The U.S. Bureau of Ocean Energy Management (BOEM) will hold an oil and gas lease sale for the Gulf of Mexico on November 17, complying with a U.S. District Court order. To remind, the Biden administration had paused all oil and gas leasing activities on federal lands and waters in January, citing climate crisis. A federal judge... Continue Reading →

Brent dips after topping $80 a barrel, highest since Oct 2018

(Reuters) - Brent oil dipped on Tuesday after topping $80 per barrel for the first time in nearly three years, as a five-day rally ran out of steam with investors locking in profits. Oil benchmark prices have been on a tear, with fuel demand growing and traders expecting major oil-producing nations will decide to keep... Continue Reading →

LNG price rally could boost oil demand- Rystad Energy

(Reuters) - The rally in liquefied natural gas (LNG) prices has widened the gap with oil prices and could boost oil demand by 400,000 barrels a day (bpd) on average over the next two quarters, according to research by consultancy Rystad Energy. The average LNG price for November delivery into Northeast Asia was estimated at... Continue Reading →

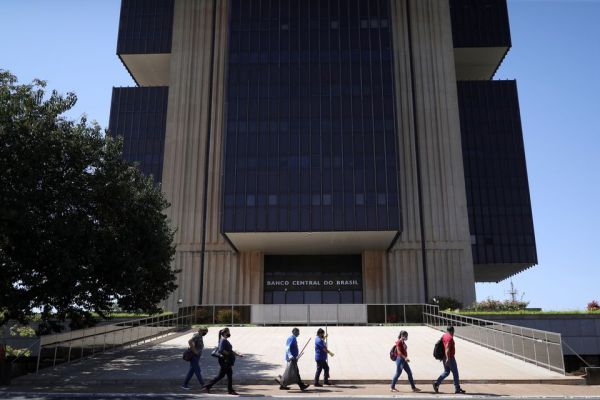

Brazil central bank eyed hiking rates more than 100 bps

(Reuters) - Brazil's central bank weighed accelerating the world's most aggressive monetary tightening, minutes from its last policy meeting showed on Tuesday, but uncertainty about a post-pandemic rebound led it to stay the course on 100-basis-point rate hikes. The minutes of the Sep. 21-22 meeting, when the bank raised its Selic policy rate to 6.25%,... Continue Reading →

Brent Shoots Past $80 a Barrel

Oil markets climbed for a sixth day on Tuesday, boosted by a tighter supply and firm demand outlook, but power shortages in China which hit factory output tempered the rally. Brent crude futures gained 67 cents, or 0.8%, to $80.20 a barrel at 1016 GMT, after reaching their highest level since October 2018 at $80.75.... Continue Reading →

Brent oil nears $80 a barrel amid supply constraints

(Reuters) - Oil prices rose for a fifth straight day on Monday with Brent at its highest since October 2018 and heading for $80 amid supply concerns as demand picks up in parts of the world with the easing of pandemic restrictions. Brent crude was up 92 cents or 1.2% at $79.01 a barrel by... Continue Reading →

Oil heads for third week of gains as output stumbles

(Reuters) - Oil prices steadied on Friday near a two-month high of $77.50 a barrel and were headed for a third straight week of gains, supported by global output disruptions and inventory draws. The rally was slightly dampened by China's first public sale of state crude reserves. Brent crude was up 222 cents, or 0.28%,... Continue Reading →

Brazil raises interest rates, signals third big hike next month

(Reuters) - Brazil's central bank on Wednesday raised interest rates by 100 basis points and flagged a third straight hike of that size in October as it battles surging inflation with the world's most aggressive monetary tightening. The bank's rate-setting committee, known as Copom, decided unanimously to raise its benchmark rate to 6.25% as forecast... Continue Reading →

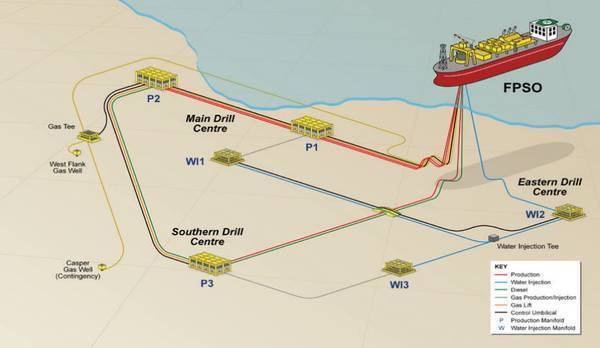

Harbour Energy Seeks to Exit Sea Lion Offshore Project in Falkand Islands

Harbour Energy, a London-listed oil firm created through a merger between Chrysaor and Premier Oil, has decided to exit the Sea Lion oil field development in the Falkland Islands. The company has a 60 percent stake in the oil field, with Rockhopper Exploration holding the remaining 40 percent stake. The field was discovered in 2010 by Rockhopper,... Continue Reading →

Column: Brazil heading for monetary overkill?: Jamie McGeever

(Reuters) - Brazil's central bank has put itself on the front line of the global battle against inflation, but its aggressive monetary tightening risks choking the economy. With annual inflation at 10%, the central bank will fail to meet its 3.75% central target this year and possibly next year's 3.50% goal too. A chronically weak... Continue Reading →