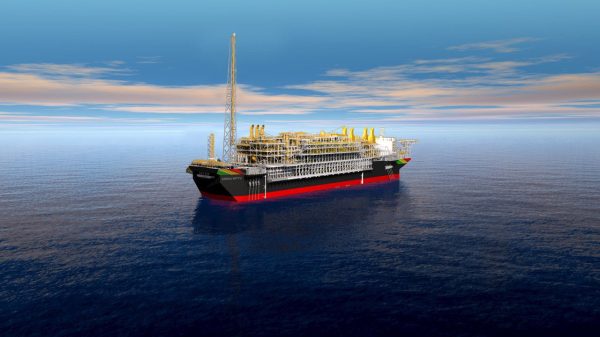

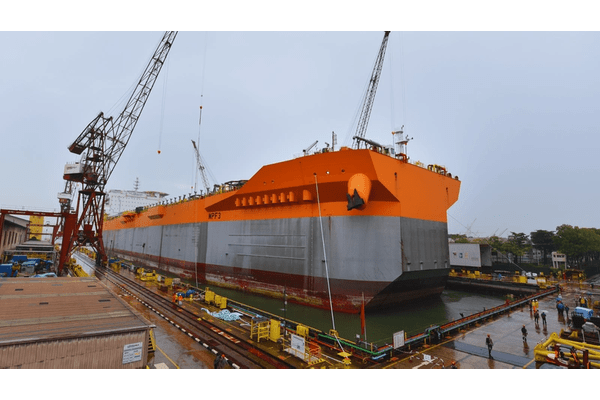

March 4 (oilnow.gy) Rystad Energy said TotalEnergies’ GranMorgu development offshore Suriname will feature a 50,000 ton topside and gas-processing capacity of 500 million cubic feet per day (MMcf/d), underscoring the country’s emergence in the floating production, storage and offloading (FPSO) segment. In a February 19 report, Rystad Energy said, “TotalEnergies’ FPSO marks Suriname’s emergence in the FPSO... Continue Reading →

South America Dominates Global FPSO Market With $181 Billion Deepwater Buildout

Feb. 27 (oilprice.com) South America is set to maintain its position as the most significant region for floating production, storage, and offloading (FPSO) vessels, with 36 projects awarded or expected to be awarded between 2021 and 2030, totaling field greenfield commitments worth around $181 billion. Among these 36 projects, 25 have disclosed FPSO costs ranging... Continue Reading →

Suriname, Guyana to form team to explore joint gas projects, oil minister says

Feb 17 (Reuters) - Suriname and Guyana plan to create a joint technical team to explore the development of natural gas production projects between the two South American countries, Suriname's oil minister told Reuters. The team, which could be installed next month, would mark a major step forward for Suriname and Guyana, which have long... Continue Reading →

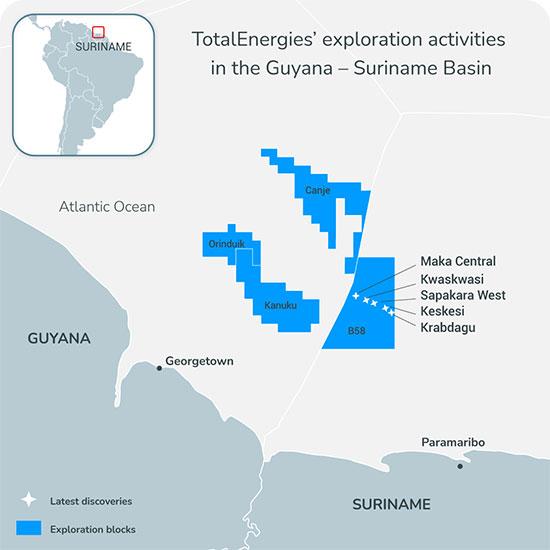

Suriname’s Oil Boom Faces Economic Headwinds Despite Major Discovery

Feb. 18 (oilprice.com) A slew of high-quality oil discoveries in offshore Block 58 by TotalEnergies and its 50% partner, APA Corporation, has seen the tiny South American country of Suriname touted as the next Guyana. While Suriname’s offshore waters hold considerable petroleum potential, the country’s oil boom has been fraught with delays. Conflicting geological data, high gas-to-oil ratios,... Continue Reading →

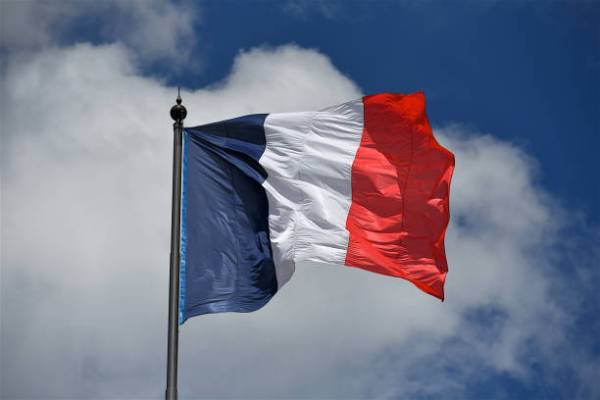

France Calls Draft Law on Oil Exploration in Overseas Territories

Jan. 29 (Reuters) French Finance Minister Roland Lescure called a draft law proposing to allow offshore oil and gas exploration in its overseas territories "anachronistic" during a debate in the country's Senate on Thursday. In a world first, France banned new oil and gas exploration and production licenses in 2017, hoping other nations would follow suit. But energy security... Continue Reading →

Guyana rigs extended to 2029 as Noble secures US$1.3B in new contracts

Jan. 29 (oilnow.gy) Drilling activity offshore Guyana has been extended through 2029 after ExxonMobil awarded Noble Corporation plc additional rig years under its Commercial Enabling Agreement. The award applies evenly across four drillships operating in Guyana — Noble Sam Croft, Noble Don Taylor, Noble Tom Madden and Noble Bob Douglas — and is part of a broader... Continue Reading →

Global Upstream Capex Set To Fall Again In 2026 Amid Low Oil Prices

Jan. 13 (oilprice.com) Last year, upstream oil investment was projected to have declined 2.5% Y/Y to $420 billion after low oil prices put pressure on producers and slowed expansion plans. Companies across the industry continued to prioritize profitability, free cash flow, and debt reduction over aggressive production growth, a trend reinforced by macro uncertainty. The decline was... Continue Reading →

Bourbon Completes Financial Overhaul Under New Ownership

Jan. 4 (OE) French offshore marine services company Bourbon has completed a financial and capital restructuring, with Davidson Kempner Capital Management LP and Fortress Investment Group becoming its majority shareholders. The restructuring marks the start of a new strategic phase aimed at improving profitability, enhancing organizational efficiency, and expanding market presence. Approved in July 2025... Continue Reading →

Suriname’s Oil Dreams Collide With Geological Reality

Jan. 3 (oilprice.com) Suriname’s government, in the capital Paramaribo, has been hungrily eyeing neighboring Guyana’s massive world-class oil boom since before the 2020 pandemic. Both impoverished South American nations of less than one million share the Guyana Suriname Basin. The offshore basin is delivering an oil boom that is exceeding all expectations, making Guyana, based... Continue Reading →

Petronas Drills First of Four Wells in Block Offshore Suriname

Dec. 29 (OE) Petronas has completed drilling of the Caiman-1 exploration well in Block 52 offshore Suriname, marking the first well in its four-well 2025–2026 drilling campaign in the block. The Caiman-1 well was spudded on July 21, 2025 and safely plugged and abandoned on December 6, 2025. The well delivered encouraging results and represents... Continue Reading →