(Rigzone) The United States has added 10 rigs week on week, according to Baker Hughes latest rotary rig count, which was released on October 15. The ten rigs added week on week comprised nine land rigs and one offshore rig. The total U.S. rig count now stands at 543, comprising 529 land rigs, 12 offshore... Continue Reading →

“THE RIG” – Saudi Arabia Launches Offshore Platform Inspired Tourism & Entertainment Project

Saudi Arabia's sovereign wealth fund, the Public Investment Fund, announced on Saturday the launch of "THE RIG", which it said would be the world's first tourism destination on offshore platforms. The fund, the engine of Crown Prince Mohammed bin Salman's economic transformation plans for Saudi Arabia, manages a portfolio worth $400 billion. It added in... Continue Reading →

Oil prices scale $85/bbl on back of supply deficit

(Reuters) - Oil prices hit a fresh three-year high on Friday, climbing above $85 a barrel on forecasts of a supply deficit over the next few months as rocketing gas and coal prices stoke a switch to oil products. Brent crude futures were up 80 cents, or 0.95%, to $84.80 a barrel at 0930 GMT.... Continue Reading →

Bolsonaro now favors privatization of Brazil’s Petrobras

(Reuters) - Brazilian President Jair Bolsonaro, frustrated that he has been blamed for gasoline price increases, is now inclined to privatize oil company Petrobras (PETR4.SA), he said on Thursday, adding he would discuss the idea with economic advisors. "Now I want to privatize Petrobras. ... I will check with the economic team what we can do... Continue Reading →

How to Ensure Oil & Gas Infrastructure Still Has Value

(OE) By David Linden Head of Energy Transition at Westwood Global Energy Group If we want to reach net zero by 2050, there is an increasingly high risk that some of the oil and gas infrastructure investments (i.e. in platforms, pipelines, processors, storage sites etc) made today will result in stranded assets. In other words,... Continue Reading →

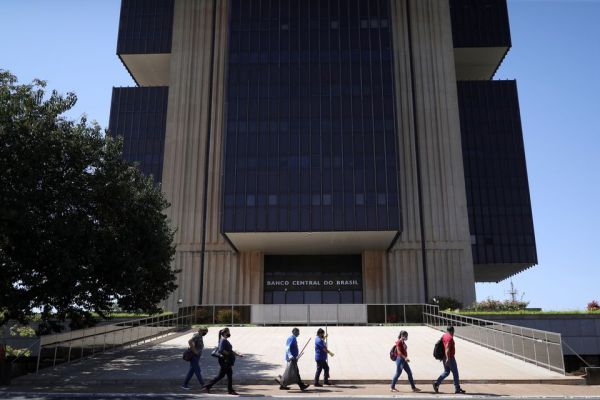

Brazil central bank sells $1 bln in surprise FX swap auction

Oct 13 (Reuters) - Brazil's central bank sold $1 billion worth of currency swaps in a surprise auction on Wednesday afternoon, and said later it would hold another sale on Thursday, seeking to boost the local currency from nearly six-month lows. The central bank said it sold all 20,000 foreign exchange swap contracts offered in... Continue Reading →

Mexico president says foreign companies smuggled fuel, names Trafigura

(Reuters) - Mexican President Andres Manuel Lopez Obrador said on Monday that well-known foreign companies had engaged in what he described as fuel smuggling and he named global energy trader Trafigura (TRAFGF.UL) as an example of the practice. The comments marked a new development in a web of corruption probes of some of the world's... Continue Reading →

Citi Says Oil May Climb to $90

(Bloomberg) Citigroup Inc. said oil prices may hit $90 a barrel at times this winter as gas-to-oil switching drives stockpiles lower. The bank, which raised its Brent oil forecast for the fourth quarter to $85, said inventories may dwindle to their lowest level on record in terms of days-of-cover by year-end. That comes as consumption... Continue Reading →

Oil Rises to Multi-year Highs on Global Energy Crunch

Oil prices rose by about 2% on Monday, extending gains as an energy crisis grips major economies amid a pick-up in economic activity and restrained supplies from major producers. Brent crude was up $1.45, or 1.8%, at $83.84 a barrel by 1336 GMT, its highest since October 2018. U.S. West Texas Intermediate (WTI) crude rose... Continue Reading →

Oil Market Needs $500B+ Injection to Ensure Supply

(Bloomberg) Oil explorers need to raise drilling budgets by 54% to more than half a trillion dollars to forestall a significant supply deficit in the next few years, according to Moody’s Investors Service Inc. Crude and natural gas drillers chastened by last year’s unprecedented collapse in demand and prices haven’t responded to the recent market... Continue Reading →