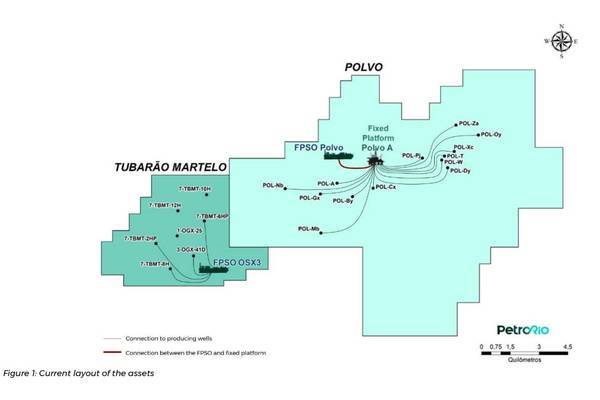

Completion of the tieback between the Polvo and Tubarão Martelo fields, in the Campos Basin, allowed for a reduction in operating costs (“OPEX”) of US$ 50 million per year

The third quarter results evidenced PetroRio’s successful strategy of increasing production levels and rationalizing costs, with excellence in environmental responsibility, safety and operational efficiency. The largest independent oil and gas company in Brazil had net income (ex-IFRS 16) of R$125 million in the period, against a negative R$118 million recorded in 3Q20. The main factors that boosted the company’s financial performance were the increase in sales and the increase in the price of Brent, with a direct impact on the increase in revenue.

“PetroRio believes that the best protection against Brent’s volatility is the reduction of its lifting cost and this will continue to be a pillar of the company’s current and future projects. During this period, we achieved a reduction of almost 14% in lifting cost compared to the second quarter of this year. It went from USD/bbl 14.2 to USD/bbl 12.3 in 3Q21. This was possible due to the completion of the tieback between the Polvo and Tubarão Martelo fields, in the Campos Basin, which allowed a reduction in operating costs (“OPEX”) of US$ 50 million per year with the shutdown of the FPSO Polvo, which was chartered to the field. These results demonstrate that we are on the right path to sustain the solidity of the company”, says Roberto Monteiro, CEO of PetroRio.

PetroRio had net revenue of R$940 million in 3Q21, an annual increase of 92%. The result was positively impacted by the increase in the price of Brent oil, which recorded an average of US$ 73.23 per barrel, an increase of 69% year-on-year and 6% compared to the immediately previous quarter.

PetroRio continues to prioritize the monitoring of liquidity and its degree of leverage. After the issuance of Debt Representative Notes (“bonds”) in the amount of US$ 600 million in June 2021, the company maintains the strategy of fully paying off all other debts by the end of 2021, leaving the bond as only current funding.

“The average term of the company’s debts reinforces the greater strength of the capital structure that PetroRio has been pursuing, focusing on a longer-term horizon, facilitating financial planning and leaving the company more prepared for inorganic growth, an important pillar of growth”, explains the CEO.

Field Revitalization

The period was marked by the company’s greatest operational achievement: the completion of the interconnection, known as tieback, between Polvo and Tubarão Martelo. PetroRio became the first independent company to create a private cluster for the production of mature fields in the Campos Basin region. The initiative will make it possible to reduce operating costs, which were around US$ 120 million per year and will decrease to approximately US$ 70 million per year.

“The project lasted 11 months and cost R$45 million. We are very proud to have completed it on budget and on schedule, as well as making a significant contribution to reducing the lifting cost and carbon footprint. This achievement demonstrates the great execution capacity and punctuality of our operational project teams, who are able to safely implement future projects, such as the Revitalization of the Frade field, the development of the Wahoo field and the Frade and Wahoo interconnection project ”, says Monteiro.

The quarter also saw the completion of acquisitions of PetroRio in Wahoo’s stakes, reaching 64.3% of the consortium. The strategy aims to create a second production cluster through the interconnection (tieback) of Wahoo to Frade, continuing the culture of operational optimization of the company’s assets. Wahoo’s first oil is slated for early 2024.

In the Frade field, the company seeks to increase the asset’s recovery factor. The Field Development Plan considers the drilling of four producer wells and three injector wells, which were selected based on the maximization of the field’s recovery factor. The first phase of the Frade Field Revitalization Plan will include the drilling of one producer well and two horizontal injection wells, scheduled to start in March 2022, to be carried out by the NORBE VI rig, from Ocyan.

Leave a comment