(OE) Paratus Energy Services, through its subsidiary SeaMex Holding, has secured a one-year contract for the Titania jack-up rig in Mexico. The new contract will contribute approximately $55 million in backlog and is expected to start around mid-February 2024, Paratus informed. As previously disclosed, the Titania jack-up remained operating under its existing contract with Pemex... Continue Reading →

Pemex Will Have Nearly $12 Billion for Debt Payments

(Reuters) Mexico's heavily indebted state oil company Pemex will have about 200 billion pesos ($11.7 billion) this year to cover almost all of its regular debt payments, a senior finance official said on Tuesday. Deputy Finance Minister Gabriel Yorio told reporters that some 145 billion pesos were allocated from the federal budget, which was approved... Continue Reading →

Mexico Pacific and ExxonMobil sign additional LNG offtake agreement

(OET) LNG project developer Mexico Pacific has signed a third long-term sales and purchase agreement (SPA) with ExxonMobil LNG Asia Pacific for an additional 1.2 million tonnes per annum (mtpa) of LNG from Train 3 of Mexico Pacific’s Saguaro Energia project located on the west coast of Mexico. With this agreement, ExxonMobil exercised the option... Continue Reading →

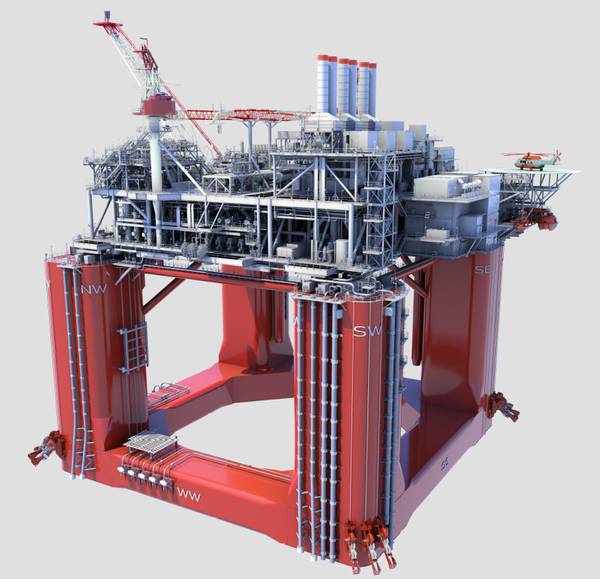

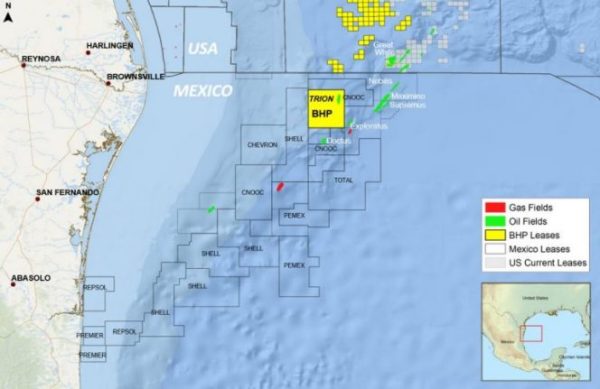

Wood Secures Trion FPU Topsides Job

(OE) UK engineering company Wood has secured a contract from HD Hyundai Heavy Industries for detailed engineering of the topsides facilities on Woodside Energy's Trion floating production unit (FPU) in the Gulf of Mexico. When complete, Trion will have a production capacity of 100,000 barrels per day and connect to a 950,000 barrel capacity floating... Continue Reading →

Mexico orders Pemex to occupy privately-operated hydrogen plant

(Reuters) - Mexico's government on Friday ordered state energy company Pemex to temporarily take control of a hydrogen plant inside one of its largest refineries but operated by French company Air Liquide (AIRP.PA). President Andres Manuel Lopez Obrador, who signed a decree that declared hydrogen supply from the plant "a matter of public interest," has tightened... Continue Reading →

Woodside, Eseasa ink shore base contract for Trion project offshore Mexico

(OM) Woodside Energy has awarded a contract to Mexican company Eseasa Offshore to supply shore base facilities and services for Woodside’s operations supporting the Trion oil and gas project offshore Mexico. Woodside says it is continuing to progress the Trion project toward first oil in 2028. Eseasa will provide a broad range of services out of its... Continue Reading →

Pemex’s failure to pay debts threatens suppliers’ survival, industry warns

(Reuters) - Mexican state energy company Pemex's mounting debt with oil service providers as well as private crude and gas producers threatens production, investment and in some cases even the survival of suppliers, industry groups warned. In addition to financial debt of more than $105 billion, the company disclosed that at the end of September... Continue Reading →

Report: international E&P outlook will remain ‘healthy’ for 2024

Bruce Beaubouef * Managing Editor(OM) The outlook for international E&P for next year “remains healthy,” according to Evercore ISI’s latest Offshore Rig Market Snapshot report. The report borrowed from the firm’s recently released 2024 Evercore ISI E&P spending survey and 2024 Oilfield Services outlook, which found that E&P spending growth in the US for 2024... Continue Reading →

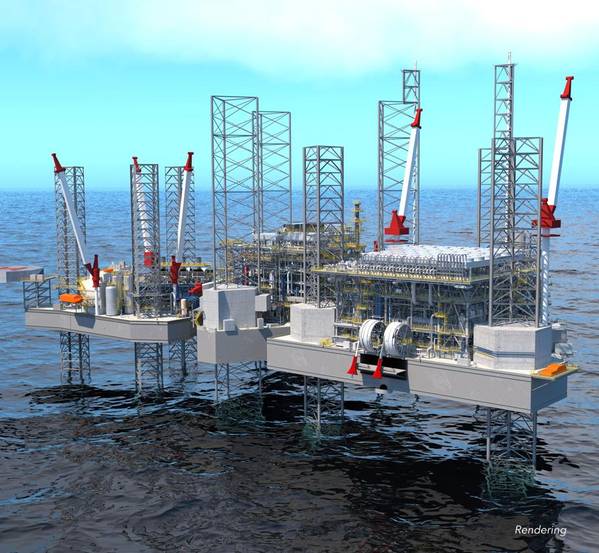

Plan submitted for next-phase drilling on Block 30 offshore Mexico

(OM) Wintershall Dea has submitted an appraisal drilling plan to build on its recent Kan oil discovery in Block 30 in the shallow-water Sureste Basin offshore Mexico. According to partner Harbour Energy, the partners aim to start drilling next year. Exploration started in October 2022 and led to the Upper Miocene Kan-1 discovery this April, drilled by the... Continue Reading →

Mexico’s Pemex, New Fortress Energy scrap deepwater gas project -sources

(Reuters) - Mexican state energy company Pemex and U.S. liquefied natural gas (LNG) company New Fortress Energy (NFE.O) have terminated a deal to develop potentially the country's first deepwater natural gas project that was signed a year ago, two sources with direct knowledge of the matter said. Now Pemex wants to continue with the development of the Lakach... Continue Reading →