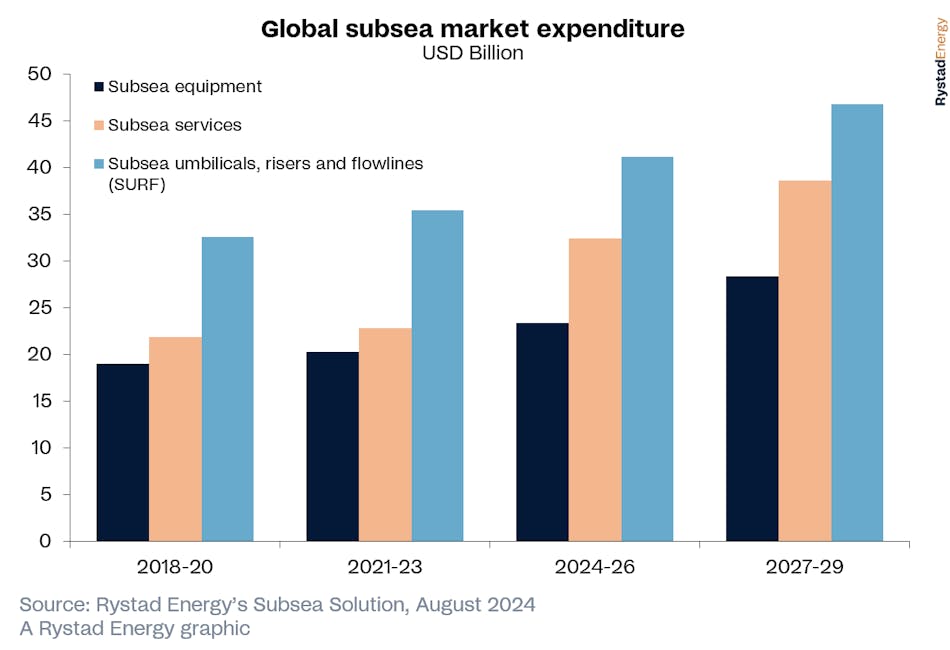

(offshore-mag.com) Global expenditure on subsea facilities is set for a 10% compound annual growth rate (CAGR) from 2024 to 2027, according to research by Rystad Energy.

The consultants project a total capex spend for the period of more than $42 billion.

Some of the biggest investments are taking place in South America and Europe. In Brazil, spending on subsea equipment and the SURF segment is set to increase 18% this year to $6 billion, much of this on presalt projects.

Norway’s continued resurgence is supported by advances such as a cost-efficient subsea hydraulic power unit and the remotely operated tubing hanger tool SWIFT, which lessens the need for a heavy topside kit through enabling umbilical-less operations.

