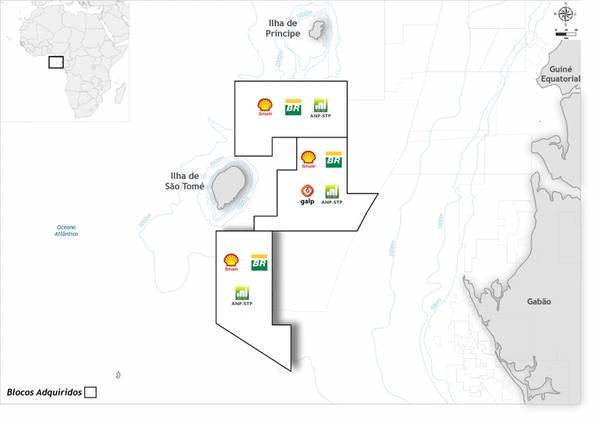

Sept. 13 - Petrobras informs that it has concluded the acquisition of a 27.5% stake in Block 4, located in São Tomé and Príncipe, Africa. With this acquisition, Petrobras joins the consortium of the aforementioned block, which includes Shell, the operator of the asset (30%), as well as Galp (27.5%) and ANP-STP (15%). Petrobras has... Continue Reading →

Petrobras makes new discovery in the Aram Block

Sept. 12 (PN) Petrobras notified the National Petroleum Agency (ANP) about the discovery of oil signs in well 3-BRSA-1399-SPS, in a water depth of 1,866 meters in the Aram block. Drilling on the well began at the end of May by the Valaris DS-4 drillship. The oil company has already found oil signs in two... Continue Reading →

Vallourec Bags $1B Offshore Pipe Order from Petrobras

Sept. 12 (OE) French tubular solutions supplier Vallourec has secured a major contract by Petrobras for the supply of Oil Country Tubular Goods (OCTG) products and services for its offshore operations from 2026 to 2029. The long-term agreement could generate total revenue of up to $1 billion, representing the widest award both in volumes and... Continue Reading →

Petrobras announces the settlement of its global notes offering

September 10, 2025 – Petróleo Brasileiro S.A. – Petrobras, following up on the statements disclosed on September 3, 2025, announces the settlement of its global notes offering in the international capital markets, totaling US$ 1 billion with maturity in 2030 and US$ 1 billion with maturity in 2036, issued through its wholly-owned subsidiary Petrobras Global... Continue Reading →

Petrobras Completes Test in Offshore Oil Area Ahead of Environmental Assessment

Sept 9 (Reuters) Brazil's President Luiz Inacio Lula da Silva said on Tuesday that environmental agency Ibama should be satisfied with the results of an emergency drill done by state-run oil firm Petrobras in the country's Foz do Amazonas basin, ahead of Ibama's official assessment. "Petrobras has already carried out the test. Ibama should be... Continue Reading →

Petrobras announces the pricing of U.S. Dollar-Denominated Global Notes

September 3, 2025 – Petróleo Brasileiro S.A. – Petrobras, following up on the statement disclosed on September 3, 2025, announces the pricing of two series of global notes denominated in U.S. Dollars (the “Notes”) to be issued by its wholly-owned subsidiary Petrobras Global Finance B.V. (“PGF”). The Notes will be unsecured obligations of PGF and... Continue Reading →

China Demand Shields Petrobras From U.S. Tariff Fallout

Sept. 3 (oilprice.com) Strong demand for crude oil from Asian countries, especially China, has insulated Brazil’s Petrobras from the worst of the tariff war fallout, chief executive Magda Chambriard told Bloomberg in an interview. “There is a lot of demand in Asia for our products,” Chambriard told the publication at an industry event in Sao Paulo, adding... Continue Reading →

Petrobras announces offering of U.S. Dollar-Denominated Global Notes

September 3, 2025 – Petróleo Brasileiro S.A. – Petrobras announces that its wholly-owned subsidiary, Petrobras Global Finance B.V. (“PGF”), has commenced an offering of two new series of U.S. dollar-denominated global notes in the international capital markets (the “Notes”), subject to market and other conditions. The Notes will be unsecured obligations of PGF and will... Continue Reading →

Carlyle to buy Altera Infrastructure’s FPSO Business

Sept. 2 (OE) Altera Infrastructure has entered into an agreement to sell its entire floating production, storage and offloading (FPSO) business to global investment firm Carlyle. The acquired business includes Altera’s full FPSO portfolio, the floating storage and offloading (FSO) unit Yamoussoukro and the 50% ownership in the joint venture Altera&Ocyan. The portfolio includes the... Continue Reading →

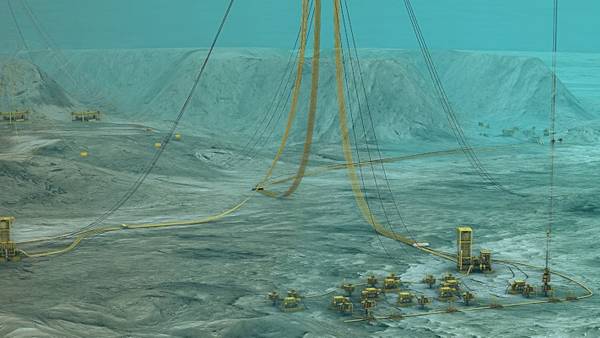

Petrobras Taps TechnipFMC for Flexible Gas Pipe Systems for Brazil Fields

Sept. 2 (OE) TechnipFMC has secured two subsea contracts from Brazil’s state-controlled oil company Petrobras to supply flexible pipe systems for projects in the Santos and Campos basins. The first award, classed by TechnipFMC as ‘substantial’ and valued between $250 million and $500 million, covers the design, engineering and manufacture of flexible gas injection risers.... Continue Reading →