By Rafael Clemente, Key Sales Account Manager, Castrol

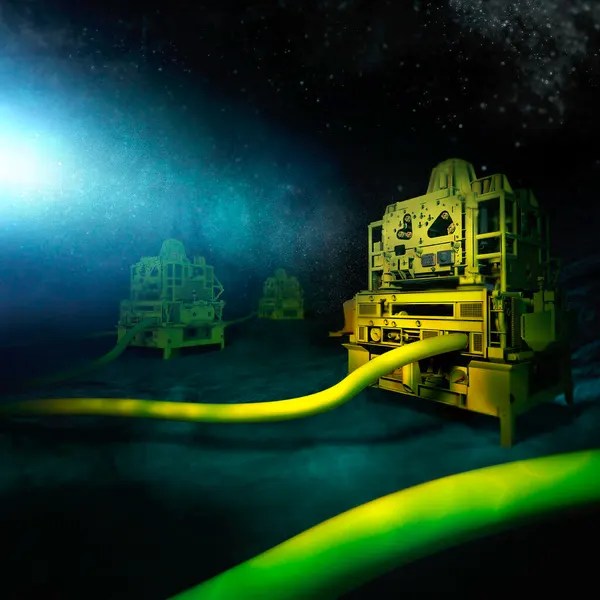

Castrol explains why subsea hydraulic systems will be integral as we look for proven, viable solutions that are commercially feasible and do the job

Operators today face an unenviable challenge: deploying new technology in more complex locations while increasing uptime and reliability at the same time.

The Brazilian energy sector is growing. Oil investments in key regions such as Brazil are set to soar, with the FPSO order book filling up rapidly and production exceeding by 200,000 BPOD. Brazil is expected to be the third-largest contributor to non-OPEC+ supply growth in 2024, with the potential for over 30 FPSOs to be deployed in Brazil alone, representing 20% of the total global FPSOs.

Considering all this, it is inevitable that more demands will be placed on the Brazilian energy value chain. Owners and operators must invest in new technology and can expect the entire supply chain to support this with products, services, and expertise.

This demand is felt acutely in the subsea industry, where R&D continues to flourish, especially in the growth of all-electric system solutions. As a result, subsea control fluids – already the lifeblood of Electro-Hydraulic Multiplex (EH-Mux) systems – must also continue to evolve.

As excitement builds around new all-electric systems, it is the learnings from proven and available technology that will ensure their future success.

Make the most of what works

The oil and gas sector is depended upon to deliver the energy we need. It, therefore, relies on system solutions with the highest technology readiness level (TRL) and lowest through-life risk profile, making hydraulic subsea production control systems the industry favourite today.

The current order book for subsea Christmas Trees (XT) reflects the need for proven solutions. Approximately 20,000 existing wells are hydraulically operated and will continue to operate for decades] Meanwhile, this appetite for XTs is reflected in the new order book, with over 200 XT to be awarded in Brazil alone. The popularity of XT demonstrates that while an all-electric future is indeed conceivably emerging, the trustworthy EH-Mux system still has a critical role to fulfil and perform in the medium-and long-term future. CAPEX and OPEX costs stand out when considering the factors that make technology the de facto standard. Through-life total cost exposure must be understood and forecasted to ensure developments are viable investments. Hydraulics offers a known, reliable solution, proven through decades of optimization across the product’s lifecycle, from the supply chain to maintenance requirements.

Currently, that is not the case with all-electric systems. All electric offers hugely attractive benefits when considering long offsets and fast tiebacks, with electrification offering CAPEX reduction of up to 15% vs a conventional EH- Mux system and it still lacks a proven track record compared to EH-Mux system.

Meanwhile, investment into more subsea fluid solutions that meet environmental regulatory compliance continues at pace. This is driven by the continuing evolution of environmental standards such as OSPAR and OCNS, requiring subsea control fluid providers to develop products that demonstrate life performance and ensure no degradation in operational performance.

Control fluids remain the lifeblood of all subsea systems. They provide insights into system health and can save precious time and money. These control systems are evolving to meet the ever-challenging demands of wells and fields, such as depth, temperature and hydrate management. Having proven and effective control fluids that suit all systems and conditions is crucial to uptime and reliability.

A synergy in technologies

Hydraulic and all-electric must coexist, and its Castrol plays a role in supporting the industry to choose the right solutions that address operational and commercial challenges

Lubricant and fluid suppliers are indispensable in supporting the evolution of all-electric systems. Castrol supplies many products that will directly apply to the all-electric field development of tomorrow, grounded in an in-depth understanding of the technology deployed today.

Dielectric oil volume for subsea transformers to all-electric subsea connectors, for example, is vital to protecting and ensuring the longevity of the latest electrical hardware from water ingress, including pumps, compressors, actuators, and control modules.

Products for all-electric systems are being developed based on industry feedback to meet the demands of owners and operators. As a leader in the automotive lubricants sector, Castrol is able to draw on parallels between cooling for subsea electric trees, as provided to major OEMs and battery EVs will be essential in making all-electric a scalable reality.

Trust proven solutions

To truly rationalize operations and reduce costs, a rapid move to all-electric could be counterintuitive and will not happen overnight.

Uptime, reliability, and regulatory compliance are the three key pillars of the offshore industry, with the growing need for proven solutions to ensure environmentally responsible operations in increasingly extreme and remote locations. As the sector rationalizes operations to reduce costs and boost efficiency, the need for proven, trusted solutions only intensifies. EH-Mux systems will, therefore, often continue to present the most viable answer.

There is no doubt that all-electric has real potential for the future of the subsea industry. As a sector, we must continue the collaborative journey of sustained investment and prove the safety and reliability of these latest technical offerings. Unlocking the answers for tomorrow lies in evolving the trusted realities of today.

Leave a comment