The move by the OPEC+ group of oil exporters to ease their output restrictions from May onwards is effectively a bet that the current soft demand for crude will improve at the same pace as production returns. If history is a guide, it will be extremely difficult to get that balance correct, especially in the... Continue Reading →

Petrobras publishes its 2020 Sustainability Report

Petróleo Brasileiro S.A – Petrobras informs that it published today its 2020 Sustainability Report. In addition to presenting its operating, economic, social, environmental and governance performance, the report shows Petrobras’ advances in environmental and social indicators and the support in the fight against the effects of the Covid-19 pandemic on Brazilian society, thus expanding the... Continue Reading →

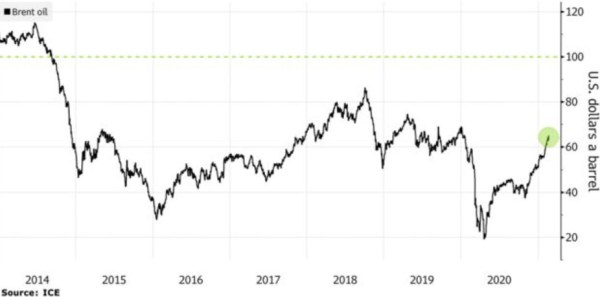

Oil trader Gunvor sees crude stuck around $65 as stock drawdown slows

(Bloomberg) --The head of oil trader Gunvor Group Ltd. expects prices to remain stuck where they are as draws of excess stocks slow amid rising coronavirus cases in Europe. “Oil prices are going to stay where they are - 65 ish - give or take a bit,” Torbjorn Tornqvist, the chairman and chief executive officer... Continue Reading →

Brent crude hits $70 as China energy demand outlook brightens

(Reuters) - Oil prices rose on Monday, with Brent reaching $70 a barrel, as data showed China’s economic recovery accelerated at the start of 2021, boosting the energy demand outlook at the world’s largest oil importer. Brent crude futures for May were steady at $69.21, down 1 cent a barrel by 1150 GMT while U.S.... Continue Reading →

Brazil judge annuls Lula’s convictions, opens door to 2022 run

(Reuters) - A Brazilian Supreme Court judge on Monday annulled the criminal convictions against former leftist President Luiz Inacio Lula da Silva, a move that could allow the popular politician to run in next year’s presidential election. The decision roiled financial markets and scrambled forecasts for the 2022 race, with many investors betting it would... Continue Reading →

Brent Tops $70 after Houthi Attack on Saudi Oil Export Hub

(Reuters) Yemen's Houthi forces fired drones and missiles at the heart of Saudi Arabia's oil industry on Sunday, including a Saudi Aramco facility at Ras Tanura vital to petroleum exports, in what Riyadh called a failed assault on global energy security.The Saudi energy ministry said there were no casualties or loss of property from the... Continue Reading →

Oil Prices Near 14-month High on OPEC+ Decision to Extend Output Cuts

Oil prices jumped more than $1 a barrel on Friday, hitting their highest levels in nearly 14 months, after OPEC and its allies agreed not to increase supply in April as they await a more substantial recovery in demand amid the coronavirus pandemic. Brent crude futures for May rose to as high as $68 a... Continue Reading →

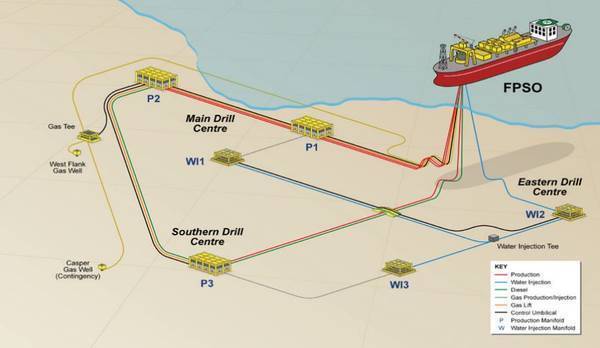

Falkand Islands Gov’t Gives More Time to Sea Lion Field Partners

The Falkland Islands government has agreed to extend the terms of several offshore oil and gas licenses, including the one containing the undeveloped Sea Lion field, oil and gas company Rockhopper has informed. To remind, Premier Oil, the operator of the Sea Lion development, in May last year suspended work on the $1.8 billion Sea Lion offshore... Continue Reading →

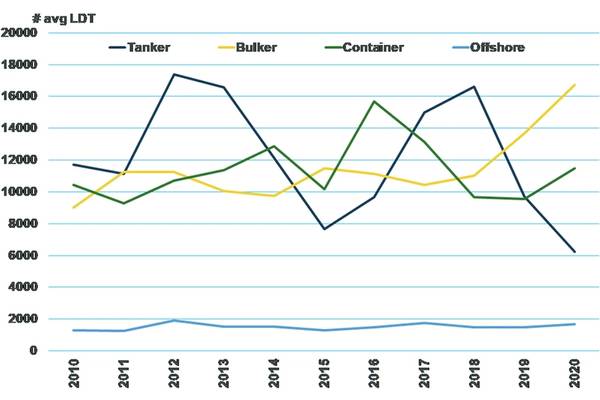

MARKET: Why Don’t OSVs Get Scrapped?

The OSV sector will be reliant on a hitherto unseen amount of scrapping to balance the market, writes Gregory Brown, Associate Director – Offshore, Maritime Strategies International There is a consensus that an OSV market recovery will only be driven a supply side rationalization. As well as a lack of newbuild activity, that rationalization will... Continue Reading →

Rumours of $100 oil return as crude recovers from Covid grip

While the oil price collapse is still fresh in our minds, rumours are starting to emerge that by the end of next year prices could once again top $100 a barrel. Bloomberg quoted Azerbaijan’s Socar which predicted that global benchmark Brent could hit triple digits in the next 18 to 24 months. Bank of America also... Continue Reading →