BRAVA ENERGIA S.A. (“BRAVA” or “Company”) (B3: BRAV3), pursuant to CVM Resolution No. 44, hereby informs its investors and the market in general that, yesterday, production began on wells 4H and 5H, which are currently undergoing testing and stabilization. Both wells have already produced through the early production system (FPSO Petrojarl I). With the connection... Continue Reading →

ANP forecasts 29% increase in production from Brazilian onshore fields by 2029

(PN) Oil and natural gas production in Brazil's onshore fields is expected to continue growing over the next five years, according to projections released by the National Petroleum Agency (ANP). By 2029, extraction from onshore wells could increase by around 29%, according to data presented in the 2025 Annual Production Programs (PAPs). These documents are... Continue Reading →

Geopark announces the sale of its 10% stake in Manati Field

(PN) GeoPark announced a reorganization of its portfolio, with repercussions on its operations in Brazil. The company revealed that it will sell certain “non-core” assets, as well as implement cost reduction initiatives to strengthen its position aiming at profitable, reliable and sustainable growth in the long term. One of the points of the reorganization involves... Continue Reading →

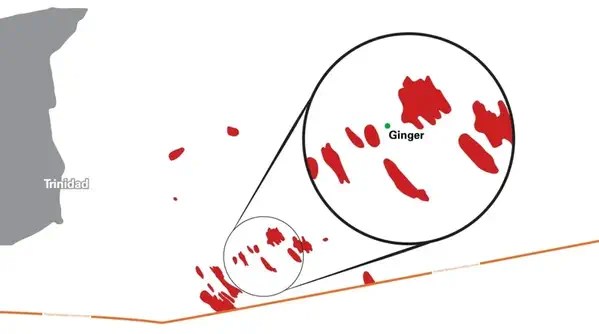

BP Trinidad and Tobago: Ginger Gets Green Light, Frangipani Delivers Gas Find

(OE) BP Trinidad and Tobago has taken the final investment decision (FID) for the Ginger gas development offshore Trinidad and Tobago, while marking the exploration success at its Frangipani well. Taking FID on Ginger and discovering gas at Frangipani are the latest demonstrations of upstream activity this year for BP, in line with its strategy... Continue Reading →

Shell Makes FID for Deepwater Gato do Mato Project off Brazil

(OE) Shell Brasil Petróleo, a subsidiary of Shell, has taken the Final Investment Decision (FID) for Gato do Mato, a deepwater oil and gas project in the pre-salt area of the Santos Basin, offshore Brazil. The Gato do Mato Consortium includes Shell (operator with a 50% stake), Ecopetrol (30%), TotalEnergies (20%) and Pré-Sal Petróleo... Continue Reading →

Vitol snaps up West Africa assets from Eni, strengthening upstream presence

(Reuters) - Vitol will buy stakes in West African oil and gas assets from Italy's Eni, bolstering the global commodity trading house's position in the upstream sector, as it seeks to reinvest the huge profits it has been generating since 2022. The commodity trader will acquire an interest in oil and gas producing assets and... Continue Reading →

Brava Energia Production Data February 2025

BRAVA ENERGIA S.A. (“BRAVA” or “Company”) (B3: BRAV3), informs its investors and the market in general the preliminary and unaudited production data for the month of February 2025. Brava reached a record production level in February, registering a significant increase when compared to the previous month. This result is linked to the investments and improvements... Continue Reading →

Ecuador awards oil contract to Chinese-led group to boost ‘crown jewel’ project

(Reuters) - Ecuador's government awarded an onshore oil contract to a consortium led by China's state-owned producer Sinopec on Monday, in a push to grow crude output from the country's Sacha block. The block is Ecuador's most productive, located in the country's northeastern Amazonian province of Orellana. It pumped 77,000 barrels per day (bpd) last year.... Continue Reading →

Brava -Definition of Perimeter for Binding Phase of Possible Sale of Onshore and Shallow Water Assets

BRAVA ENERGIA S.A. (“BRAVA” or “Company”) (B3:BRAV3), pursuant to CVM Resolution No. 44, following the material facts disclosed on December 27, 2024 and on January 10 and 24, 2025, informs its investors and the market in general that the Company's Board of Directors has defined that the scope of the possible divestment transaction of the... Continue Reading →