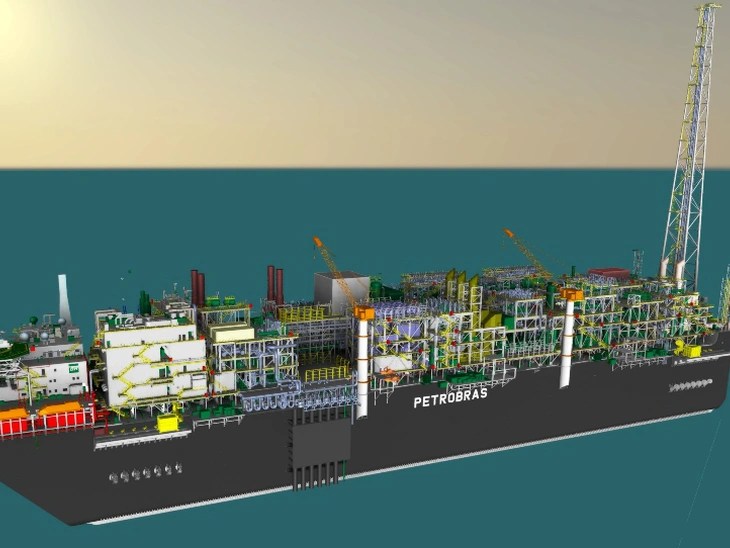

(PN) Despite making progress in some of its bidding processes for platform ships (FPSOs), Petrobras is encountering difficulties in contracting various equipment and vessels. According to the director of engineering, technology and innovation at the state-owned company, Carlos Travassos, other actors in the oil and gas sector around the world are also experiencing this situation. The statements were made during a virtual press conference.

According to Travassos, Petrobras currently has six platform contracting processes underway, four of which are planned for the current Strategic Plan. The director stated that the bidding for contracting the Barracuda FPSO, in the Campos Basin, is proceeding normally, with proposals expected to be received in July 2024. The contracting for the Albacora FPSO is in a further stage, already in the negotiation with a bidder. “It’s a challenging process, but our teams are discussing it. The deadline for closing negotiations is next April”, stated the executive.

Tenders for Sepia 2 and Atapu 2 are also proceeding as planned, according to Travassos. “We had a forecast of individual proposals for each of these units or a joint proposal. That is, a single company for both units. And that’s exactly what happened. We are in the final stage of negotiations for these two units and we are optimistic about this process. But we are still negotiating.”

Petrobras postponed the deadline for submitting proposals for the Sergipe Aguas Profundas platforms (SEAP I and SEAP II) to June. According to the director, this decision was made due to the “low competitiveness”. The executive assessed that one of the difficulties in this bidding is the issue of financing the project. Therefore, the company is looking for alternatives. “We are working with the Merchant Marine, with private and foreign banks, in order to change the financing conditions, change the conditions of the tender and obtain proposals”, he said.

Travassos also narrated that the market is going through a period of difficulties in contracting, not only for topside and FPSOs, but also for subsea and rigs. “When it comes to subsea systems, we face several challenges both in EPCI and in line manufacturing. In this sense, we are carrying out two initiatives. The first is to dialogue with the market regarding issues related to guarantees, which are the main obstacle in this sector. Secondly, we also implement internal initiatives to perform matrix analysis of the supply chain. We are evaluating the production capacity of these companies and adjusting our systems and strategies according to this capacity. In other words, we are aligning our demands with market capabilities,” he explained.

Petrobras’ financial director, Sergio Caetano, also commented on the impact of rig chartering on the company’s debt. According to the executive, the oil company’s debt at the end of 2023 was around R$59 billion. In 5 years, according to him, this volume will be R$57 billion, already considering the costs of chartering platforms. “This increase that occurred [in debt] to R$62 billion is partly due to inflation in the contracting of goods and equipment. And another substantial part is due to the anticipated entry into operation of one of our FPSOs. On the curve, this will be cushioned until the end of the plan, without the need to borrow money”, he detailed.

Leave a comment