After a failed sale attempt, Petrobras no longer intends to divest of its refining asset in Pernambuco. The Abreu e Lima Refinery (Rnest) was included in the company’s Strategic investment plan for 2022-2026. According to a statement from the company, more than R$ 5 billion (US$ 1 billion) will be invested in the completion of the second train at the refinery.

The divestment process of Rnest has dragged on since 2019, when Petrobras announced that it intended to dispose of eight refining plants throughout the country. The Alberto Pasqualini Refinery (REFAP) in Rio Grande do Sul, the Gabriel Passos Refinery (REGAP) in Minas Gerais were also in the process of finalizing the sale, with Lubricants and Petroleum Derivatives of the Northeast (LUBNOR), in Ceará, and the Unit of Shale Industrialization (SIX), in Paraná.

According to the Strategic Plan for the 2022-2026 five-year period, Petrobras points out that, in the Refining area, US$ 6.1 billion will be invested over the next five years, with US$ 1.5 billion in the integration between the Duque de Refinery Caxias (Reduc) and GasLub Itaboraí, for the production of high quality derivatives and base oils, “in order to take advantage of the growing demand in the lubricant market”.

Rnest will receive a total of US$ 1 billion (more than R$ 5 billion) for the completion of the refinery’s second train, which allows for the expansion of its production from 115,000 to 260,000 barrels per day (bpd) in 2027.

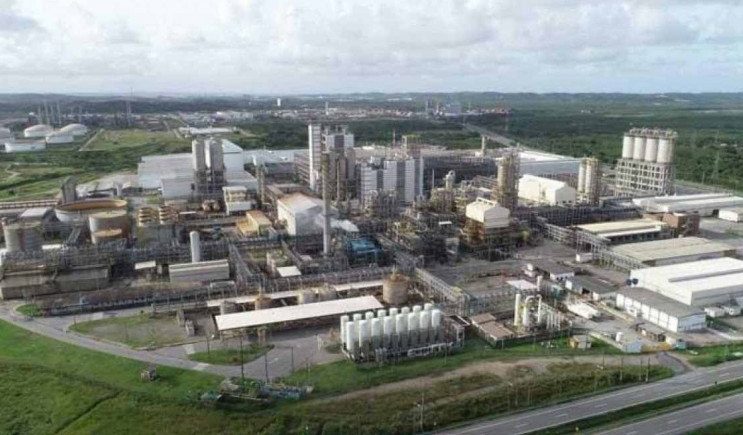

The Abreu e Lima Refinery has been in operation for seven years, and is the most modern in the country. The last refining unit delivered by Petrobras, Rnest had a cost of US$18.5 billion, according to Petrobras. The amount, however, was indicated in the Lava Jato operation with a 566% surcharge due to the payment of bribes.

The cost, although the unit so far only operates with the production of 130 thousand barrels per day (1st train), placed the project as the most expensive of its type in the world, even with a performance corresponding to 5% of the total refining capacity of the country’s oil.

Currently, Rnest produces diesel with low sulfur content (69% of production), naphtha, fuel oil, coke and liquefied petroleum gas (LPG) and gasoline A.

In all, the Strategic Plan for the 2022-2026 five-year period foresees investments of US$ 68 billion, an amount 24% higher than the same period of the previous plan.

In 2021, more than R$ 220 billion are estimated between taxes and taxes collected and dividends paid to the Union and other federative entities, according to Petrobras. Payments of government take, taxes and dividends to the Union will represent 58% of the company’s operating cash flow.

Leave a comment