March 3 (Reuters) - The U.S.-Israeli conflict with Iran presents Brazil with an "enormous opportunity" to attract investments to develop its oil assets, Shell's CEO in the country told reporters on Tuesday. Brazil's geopolitical stability and track record as a reliable oil producer give it an advantage over other nations, Cristiano Pinto da Costa said, though... Continue Reading →

Petrobras does not pass through sudden oil volatility to local market, CEO says

March 2 (Reuters) - Brazilian state-run oil firm Petrobras sees oil prices under pressure due to the conflict in Iran, but does not usually pass through sudden volatility to the domestic fuel market, its chief executive officer said on Monday. Global oil prices jumped after Iran's retaliatory attacks disrupted shipping through the Strait of Hormuz, following weekend strikes by Israel... Continue Reading →

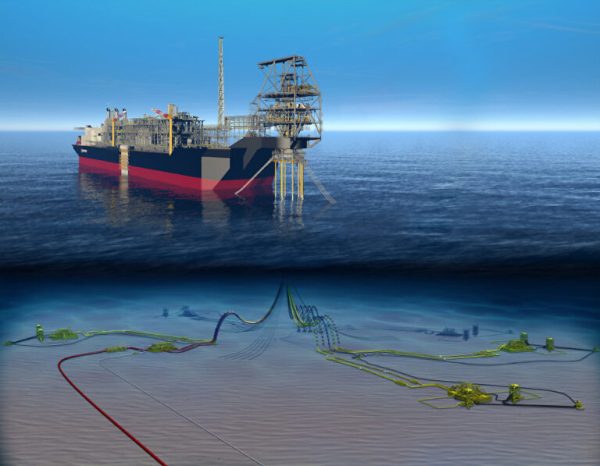

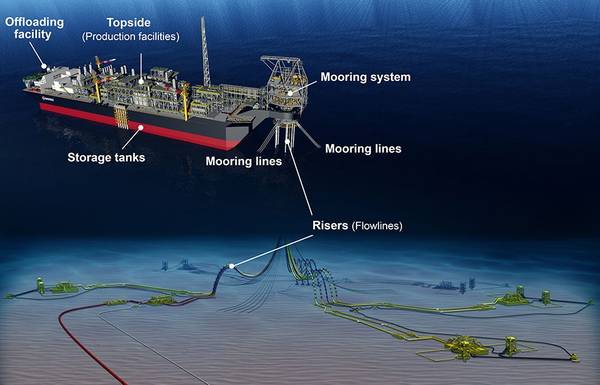

Shell Welcomes KUFPEC as Partner in the Orca Project (Gato do Mato) in Brazil

Feb. 3 (TN) Shell Brasil Petróleo Ltda. (Shell Brasil), a subsidiary of Shell plc, has signed an agreement to sell a 20% stake in the Orca Project to Kuwait Foreign Petroleum Exploration Company (KUFPEC). Orca is a deepwater project in the pre-salt area of the Santos Basin. After the transaction is completed, Shell will remain... Continue Reading →

ADNOC Considering Entry Into Venezuela Gas Sector

Jan. 16 (Reuters) Abu Dhabi state oil firm ADNOC is weighing entering Venezuela's energy industry and could seek a partnership with another international producer to participate in the nation's gas projects, Bloomberg News reported on Thursday, citing people familiar with the matter. Reuters could not immediately verify the report. XRG, ADNOC's international investments arm set... Continue Reading →

Subsea Vessel Market Outlook ‘Robust’ for 2026

Jesper Skjong, Contributor Dec. 20 (OE) Throughout 2025 we have seen the subsea vessel market transitioning from a period of record highs towards a more cautious, but still fundamentally strong, outlook. While short-term activity and rates have softened in the latter part of the year, long-term demand - driven by deepwater projects and global energy infrastructure-... Continue Reading →

Seatrium secures repeat contract from International Maritime Industries for the supply of equipment and license for a LeTourneau Super 116E Class Self-Elevating Drilling Unit (SE-MODU), Kingdom 4

Singapore, 10 Dec 2025 – Seatrium Offshore Technology, the flagship offshore jack-up designer forSeatrium Group, has been awarded a repeat contract by International Maritime Industries (IMI), thelargest shipyard in the MENA region, for the supply of equipment and license for a LeTourneau Super116E Class Self-Elevating Drilling Unit (SE-MODU), Kingdom 4. This latest award follows the... Continue Reading →

Lukoil’s international assets and potential buyers

Dec 9 (Reuters) - Russia's Lukoil has until December 13 to negotiate the sale of the bulk of its international assets after the U.S. imposed sanctions on the company and rejected its initial buyer, Swiss commodity trader Gunvor. Lukoil's international assets, spanning upstream oil and gas projects, refining, and more than 2,000 filling stations across Europe, Central Asia, the Middle... Continue Reading →

Carlyle Eyes Lukoil’s Foreign Assets

Nov. 14 (Reuters) U.S. private equity firm Carlyle is exploring options to buy Russian oil major Lukoil's LKOH.MM foreign assets, three sources familiar with the situation said. The U.S. has hit Lukoil with sanctions as part of its effort to bring the Kremlin to peace talks over Ukraine, and has blocked Lukoil's attempt to sell... Continue Reading →

Britain’s Wood Group posts drop in first-half profit amid audit delays

Oct 30 (Reuters) - Britain's Wood Group posted a fall in profit for the first half of the year on Thursday, citing uncertainty stemming from an independent review, delays in publishing its 2024 audited accounts and a weakening financial position. The oilfield services and engineering company launched an independent review in November last year into the accounting of... Continue Reading →

Halliburton projects $400 million annual savings as profit beats on North America strength

Oct 21 (Reuters) - Halliburton beats Wall Street estimates for third-quarter profit estimates on Tuesday, supported by steady North American oilfield activity and equipment demand, and said its cost-cutting measures are expected to save $400 million annually. The company's shares rose 5.4% in premarket trading, also aided by a partnership with VoltaGrid to provide distributed power... Continue Reading →