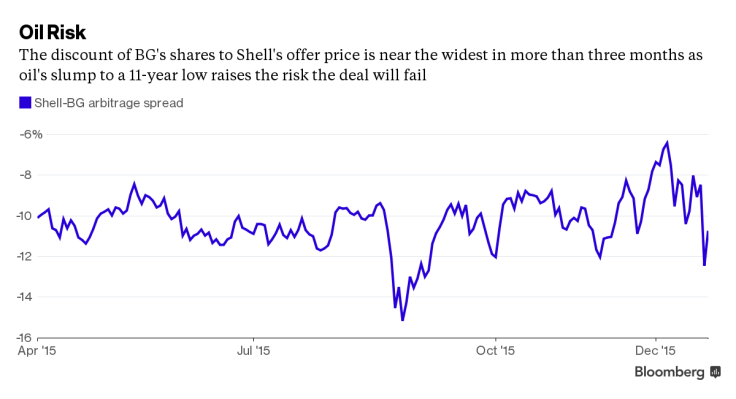

Royal Dutch Shell Plc is on the brink of pulling off its biggest acquisition. Yet the widening discount of target BG Group Plc to the offer price shows that a further steep drop in oil prices could still put the deal in doubt.

BG traded 12.5 percent below Shell’s bid price on Dec. 18, the biggest discount since early September, compared with a 6.4 percent gap on Dec. 4. While BG shares soared when news of the deal broke eight months ago, they’ve since tumbled more than 20 percent as oil prices slumped.

If benchmark Brent crude sinks to the mid-$20s a barrel, the transaction may fall through, said Philip Lawlor, a strategist at Smith & Williamson Investment Management LLP in London, which owns shares in both Shell and BG. Trz Trading BV’s Niels Lammerts Van Bueren said it “all depends on the oil price.”

Leave a comment