Norwegian firms Aker Solutions and Kvaerner have received the necessary approvals from governmental bodies for the completion of the earlier announced merger. In June this year, the two companies entered into a merger plan to create an optimised supplier company. The merger means that Aker Solutions takes over all Kvaerner’s assets, rights and obligations. As... Continue Reading →

Coronavirus Surge Throws Oil Recovery into Reverse

Oil futures prices have started to signal OPEC+ may have to do more to offset a second wave of coronavirus and a renewed economic slowdown. Between mid-September and mid-October, Brent’s six-month calendar spread had been tightening, a signal traders expected production to run below consumption and inventories to fall. Over the last ten days, however,... Continue Reading →

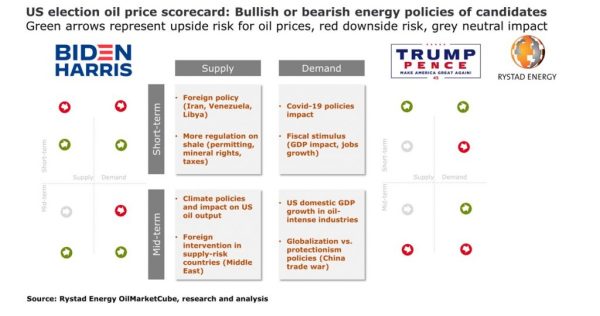

Rystad: Biden win could benefit short-term oil demand, but Trump win could be the most bullish outcome

Looking at different energy visions of the two U.S. presidential candidates, Rystad Energy believes that if Trump should win it may make oil prices great again while Biden effect is more mixed. The U.S. presidential election of 2020 comes amid a pandemic that has ravaged energy markets and the two main candidates have very divergent... Continue Reading →

Petrobras starts binding phase of Araucária Nitrogenados S.A

Rio de Janeiro, October 30, 2020 - Petróleo Brasileiro S.A. – Petrobras, following up on the press release disclosed on September 17, 2020, informs the beginning of the binding phase regarding the sale of all its shares in the wholly-owned subsidiary Araucária Nitrogenados S.A. (ANSA). Potential buyers qualified for this phase will receive instructions on... Continue Reading →

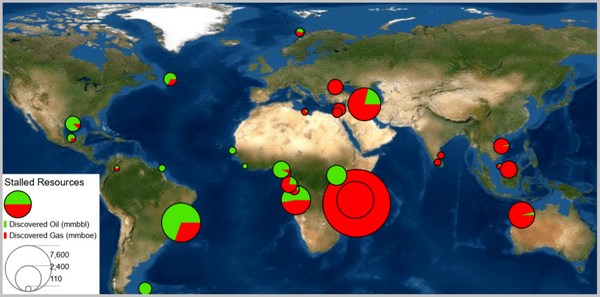

Stalled Oil and Gas Resources – How Big an Opportunity Is It?

A new study by Westwood Global Energy Group shows that 11 billion barrels of oil and 36 billion barrels of oil equivalent (boe) gas in 119 discoveries >100 million boe in size made between 2008 and 2016 is currently stalled with no progression towards development. This oil and gas, potentially, worth more than $65 bn... Continue Reading →

PETROBRAS REPORTS A LOSS OF R$ 1.5 BILLION IN THE THIRD QUARTER OF 2020

The third quarter of 2020 ended with a financial loss for Petrobras. The company announced losses of R$ 1.546 billion between July and September. This is the third quarter followed of recorded losses for the oil company. For the first quarter of 2020 the company recorded losses of R$ 48.5 billion, between April and June... Continue Reading →

Ørsted’s 3Q Results Beat Expectations

Danish energy group Ørsted beat third-quarter profit expectations on Wednesday but said offshore wind projects in the United States faced “significant” delays. The world’s largest offshore wind farm developer kept its full-year guidance for earnings before interest, tax, depreciation, and amortization (EBITDA) of 16-17 billion Danish crowns ($2.5-$2.7 billion). “Despite the tenacious COVID-19 pandemic, our... Continue Reading →

ENAUTA has R$ 2 billion to acquire new fields, says CEO

(Reuters) - Oil company Enauta has 2 billion reais available to restore its portfolio and acquire new fields, said the company's chief executive, Décio Oddone, who took office in September. The company, which over the past year has sold the Manati and Carcará fields, is open to opportunities in shallow water and onshore areas, apart... Continue Reading →

Schlumberger Reports Third Straight Quarterly Loss

Top oilfield services provider Schlumberger NV on Friday posted its third straight quarterly loss as this year's prolonged slump in oil prices due to the COVID-19 pandemic compelled its major energy customers to shun drilling. The company kicked off earnings from hard-hit U.S. oilfield service providers and come as the reintroduction of lockdowns in some... Continue Reading →

Oil Traders See Slow Demand Recovery

Top global oil traders Vitol, Trafigura and Gunvor said on Thursday they saw slow oil demand recovery because of a second coronavirus wave with oil prices rising to or above $50 per barrel only by October next year. Benchmark Brent crude futures traded down 1.6% to $42.62 a barrel at 0905 GMT on Thursday as... Continue Reading →