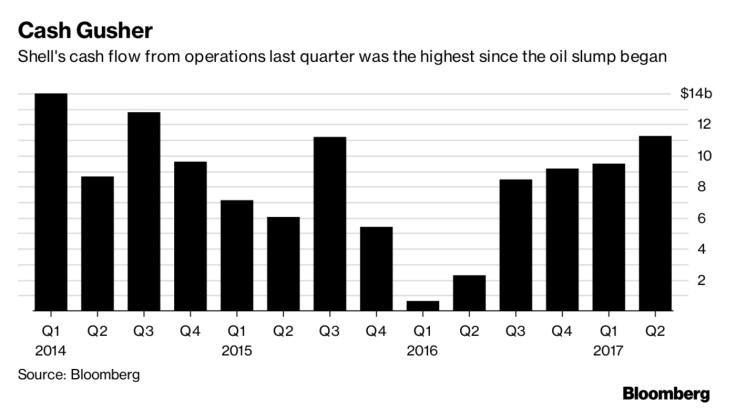

Royal Dutch Shell Plc’s cash flow from operations rose to the highest since the oil price slump started in 2014 as asset sales and cost cuts helped Europe’s largest energy company pay down debt and boost profit.

The consensus-beating second-quarter performance showed how Shell’s response to the worst industry downturn in a generation — the $54 billion takeover of BG Group Plc last year, deep cost reductions, and the disposal of less profitable assets — is paying off.

Leave a comment