(offshoreWIND.biz) European wind energy industry organisation, WindEurope, has warned that the negative bidding approach will lead to the bid costs falling onto the supply chain and/or electricity consumers after Germany and the Netherlands closed their latest offshore wind tenders, securing nearly EUR 4 billion in total through winning bids. In both countries, the offshore wind... Continue Reading →

WoodMac Sees $1 Trillion At Risk for Clean Energy Investments Under Trump

(Oilprice.com) A second Trump presidency could place a huge part of renewable energy investments at risk, increase carbon emissions by 1 billion tonnes more by 2050 and delay peak fossil fuel demand by 10 years beyond current forecasts, energy analytics firm Wood Mackenzie has predicted. WoodMac projects ~$7.7T in overall spending by the U.S. energy sector... Continue Reading →

Guyana’s cabinet clears oil block bid by QatarEnergy, TotalEnergies, Petronas, minister says

(Reuters) - Guyana's cabinet has approved a bid for an offshore oil block by a consortium including QatarEnergy (QATPE.UL), TotalEnergies and Malaysian state-owned Petronas (PETRA.UL), a minister from the South American country said on Wednesday. Guyana, home of the largest oil discoveries in nearly a decade, offered 14 offshore blocks in September in its first competitive auction that... Continue Reading →

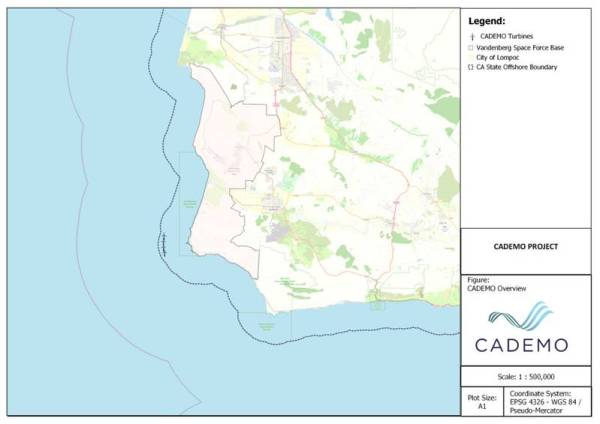

California’s First Floating Wind Project Steps Closer to PPA

(OE) CADEMO Corporation, established by Floventis, and California Community Power (CC Power) have signed a memorandum of understanding (MoU) to facilitate the development of the 60 MW floating wind project off the California coast. The MoU is intended to establish a collaborative engagement between CC Power, a joint powers authority that conducts joint power procurement... Continue Reading →

Explainer: China’s dominance in wind turbine manufacturing

(Reuters) - The European Union will investigate subsidies received by Chinese suppliers of wind turbines destined for Europe, the bloc's anti-trust commissioner, Margrethe Vestager, has said. Tuesday's move is the latest in a growing effort in both Europe and the United States to shield domestic clean energy industries from cheap Chinese imports, which authorities say benefit... Continue Reading →

Netherlands Receives Multiple Bids in 4GW Offshore Wind Tender

(Reuters) The Dutch government on Thursday said it had received multiple bids in a tender to build an offshore wind farm in the Dutch part of the North Sea with a total capacity of 4 GW. The government said it expected to announce the winning bid in June, while the wind farms were expected to... Continue Reading →

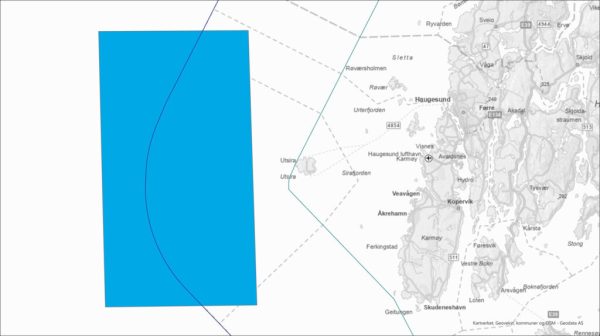

Norway Postpones Floating Wind Tender to 2025 as Gov’t Establishing ‘Common State Aid Model’

(offshore WIND.biz) The award of 1.5 GW of floating wind capacity in Norway, which was planned for this year, will be held in 2025 as the Norwegian government plans to have the subsidy model in place and announced before allocating the Utsira Nord (Utsira North) offshore areas for development. The government says the decision to... Continue Reading →

What’s behind the calm winds of the offshore wind farms Bill in Brazil

This free translation may be of interest Article by Paloma Amorin and Thiago Silva partners at Vieira Rezende Advogados (epbr) The development of the offshore wind sector in Brazil requires the consolidation of a robust legal and regulatory framework. Although there has been a framework approved since 2022 (Decree 10,946/2022), several pending regulatory actions remain... Continue Reading →

Engie’s Billion-Dollar Tax Equity Financing

(GIS) Engie North America secured over $1 billion in tax equity financing from JPMorgan, Goldman Sachs, and BNP Paribas to finance the development of six renewable projects, focusing on diverse U.S. markets under the ERCOT, MISO, and SPP regions, with a combined capacity of 1.3 gigawatts. Engie's involvement in the ERCOT market is important including a collaboration with Schneider Electric on a solar-plus-storage... Continue Reading →

Analysis: Readjustment seen in the US offshore wind sector

(OM) The start of 2024 marks a period where the “readjustment” of the US wind segment is becoming more apparent, according to recent analysis from market analysis firm Intelatus Global Partners. At a federal level, nearly nine gigawatts (GW) of lease potential in the Central Atlantic and Oregon have passed further hurdles to be auctioned... Continue Reading →