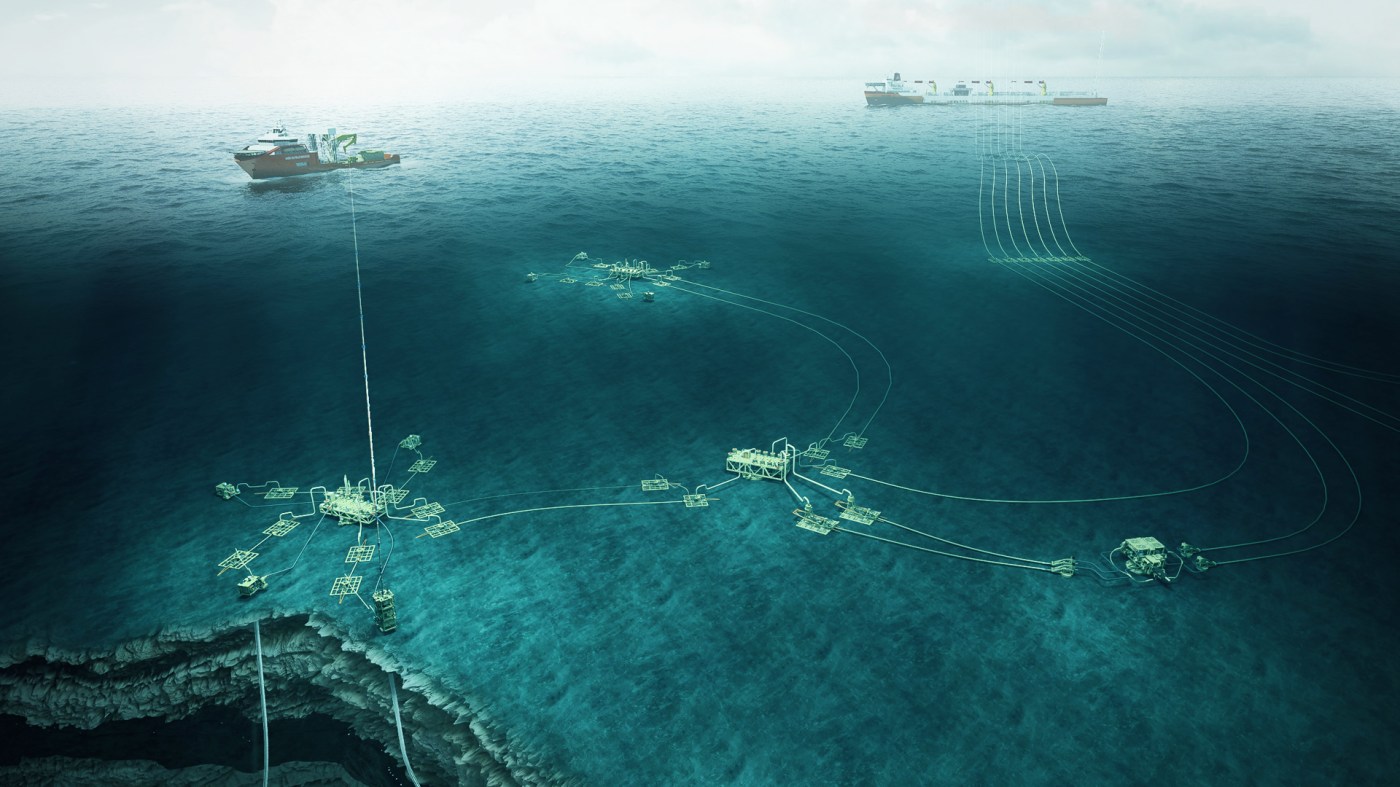

In general, there has been significant investment in deepwater and ultradeepwater projects, Rystad added, with the subsea sector also expanding beyond oil and gas into carbon capture and storage .

Suppliers are developing more efficient subsea production systems, which are set for wider adoption.

“The subsea market has rebounded robustly from the impacts of COVID-19, which caused a significant 20% drop in expenditure in 2020,” said Sanwari Mahajan, a Rystad analyst for Supply Chain Research.

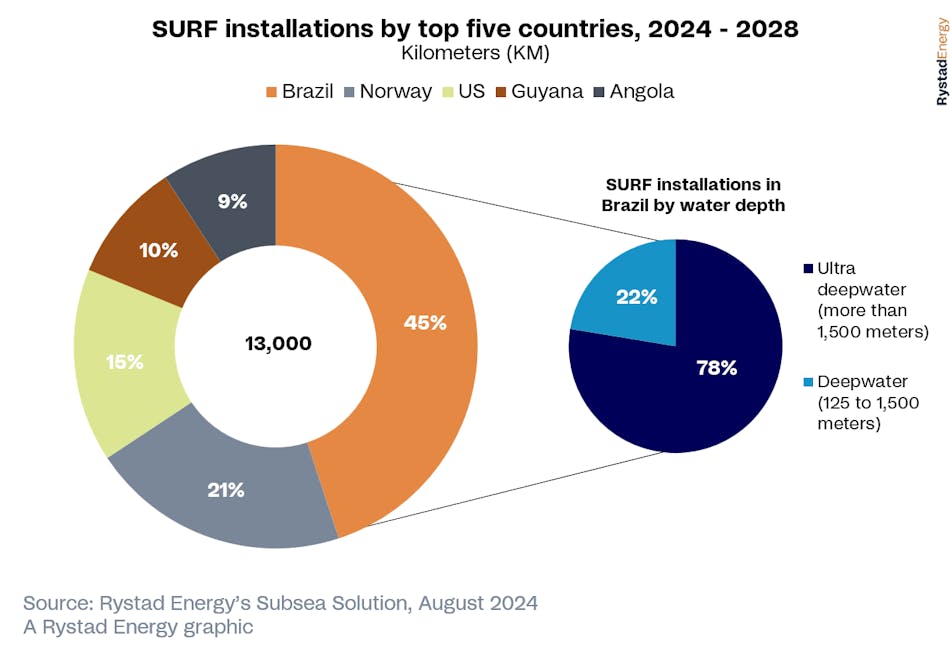

Deepwater developments will likely account for 45% of the subsea market from 2024 to 2028, led by greenfield projects such as the Barracuda Revitalization in Brazil, Johan Castberg offshore Norway and Golfinho offshore Mozambique.

Among the larger brownfield projects in the North Sea region are Balder Future, Gullfaks South and Schiehallion.

Ultradeepwater projects featuring FPSOs offshore Brazil and Guyana could represent 35% of the market. South America is set to lead the way with about 500 subsea tree installations over the next five years.

Ultradeepwater greenfield projects (beyond 1,500 m) include Yellowtail, Tilapia and Redtail in Guyana, and Búzios VIII, Búzios IX, Sépia and Atapu in Brazil. Brownfield deepwater activity will feature at Egina offshore Nigeria and Argos (Mad Dog Phase 2) offshore the US.

Equinor is responsible for installing 17% of new subsea trees globally this year followed by Exxon Mobil with 12%, primarily in Guyana (Yellowtail, Redtail and Payara).

In the SURF sector, Rystad forecasts 3,500 km of installations worldwide in 2024, led by Brazil (22%), the US (15%) and Angola (10%).

TechnipFMC could supply about 400 subsea trees between 2024 and 2029, of which 35% is destined for Exxon Mobil developments offshore Guyana and 22% for Petrobras offshore Brazil.

OneSubsea could deliver nearly 270 trees over the same period, with about 40% in Brazil. Aker Solutions (now OneSubsea) should provide 150 trees, and 80% of these are for fields offshore Norway.

Leave a comment