(Offshore) Wood Mackenzie’s Global Upstream Outlook 2022 predicts a 9% increase in investments next year to more than $400 billion. The consultants expect more than 40 projects with resources of more than 50 MMboe to be sanctioned, with low-breakeven, low-carbon deepwater projects dominating greenfield final investment decisions. Fraser McKay, vice president upstream research, said: “Companies will allocate... Continue Reading →

Woodmac: Oil & gas on the rebound but tension will define 2022

Energy intelligence provider Wood Mackenzie, a Verisk business, believes that the oil and gas sector will continue to rebound in 2022, but the positive outlook will be tempered by concerns about its future. In its Global Upstream Outlook 2022, Wood Mackenzie points out the upstream industry must respond to the implications of the pledges made at COP26 and... Continue Reading →

ANP REDUCES ROYALTIES FOR SMALL ONSHORE PRODUCERS AND DISCUSSES PRODUCTION MEASUREMENT RULES

The National Petroleum Agency (ANP) approved today the reduction of the royalty rate levied on fields operated by small or medium-sized companies. In all, the agency granted a reduction in the charge for 36 fields, located in the states of Rio Grande do Norte (31), Espírito Santo (3), Bahia (1) and Sergipe (1). Small companies... Continue Reading →

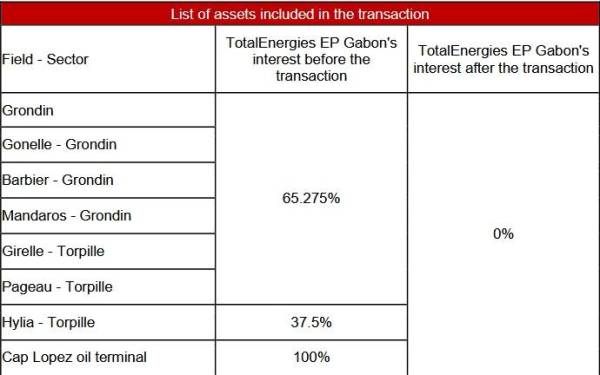

TotalEnergies Sells Gabon Terminal, Offshore Fields to Perenco for $350M

(OE) French oil major TotalEnergies has completed the sale of the Cap Lopez Terminal and non-operated offshore field in Gabon to Perenco. "After receiving the approval of Gabonese authorities, TotalEnergies announces the closing of its agreement to divest to Perenco Oil and Gas Gabon the Cap Lopez Terminal and non-operated assets of its 58%-owned affiliate TotalEnergies EP Gabon," TotalEnergies said Thursday. With the transaction valued at $350 million before final adjustment, TotalEnergies EP Gabon... Continue Reading →

Brazil is a priority in Equinor’s global portfolio

(Valor) In a strategic repositioning process, with an eye on the energy transition, Equinor decided to halve the number of countries where it operates in the oil and gas sector. In Brazil, on the contrary, the idea is to continue to grow. After announcing, this year, investments of US$ 8 billion - together with ExxonMobil... Continue Reading →

3R Petroleum Production Data November 2021

3R PETROLEUM ÓLEO E GÁS S.A. (“3R” or “Company”), following best practices in corporate governance and transparency, informs its investors and the market in general the preliminary unaudited production data for November 2021 in the assets that the Company holds participation. (1) Refers to 3R's participation in Macau Cluster concessions after discounting Galp's 50% stake... Continue Reading →

PetroRio November 2021 Operational Data

Petro Rio S.A. (“Company” or “PetroRio”) (B3: PRIO3), following best practices in corporate governance and transparency, informs its preliminary and non-audited Operational Data for the month of November. Obs.: (1) Frade figures account for a 70% interest in the Frade Field until February 4 and 100% interest as of February 5, when the Company announced... Continue Reading →

TotalEnergies Starts Production from CLOV Phase 2, Offshore Angola

French oil major TotalEnergies said Friday it had started production from the CLOV Phase 2 in Angola, a project connected to the existing CLOV FPSO. Sitting approximately 140 kilometers from the Angolan coast, in water depths from 1,100 to 1,400 meters, the CLOV Phase 2 resources are estimated at around 55 million barrels of oil... Continue Reading →

Brazil produced 3,606 MMboe/d in October

The national production of oil and natural gas in October totaled 3,606 MMboe/d (million barrels of oil equivalent per day), with 2,777 MMbbl/d (million barrels daily) of oil and 132 MMm3/d (million cubic meters) of natural gas. There was a 7.4% reduction in oil production compared to the previous month and 3.3% compared to October... Continue Reading →

Chevron plans $15 billion spending budget for 2022

U.S. oil major Chevron Corporation has revealed its 2022 organic capital and exploratory spending programme of $15 billion, at the low end of its $15 to $17 billion guidance range and up more than 20 per cent from 2021 expected levels. The company also expects to increase its share buyback programme. As explained by Chevron on Monday, this capital programme... Continue Reading →