Brava Energia (“Brava” or “the Company”) (B3: BRAV3) presents the results for the first quarter of 2025 (“1Q25”). The quarterly information for the 1Q25 is shown in comparison with the pro forma quarterly information for the 1Q24, considering the combined results of 3R Petroleum and Enauta prior to the effective merger date.

The pro forma results are based on the information available and attributable to the absorption of Enauta Energia by Brava Energia and seek to illustrate the impact of this merger on the Company’s historical financial and operational information. There is no assurance by the independent auditors or by the Company itself that the results of the transaction would have been as presented if it had been completed on January 1, 2024 and the quantitative operational data did not fall under the scope of the auditors’ review.

The amounts, except where otherwise indicated, are presented on a consolidated basis and in Brazilian Reais (R$), in accordance with accounting practices adopted in Brazil (CPC) and international financial reporting standards (IFRS).

1Q25 HIGHLIGHTS AND SUBSEQUENT EVENTS

Operating Highlight: record production level in April/2025.

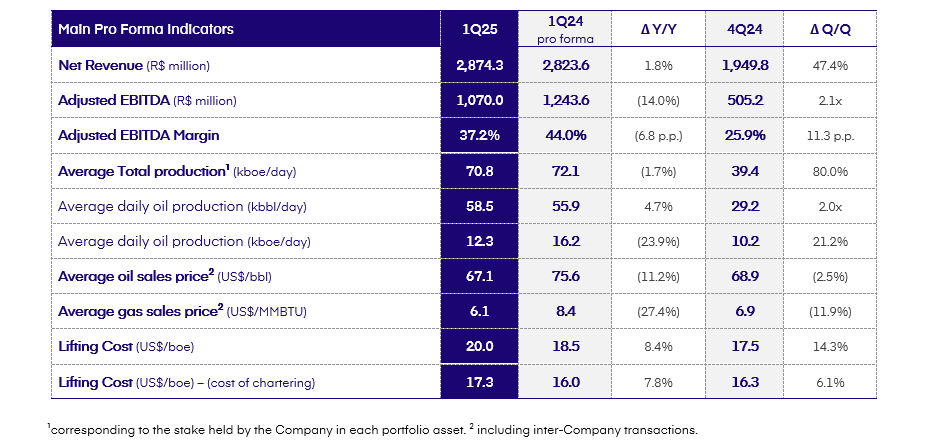

- Production of 70.8 thousand boe/d in the 1Q25, followed by a historical production record in April/2025.

- Production of 82 thousand boe/d in April, +16% compared to the 1Q25, setting a historical production record.

- Growth underpinned by oil: oil production reached 69 thousand bbl/d in April, +18% compared to the 1Q25.

- Operational progress and gains in scale

- Papa-Terra has been showing greater operational efficiency since the return to production at the end of 2024, making April the best production month since December/2023: +35% compared to the

- Atlanta achieved record production in April: 34 thousand boe/d (100% stake), +45% compared to the

- Completed connection of 2 more wells (4H and 5H) in the Atlanta field during April.

- Completion of the Company’s biggest offloading: 900 thousand bbl in the Atlanta field.

- Certification of more than 470 m in 1P reserves in the Company’s main assets, 92% of it oil.

Financial Highlights

- Net Revenue amounted to R$ 2,874.3 million in the 1Q25, +47.4% Q/Q;

- Adjusted EBITDA of R$ 1,070.0 million, equivalent to US$ 182.8 million in the 1Q25, up 2.1x in comparison Q/Q.

- Adjusted EBITDA Margin (including Mid&Downstream) of 37.2% in the 1Q25, +11.3 p.p. Q/Q.

- Total Lifting Cost (without chartering) is stable, with a notable reduction in the onshore segment, for the second consecutive quarter, reaching US$ 16.7 in the 1Q25.

- Capital Structure: sound cash position, with US$ 831 million at the end of the 1Q25, following early payment of debts and payment of earn-outs installment related to acquisitions during the period, amounting to US$ 162 million, plus a bond issue of US$ 64 million on competitive terms (duration of 2 years and interest of 6.5% p.a.).

- Operational Cash Flow¹ of ~R$ 1 billion, backed by strong operational progress in the 1Q25;

Other highlights

- Publication of the 1st Brava Annual and Sustainability Report, reflecting the alignment of practices and the track record of the 3R Petroleum and Enauta sustainability programs.

- The new Diretor of Offshore Operations assumed his post, in April 2025, with the place now being occupied by Mr. Carlos Travassos, an executive with more than 39 years of experience in the sector, who has also held leadership positions at Braskem and Petrobras.

To access the materials for the quarter, click here.

Leave a comment