Dec 4 (Reuters Breakingviews) - Shell’s status as Big Oil’s safest pair of hands has its limits. The $212 billion UK major's dividend is relatively more secure against oil price slumps than peers, its net debt is a low 21% of total capital, and operating costs are over 10% less than two years ago. Yet Shell... Continue Reading →

Petrobras announces results of PPSA’s Non-Contracted Areas Auction

Dec. 4 - Petrobras informs that it has acquired the rights and obligations of the Union in Mero and Atapu units at the Non-Contracted Areas Auction held today by Pré-Sal Petróleo S.A. – PPSA. The consortium formed by Petrobras (80%), in partnership with Shell Brasil Petróleo Ltda (20%), acquired the Union’s 3.500% participation in the production sharing agreement of the Mero shared... Continue Reading →

PPSA Announces Postponement of Union Oil Auction from Bacalhau Field

PPSA (Pré-Sal Petróleo) has postponed the spot auction of Union oil from the Bacalhau Field to early 2026, previously scheduled for the 10th. The auction will be divided into two phases: the first will take place on January 14th at 11:00 AM, with an offer of 1 million barrels; the second is scheduled for March... Continue Reading →

Brazilian Oil and Gas Production Hits New Record in October

Dec. 2- Brazilian oil and gas production — including pre-salt, post-salt, and onshore — hit a new record in October, reaching 5.255 million barrels of oil equivalent per day. In total, 4.030 million barrels of oil per day were produced, a 2.9% increase compared to September and a 23.2% increase compared to October 2024. Natural... Continue Reading →

Ibama Authorizes Decommissioning of 5 Fields in the Sergipe Basin

Dec. 1 - Ibama has authorized the decommissioning of five shallow-water production fields in the Sergipe Basin, which are part of the state's offshore field cluster. The fields are operated by Petrobras, which had already announced the closure of exploratory activities in the units in 2020. The specific fields authorized for decommissioning are:GuaricemaCaiobaCamorimDouradoRobalo The activity... Continue Reading →

Petrobras announces approval of redetermination of the Tupi Shared Reservoir

December 1, 2025 – Petróleo Brasileiro S.A. – Petrobras announces that it has been notified by Brazil’s National Agency of Petroleum, Natural Gas and Biofuels (ANP) regarding the approval of the addendum to the Production Individualization Agreement (AIP) of the Tupi Shared Reservoir, located in the Santos Basin, which becomes effective as of today. The... Continue Reading →

Petrobras Postpones Contracting Two FPSOs until after 2030: Albacora and SEAP I

Nov. 28 - Petrobras has postponed the contracting of two FPSO (floating production, storage and offloading) units until after 2030: one for the Albacora field revitalization project and the other for the second FPSO for Sergipe Águas Profundas (SEAP). Both units were left out of the horizon of the company's new 2026-2030 Business Plan. The... Continue Reading →

Petrobras cuts dividend, investment projections in new five-year business plan

Nov 27 (Reuters) - Brazilian state-run oil firm Petrobras has lowered its dividend forecast and cut expected investments by almost 2% in a new five-year business plan announced Thursday, as it grapples with lower crude prices. Petrobras expects to dole out between $45 billion and $50 billion during the 2026-2030 period in ordinary dividends, a... Continue Reading →

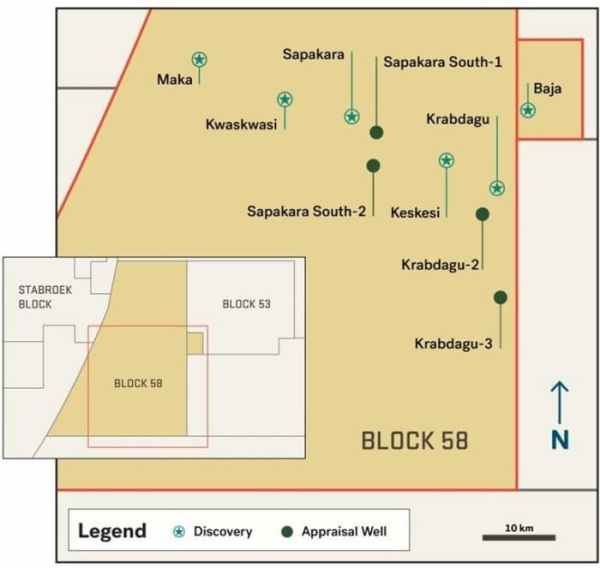

Suriname’s Long-Awaited Oil Boom Finally Takes Shape

Nov. 28 (oilprice.com) After the discovery of oil in Suriname’s territorial waters in January 2020, the government in the capital Paramaribo pitched its hopes on an oil boom matching that of neighboring Guyana. You see, decades of economic mismanagement, excessive spending, and corruption wreaked havoc on the former Dutch colony’s economy. Over the last decade, gross... Continue Reading →

Petrobras investment to drop in first cut under Brazil’s Lula

Nov 26 (Reuters) - Brazilian state-run oil firm Petrobras' five-year investment plan will see its first cut under President Luiz Inacio Lula da Silva's government due to lower oil prices, three sources familiar with the matter told Reuters. The new plan, to be unveiled on Thursday, is set to have a capital expenditure about 2%... Continue Reading →