(Reuters) BP will launch a review of how best to develop and monetize its oil and gas production assets and consider more cost cuts to boost shareholder returns, the oil major said on Tuesday, as it beat second-quarter profit expectations. BP, under pressure from investors after years of underperforming rivals and also the target of... Continue Reading →

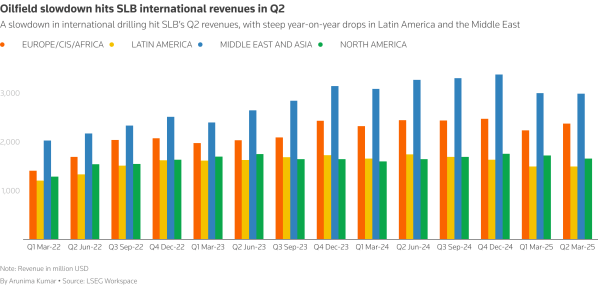

SLB beats quarterly profit estimates on steady oilfield services demand

(Reuters) - Top oilfield services firm SLB narrowly beat Wall Street expectations for second-quarter profit on Friday, as resilient demand in parts of its international business helped offset drilling slowdown in North America, Mexico and Saudi Arabia. SLB, the first of the Big Three U.S. oilfield services provider to report quarterly results, had previously flagged weaker drilling activity... Continue Reading →

Iberdrola Picks Up $4.9B to Finance 1.4GW UK Offshore Wind Farm

(OE) Iberdrola has signed green financing agreement with 24 banks for the East Anglia THREE offshore wind farm, being developed together with Abu Dhabi Future Energy Company (Masdar). The transaction valued at $4.88 billion, which was 40% oversubscribed, is one of the largest of its kind to date and will cover a substantial part of... Continue Reading →

Valaris Lifts Contract Backlog for its Drilling Rigs to $4.2B

(OE) Offshore drilling company Valaris has secured over $1 billion of new contracts and extension for its drilling rigs since its previous fleet status report published mid-February 2025. Valaris’ contract backlog, excluding lump sum payments such as mobilization fees and capital reimbursements, increased to approximately $4.2 billion from approximately $3.6 billion as of February 18,... Continue Reading →

Engineering giant Wood backing £242m takeover bid

(bbc.com) One of Scotland's largest companies - engineering giant Wood Group - is backing a £242m takeover approach. Aberdeen-headquartered Wood said Sidara, an engineering and consultancy based in Dubai, had made the offer. Wood's board of directors have now said they would be "minded to recommend" the deal. The company grew from the North Sea oil boom... Continue Reading →

Saipem Nets $720M for Offshore Work in Middle East and Guyana

(OE) Italian offshore energy services firm Saipem has secured new offshore contracts in Middle East and Guyana, worth approximately $720 million. The first contract encompasses the engineering, procurement, construction and installation (EPCI) activities for the repair of damaged subsea pipelines for a major client in Middle East. The duration of the project is expected to... Continue Reading →

Constellation-Operated Jack-Up Rig Up for Petrobras Job

(OE) Constellation, an offshore oil and gas drilling services provider in Brazil, has secured a new contract with Petrobras for the deployment of Admarine 511, a jack-up drilling rig owned by its commercial partner ADES Holding. The rig, operated by Constellation, will be used for a campaign of Plug and Abandonment (P&A) of wells at... Continue Reading →

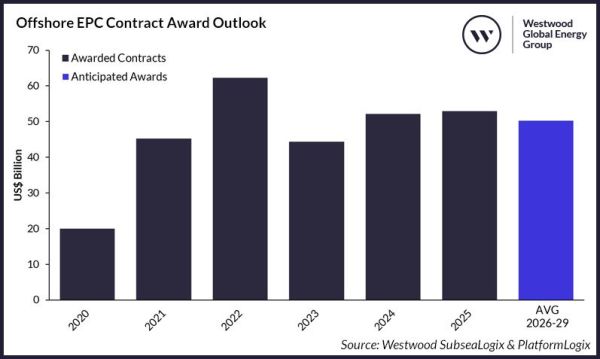

$54 billion in engineering, procurement and construction contracting opportunities on offshore oil & gas agenda for 2025

(offshore-energy.biz) Despite the challenges hitting the fossil fuel industry, demand for hydrocarbons remains steady, as confirmed by the global engineering, procurement, and construction (EPC) contracting activity across the offshore oil and gas landscape. The batch of new projects, which are expected to reach the EPC stage this year, will lead to awards worth billions of... Continue Reading →

Offshore Service Vessels: What’s in Store in 2025

Jesper Skjong, Contributor (OE) After what we would argue has been an incredibly eventful 2024 with massive deals, tremendous dayrate developments, further charterer backlog build, and the first series of newbuild orders in years, now comes the time when we turn our gaze towards 2025. What are some of the main trends we expect for next... Continue Reading →

Report: ‘Big 3 offshore drillers’ reporting increasing day rates, ‘robust’ outlook

By Bruce Beaubouef, Managing Editor (Offshore-mag.com) The “Big 3” offshore drillers – listed as Transocean, Noble Corp., and Valaris by Evercore ISI – are all reporting “strong offshore fundamentals and a robust outlook” that will likely stretch out to 2030, according to a recent report by the oilfield marketplace consulting firm. Evercore based its analysis... Continue Reading →