(Reuters) Shell on Thursday reported third-quarter earnings of $6.2 billion, in line with expectations, on higher refining margins and strong liquefied natural gas (LNG) trading. The company announced share buybacks of $3.5 billion over the next three months, up from $2.7 billion in the previous three months. It maintained its dividend unchanged at $0.331 per... Continue Reading →

Better contracting conditions and high activity back Fugro

Fugro’s revenue for the third quarter of 2023 is €608.9 million, an increase from €480.2 million reported in the same quarter of 2022 – a result said to be due to better contracting conditions, high activity levels and good project execution. Fugro reported that its revenue was up by 32.6% on a currency-comparable basis, by... Continue Reading →

Masdar to Buy Stake in Iberdrola’s Largest Offshore Wind Project in Scotland

(Reuters) Abu Dhabi's Masdar is set to buy a 49% stake in Spanish utility Iberdrola's largest offshore wind project off Scotland's coast, known as East Anglia 3, Spanish newspaper Cinco Dias reported on Tuesday, citing unidentified market sources. The acquisition will be worth around 2 billion euros ($2.14 billion), the report added, as the entire... Continue Reading →

SLB to add $5 billion in revenue this year, sees similar growth in 2024

(Reuters) - SLB (SLB.N) is on track to add about $5 billion in revenue this year, and sees similar potential for growth in 2024, mainly helped by increased drilling in international markets, CEO Olivier Le Peuch said at a conference on Wednesday. SLB, the world's largest oilfield service company and former Schlumberger, is betting on a recent... Continue Reading →

Petrobras-Mubadala partnership may open door to refinery deal, say sources

(Reuters) - Brazilian state-run oil firm Petrobras (PETR4.SA) remains eager to repurchase a refinery from Abu Dhabi state investor Mubadala despite antitrust barriers, and a new biofuels partnership could open the door to future talks, two sources told Reuters. Petrobras on Monday announced a memorandum of understanding with Mubadala for potential investment in a biofuel refinery under development in... Continue Reading →

Iberdrola Sells 49% stake in Baltic Eagle Offshore Wind Farm to Abu Dhabi’s Masdar

(Reuters) Spanish utility Iberdrola has sold a 49% stake in its 476 megawatt (MW) offshore wind farm in German waters in the Baltic Sea to Abu Dhabi's Masdar for about 375 million euros ($414.5 million), it said on Wednesday. Iberdrola said that the deal pegged the total value of the so-called Baltic Eagle project, which... Continue Reading →

Oilfield Service Providers to Get Lift from International, Offshore Demand

(Reuters) The Big three oilfield services (OFS) companies will likely report higher profits for the second quarter as resurgent demand in international markets and strong offshore drilling helped counter tepid activity in North America. Baker Hughes, Halliburton, and SLB are set to post a combined second-quarter adjusted profit of $2.04 billion, according to Refinitiv data,... Continue Reading →

China to boost Brazil oil imports in Q3, replacing some Saudi supply – sources

(Reuters) - Chinese oil refineries, led by heavyweight Sinopec (600028.SS), are set to boost Brazilian crude imports in the third quarter to replace some of the Saudi Arabian supply it cut after the kingdom hiked prices, industry sources said. China, the world's top crude importer, has booked nearly 1 million barrels per day of Brazilian crude... Continue Reading →

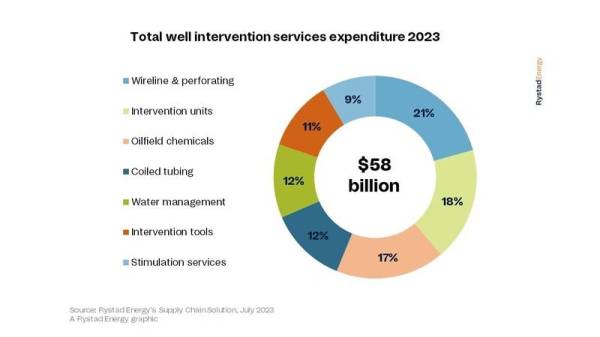

Oil and Gas Firms Set to Spend $58 Billion on Well Intervention in 2023 – Rystad

Oil and gas companies are set to spend $58 billion on well intervention – a way to extract additional resources from an existing well instead of drilling a new one – in 2023, the Norwegian energy intelligence group Rystad Energy said. Rystad Energy said its modeling showed this is just the start of a surge... Continue Reading →

Abu Dhabi’s Masdar to Join Iberdrola’s Baltic Sea Wind Farm Project

(Reuters) Spanish utility Iberdrola has signed an exclusive deal with Abu Dhabi's Masdar to develop a 476 megawatt (MW) offshore wind farm in German waters in the Baltic Sea, Expansion newspaper reported on Wednesday, citing unidentified market sources. The Baltic Eagle wind farm being built off Germany's northeastern coast will have 50 wind turbines and is part... Continue Reading →