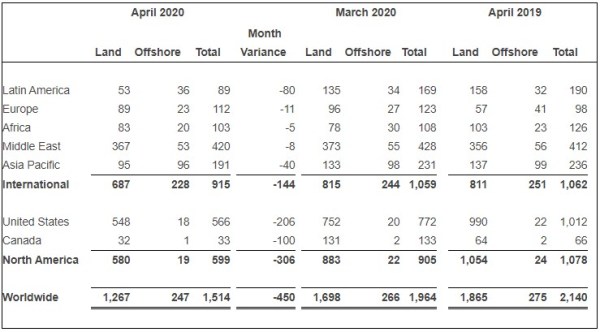

The worldwide offshore rig count in April 2020 dropped 28 rigs year-over-year and 19 rigs sequentially, according to rig count reports by Baker Hughes. Baker Hughes splits its rig counts into international and North America rig counts, which combined make the worldwide rig count. Continue reading

Saudis join three other OPEC+ nations cutting output early

Saudi Aramco began reducing oil production earlier this week ahead of the May 1 start date for OPEC+ output cuts, according to a Saudi industry official familiar with the matter. Aramco has begun to curtail production from about 12 million barrels a day to achieve the agreed level of 8.5 million barrels a day, the... Continue Reading →

No Blanket Royalty Waiver for U.S. Offshore Oil Industry

The Trump administration will not make a broad cut to the royalty rate oil and gas companies must pay on their offshore drilling operations despite a historic oil price collapse that has put the industry in crisis, a Gulf Coast lawmaker briefed on the matter told Reuters on Wednesday. The administration's decision scratches off one... Continue Reading →

GeoPark Announces First Quarter 2020 Operational Update

GeoPark Limited (“GeoPark” or the “Company”) (NYSE: GPRK), a leading independent Latin American oil and gas explorer, operator and consolidator with operations and growth platforms in Colombia, Peru, Argentina, Brazil, Chile and Ecuador, today announced its operational update for the three-month period ended March 31, 2020 (“1Q2020”). All figures are expressed in US Dollars and... Continue Reading →

Oil Price Crash, What Next?

A historic rout in oil markets sent U.S. crude prices plummeting to as much as minus $40 a barrel as traders rushed to get rid of unwanted stocks with storage capacity already overflowing amid a coronavirus-induced demand collapse. U.S. West Texas Intermediate (WTI) crude for May delivery recouped some losses on Tuesday to be just... Continue Reading →

U.S. crude futures turn negative for first time on scant storage, weak demand

(Reuters) - U.S. crude oil futures turned negative on Monday for the first time in history as storage space was filling up, discouraging buyers as weak economic data from Germany and Japan cast doubt on when fuel consumption will recover. Physical demand for crude has dried up, creating a global supply glut as billions of... Continue Reading →

The Year 2020 Will be a Large Stress Test for the Offshore Industry

As the offshore market entered 2020, many within the industry had an optimistic outlook for the future and the consensus was ‘the worst is behind us’. However, nobody could have foreseen the events that would unfold in Q1 2020 and the impact that would be felt throughout every corner of the global economy. Continue reading

Record Oil Output Cuts Fail to Make Waves in Coronavirus-hit Market

The minimal impact on oil prices from a global deal for record output cuts showed that oil producers have a mountain to climb if they are to restore market balance as the coronavirus shreds demand and sends stockpiles soaring, industry watchers said. After several days of discussions, oil producing and consuming countries aim to remove... Continue Reading →

OPEC, Russia Approve Biggest-Ever Oil Cut to Support Prices

OPEC and allies led by Russia agreed on Sunday to a record cut in output to prop up oil prices amid the coronavirus pandemic in an unprecedented deal with fellow oil nations, including the United States, that could curb global oil supply by 20%. Measures to slow the spread of the coronavirus have destroyed demand... Continue Reading →

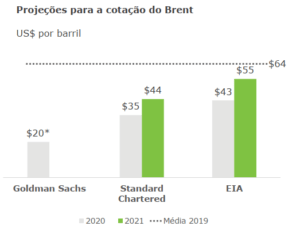

OIL UNDER $ 40 IS UNSUSTAINABLE IN THE LONG RUN FOR RUSSIA AND SAUDI ARABIA, IBP POINTS

APR 9, 2020 Today , the Organization of Petroleum Exporting Countries (OPEC) and Russia will hold a virtual conference to try to reach a new agreement on cutting production. The agreement between the sides seems to be imperative and a new study published by the Brazilian Petroleum Institute (IBP) reinforces this thesis. The document highlights... Continue Reading →