(Reuters) – Petrobras (BVMF:PETR4) came out as the big winner in an auction of exploratory oil and gas blocks this Friday, winning as operator three of the four pre-salt blocks negotiated, out of a total of eleven offered under a new competitive model of permanent offer.

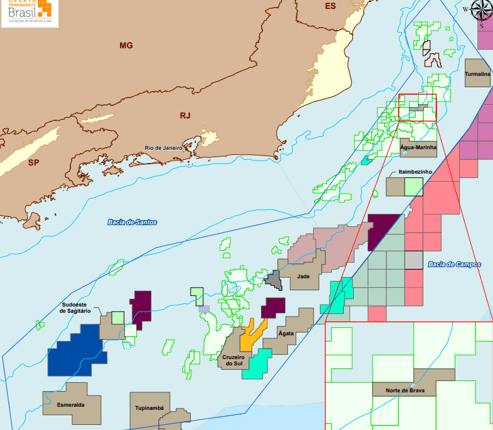

Petrobras took Água-Marinha and Sudoeste de Sagitário as operator of an integrating consortia, and Norte de Brava as the sole bidder. The Bumerangue block was 100% purchased by BP.

The auction, under a production sharing model, raised a total of 916.252 million reais in signing bonuses for the Union. The event also recorded premiums on oil profit bids that ranged from 4.24% to 220.48%.

The North Brava block, in the Campos Basin, where Petrobras had already expressed interest in being the operator before the auction, was the one with the highest signing bonus in the event, of 511.7 million reais.

The state-owned company defeated a competing consortium formed by Equinor and Petronas and took the area alone, with a profit bid of 61.71%.

In Sudoeste de Sagitário (in the Santos Basin), the second area with the highest signature bonus in the auction, of 330.256 million reais, Petrobras won in a consortium with Shell (NYSE:SHEL) with a bid of 25% of oil profit for the Union, against a minimum percentage of 21.3%, without competition.

In the consortium for Sudoeste de Sagitário, Petrobras took 60%, while Shell held the remaining 40%.

In the case of Água-Marinha, the area was won by Petrobras, TotalEnergies, Petronas and QatarEnergy, in the Campos Basin pre-salt.

TotalEnergies, Petronas and QatarEnergy had made the best bid, with a profit oil offer of 42.40%, against a minimum percentage of 13.23%. Petrobras exercised its right of preference and joined the winners.

The original consortium of TotalEnergies, Petronas and QatarEnergy had defeated an offer made by Petrobras itself, in partnership with Shell.

By law, Brazil’s state oil company has preemptive rights in pre-salt areas.

Upon auctioning off the block, the consortium will pay a signature bonus of 65.443 million reais to the Union.

With the new configuration of the consortium, Petrobras got a 30% stake, TotalEnergies with 30%, Petronas with 20% and QatarEnergy with 20%.

Bumerangue (Santos) was won by BP, also without competition, with an offer of 5.90% of profit oil against a minimum percentage of 5.66%.

In the sharing model, signature bonuses are fixed and whoever offers the highest percentage of future production to the government wins.

CHALLENGING CONTEXT

The National Agency of Petroleum, Natural Gas and Biofuels (ANP), which organized the auction, predicts that the auctioned areas will generate investments of 1.44 billion reais.

The director-general of the ANP, Rodolfo Saboia, downplayed the fact that less than half of the auctioned areas had been sold, emphasizing that “it is necessary to understand the context in which this auction took place”.

“We have a very challenging international scenario, an ongoing energy transition process, which obviously makes companies very selective in their investments, we have countries competing for these investments with Brazil…”, he said, when questioned by journalists.

“Therefore, this shows the need for us to maintain efforts to be increasingly competitive in the dispute for these investments”, added Saboia.

He also pointed out that the pre-salt exploratory risks are now better known.

“Initially it was thought that any pre-salt area would be 100% successful, today there is already an understanding that there is geological risk involved and this scenario as a whole always poses challenges for companies to select… better opportunities”.

The pre-salt areas now auctioned do not present, at least preliminarily, the same potential volumes of areas sold in the past.

However, the director general of the ANP highlighted the high percentages of profit in oil for the Union.

The blocks that had no bids were Itaimbezinho and Turmalina, in the Campos Basin, and Ágata, Cruzeiro do Sul (BVMF:CSED3), Esmeralda, Jade and Tupinambá, in the Santos Basin.

The Secretary of Oil and Gas of the Ministry of Mines and Energy, Rafael Bastos, highlighted the results obtained.

“There was diversification, six companies won the auction, so it is not concentrated in the hands of a single company… The oil industry continues to be developed in Brazil, these areas will generate jobs and investments for many years. Undoubtedly, it was very relevant and this auction was a success”, he said.

This was the last oil auction by the Jair Bolsonaro government, which held a total of nine auctions and raised 96.5 billion reais, according to data compiled by the ANP.

The signature bonus obtained in this Friday’s auction signals that the new government will no longer have at its disposal the voluminous revenues from the pre-salt auctions, as happened in the past, when areas with greater potential attracted greater interest from oil companies.

Gains to the government are likely to focus more on profit oil as the larger fields move forward with activities. Current production-sharing contracts will contribute around US$344 billion to public coffers over the next ten years, according to a previous estimate by state-owned PPSA.

The executive director of Exploration and Production at the IBP, which represents the oil companies in Brazil, Júlio César Moreira, present at the auction, pointed out that it was still a positive event, considering the government transition scenario.

“We saw several participating companies… in an environment, scenario, which I will not say is unstable, but one of government transition”, pointed out Moreira, citing that this week there was approval in the Chamber of Deputies to change the Law of State-owned Companies, in a measure that according to him impacts the oil sector.

“The sector has a characteristic of investments and projects that take a long time to mature, so any regulatory change that can impact the industry, such as this one (in the State-Owned Companies Law), is frightening. At IBP, we guide the importance of stability and predictability industry rules.”

“I think that, in this scenario, there was an important commitment of investments… my reading was super positive.”

Leave a comment