It’s been a tough run for Latin American leftists, and investors couldn’t be happier.

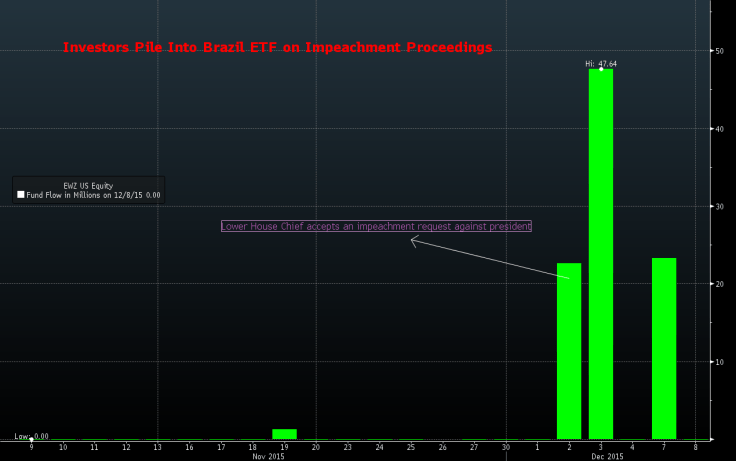

Traders have snapped up assets from countries showing a shift away from the populist leadership of the past decade. Venezuelan bonds climbed to the highest since May after the opposition on Sunday won a majority in Congress for the first time in 16 years. The Global X MSCI Argentina exchange-traded fund has seen assets under management jump since polls first showed a business-friendly candidate was likely to win the presidency in last month’s elections. Investors have piled into the biggest Brazil stock ETF as lawmakers initiated impeachment proceedings against President Dilma Rousseff.

“There’s a major shift for the region,” said Michael Ganske, who oversees $4.5 billion of debt and currencies as head of emerging markets at Rogge Global Partners in London. “That’s what investors are trading.”

* The iShares MSCI Brazil Capped ETF attracted $70.2 million of inflows last week, the biggest five-day increase since June, when lower house chief Eduardo Cunha said he accepted a request to impeach Rousseff. Investors poured in another $23.3 million on Monday.

Leave a comment