Jan 22 (Reuters) - Oil major Shell is considering a sale of its assets in Argentina's Vaca Muerta shale play and has approached potential buyers in recent weeks to gauge their interest, three sources familiar with the matter told Reuters. Shell is open to selling some or all of its interests in the highly sought shale... Continue Reading →

Strike, Privatization Push Raise Fresh Risks for Peru’s Oil Sector

Jan. 20 (oilprice.com) A three-day strike at Peru’s state oil company began Monday as workers protested government plans to open the company to private investment, a move that comes as Petroperu also weighs bringing in outside management for its debt-laden Talara refinery. Workers at state-owned Petroperu launched the strike in opposition to what unions describe... Continue Reading →

Maha Capital seeks US approval to buy stake in Venezuelan oil firm

Jan 19 (Reuters) - Swedish investment platform Maha Capital is seeking approval from the United States to acquire an indirect minority stake in a PDVSA-controlled oil firm, Maha's chairman of the board, Paulo Thiago Mendonca, told Reuters on Friday. The firm has until May to exercise an option for a majority stake in a Novonor subsidiary... Continue Reading →

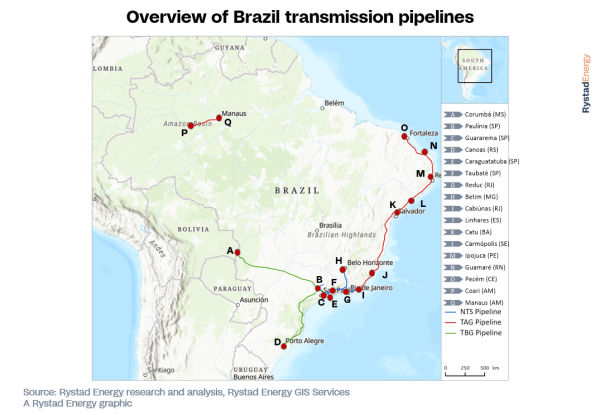

Inside Brazil’s Plan to Integrate Pre-Salt Gas and Diversify Supply

By Rystad Energy Jan. 19 (oilprice.com) The country faces the challenge of reinforcing its pipeline network to absorb growing pre-salt gas while managing declining imports from Bolivia. Although higher volumes of Argentine gas are expected to reach Brazil via Bolivia over the medium to long term, network upgrades will be required to ensure security of supply... Continue Reading →

Equinor’s AI Drive Yields $130M in Savings as Digitalization Advances

Jan. 7 (OE) Artificial intelligence (AI) contributed savings and value creation of about $130 million for Equinor and its partners in 2025, as the Norwegian firm expanded the use of AI across offshore platforms and onshore facilities. The company uses artificial intelligence to support industrial operations at scale, improving safety, efficiency and profitability, as it... Continue Reading →

Brava Energia: Production Data December 2025 & 4Q25

BRAVA ENERGIA S.A. (“BRAVA” or “Company”) (B3: BRAV3) informs its investors and the market in general of the preliminary and unaudited production data for the month of December 2025. The Company ended 2025 with an average production of 81,3 kboe/d, a 46% increase when compared to the previous year, with Papa-Terra and Atlanta standing out,... Continue Reading →

Norway’s Equinor does not plan return to Venezuela, CEO says

Jan 7 (Reuters) - Equinor does not plan a return to Venezuela, after leaving the country in the early part of this decade, the Norwegian oil and gas company's CEO told Reuters on Wednesday. "At the moment, that's not on the table," Anders Opedal said on the sidelines of a business conference. "We pulled out of... Continue Reading →

What’s the status of international oil companies in Venezuela after Maduro’s capture?

Jan 5 (Reuters) - Here are key facts about international oil companies in Venezuela, a country with the world's largest oil reserves thrown into crisis by the capture of President Nicolas Maduro by U.S. forces. In the 2000s, former President Hugo Chávez expropriated assets from several foreign oil companies, strengthening state-owned PDVSA’s control over the country's oilfields. Today, foreign... Continue Reading →

ANP Releases Consolidated Oil and Gas Production Data for November 2025

Jan. 5 - In November 2025, Brazil produced 4.921 million barrels of oil equivalent per day (boe/d) of oil and natural gas. The data was released today by the ANP in its Monthly Oil and Natural Gas Production Bulletin. Regarding oil, 3.773 million barrels per day (bbl/d) were extracted, a 6.4% decrease compared to the... Continue Reading →

Argentina’s Shale Boom Propels It Past Colombia in Oil Output

Jan. 2 (oilprice.com) Argentina, in a surprise development, overtook Colombia to become South America’s fourth-largest oil producer. The country is undergoing a once-in-a-generation unconventional hydrocarbon boom, which began with Buenos Aires nationalizing integrated energy major YPF in 2012. Since then, Argentina’s oil and natural gas output has kept soaring higher, regularly hitting new monthly highs as volumes... Continue Reading →