infrastructure in the Potiguar Basin.

Financial highlights: more efficient metrics and optimization of the capital structure

– Robust free cash flow, driven by growth in operating cash flow¹, which reached R$1.6 billion (~US$295 million), and a reduction in investing cash flow to R$813 million (~US$149 million).

– Record net income of R$ 3,142 million in the 2Q25, +9.3% Q/Q: driven by enhanced operational efficiency in the offshore segment, which contributed 62% of the total upstream revenue.

– Record Adjusted EBITDA of R$ 1,330 million (or US$ 235 million) in the 2Q25, a 24% increase Q/Q. The Adjusted EBITDA Margin increased by 5.1 p.p. in the quarter, reaching 42.3%. The offshore segment stood out, reaching an Adjusted EBITDA of R$ 796 million in the 2Q25, a 72% increase Q/Q, driven by a strong Adjusted EBITDA Margin of 51.5%, +11.6 p.p. Q/Q.

– The average lifting cost (excluding chartering) reached US$ 15.0 in the 2Q25, a reduction of 13.1% Q/Q, with the highlight being a 21.5% reduction in the offshore segment, which reached US$ 14.0 (excluding chartering).

– The Company concluded, during the months of July and August, important steps in its liability management process, notable among which are:

– prepayment of the Potiguar Debenture (US$ 500MM), using resources from a new issuing, resulting in a significant cost reduction and improved amortization profile;

– prepayment of the 2nd Series of the 1st Issue Debentures, using cash resources amounting to ~US$ 119 million (principal);

– advance on receivables in relation to the FPSO Atlanta, for a positive financial impact for the Company of more than US$ 300 million (US$ 260 million in cash and the remainder from the use of tax credits arising from the transaction).

– Signing of a shareholders’ agreement representing, approximately 21% of the Company’s share capital, on July 23rd.

– Election of members of the Board of Directors, in May 2025, with Messrs. Richard Kovacs and Halvard Idland, both with extensive experience in the financial and energy sectors, joining the body.

To access the materials for the quarter: click here.

Leave a comment