(Reuters) - Oil rose towards $75 on Thursday supported by record U.S. implied demand and falling crude stockpiles, even as the spread of the Omicron coronavirus variant threatens to put a brake on consumption globally. Crude and other risk assets such as equities also got a boost after the U.S. Federal Reserve gave an upbeat... Continue Reading →

Oil slips over 1% – crude supply growth will exceed demand

(Reuters) - Oil prices fell for a third day straight on Wednesday on growing expectations that supply growth will outpace demand growth next year, even though the Omicron coronavirus variant is not seen curbing mobility as sharply as earlier COVID-19 variants. U.S. West Texas Intermediate (WTI) crude futures fell $1.05, or 1.5%, to $69.68 a... Continue Reading →

IEA: Oil Supply Set to Top Demand

(OE) A surge in COVID-19 cases and the emergence of the Omicron variant will dent global demand for oil, the International Energy Agency (IEA) said on Tuesday, but the broader picture is one of increasing output set to top demand this month and soar next year. "The surge in new COVID-19 cases is expected to... Continue Reading →

BH’s U.S. offshore rig count up

The number of offshore rigs in the U.S. is slowly starting its upward climb by increasing to 14 units last week, based on Baker Hughes’ weekly rig count report from last Friday. Baker Hughes Rig Count: U.S. +7 to 576 rigsU.S. Rig Count is up 7 from last week to 576 with oil rigs up 4 to... Continue Reading →

Oil gains

(Reuters) - Oil prices extended their rally on Monday as investor appetite improved amid growing relief the Omicron coronavirus variant may not cause severe illness and will likely have a limited impact on global fuel demand. Brent futures climbed 72 cents, or 1.0%, to $75.87 a barrel by 0744 GMT, after rising 1% on Friday.... Continue Reading →

Oil prices on track for big weekly gain

(Reuters) - Oil prices were on track for their biggest weekly gain since late August, with market sentiment buoyed by easing concerns over the Omicron coronavirus variant's impact on global economic growth and fuel demand. The Brent and WTI benchmarks were both on course for gains of about 7% this week, their first weekly gain... Continue Reading →

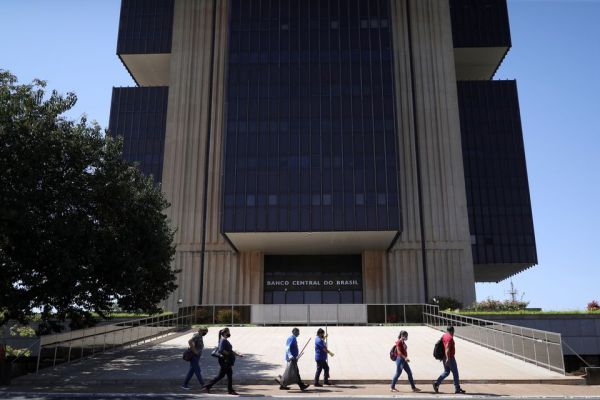

Brazil central bank makes 150 bps interest rate hike, signals another

(Reuters) - Brazil's central bank on Wednesday raised interest rates by 150 basis points and signaled another such hike in February, waging one of the world's most aggressive battles with inflation even as Latin America's largest economy has tipped into recession. The bank's rate-setting committee, known as Copom, decided unanimously to raise its benchmark interest... Continue Reading →

Oil slips after restrictions to counter Omicron

(Reuters) - Oil prices eased after early gains on Thursday after measures by some governments to slow the spread of the Omicron coronavirus variant, though losses were capped by positive comments from vaccine makers about the efficacy of their jabs. Brent crude futures fell 47 cents, or 0.6%, to $75.35 a barrel by 1004 GMT... Continue Reading →

Oil traders take a long-shot bet on a possible U.S. oil export ban

(Bloomberg) --Oil traders are scooping up options contracts that would pay out if U.S. crude futures plummet against international benchmark Brent, a signal that some believe the Biden administration could intervene in the market again to bring down oil prices. Some traders have bet on the small chance that West Texas Intermediate’s discount to Brent... Continue Reading →

Oil steadies near $75

(Reuters) - Oil prices steadied near $75 a barrel on Wednesday, taking a breather after strong gains earlier this week, as investors continued to assess the impact of the Omicron coronavirus variant on the global economy and fuel demand. Brent crude futures dropped 19 cents, or 0.25%, to $75.25 a barrel at 0925 GMT, after... Continue Reading →