(OE) Texas-based oilfield services provider Expro has secured a three-year contract by Woodside Energy to provide tubular running services (TRS) and cementing services for the Trion project, Mexico’s first deepwater oil production facility. Woodside and Expro have a long-standing partnership, with Expro supporting well construction activities in Mexico during the exploration phase. As part of... Continue Reading →

First Crude from ONE Guyana FPSO Set for Export in August-September

(Reuters) The first crude cargo from Guyana's fourth oil production facility, which arrived in the country in April and is being installed, is set to be exported between late August and early September, the government told Reuters on Tuesday. A consortium by U.S. companies Exxon Mobil XOM.N and Hess HES.N and China's CNOOC 600938.SS controls... Continue Reading →

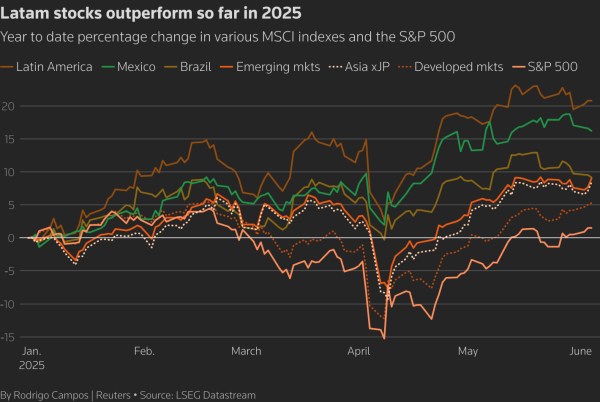

Latin America set to benefit from US market shifts, investors say

(Reuters) - Latin America has emerged as a top investing destination as ongoing wars - both of the military and trade variety - make investors seek options in a region they view as refreshingly untroubled by tariffs and major conflicts. Portfolio flows data suggests that investors are largely underexposed to Latin America even as many... Continue Reading →

Mexico’s Pemex plans restructuring to save costs, document shows

(Reuters) - Mexico's Pemex, the world's most indebted energy company, plans to restructure parts of its business in an attempt to save costs, a May document seen by Reuters showed. Earlier reports, citing another document from last month suggesting it could include a layoff of over 3,000 tenured employees and save up to around 10.5... Continue Reading →

Guyana Passes Bill Making Firms Liable for Oil Spill Damages

(Reuters) Guyana's parliament passed an oil pollution bill late on Friday that holds parties liable for damages caused by oil spills, including from vessels. The bill, which passed with a majority of votes cast in a simple voice vote, is expected to soon be signed into law by President Irfaan Ali. Guyana, whose oil production... Continue Reading →

Pemex Considers Reactivating Old Wells to Boost Oil Output

(Reuters) Mexican state energy company Pemex plans to reopen old wells in a bid to squeeze more barrels out of them to boost declining oil production, according to two documents and four sources, as it struggles to reach an ambitious government target. Pemex said in a filing to the United States Securities and Exchange Commission... Continue Reading →

Mexico’s Pemex swings to $2 billion loss as production, sales slump

(Reuters) - Pemex, Mexico's heavily indebted state energy company, reported an 11.3% drop in first-quarter production of crude and condensate on Wednesday as falling sales and foreign-exchange losses contributed to a 43.3 billion peso ($2.12 billion) net loss. In a filing with Mexico's stock exchange, Pemex, one of Mexico's largest companies, attributed the production slump... Continue Reading →

Guyana’s Q1 oil output rises 3% yr/yr to 631,000 bpd

(Reuters) - Oil output in Guyana fell about 3% to 627,000 barrels per day (bpd) in March from the previous month, but the 631,000 bpd produced in the first quarter was 3% higher year-on-year, data from the country's energy ministry showed on Thursday. Guyana last year became Latin America's fifth largest oil exporter after Brazil, Mexico, Venezuela... Continue Reading →

Mexico’s finance ministry estimates crude oil production 129,000 bpd below target

(Reuters) - Mexico lowered its estimate for average crude oil production for this year by 129,000 barrels per day (bpd), citing a "prudent approach" that takes into account the trajectory of the first months of the year. This would bring the country below the ambitious 1.8 million bpd target set by President Claudia Sheinbaum. In... Continue Reading →

Woodside Hires SLB for Trion Ultra-Deepwater Drilling Job off Mexico

(OE) Global energy technology company SLB has secured a major drilling contract by Australian oil and gas operator Woodside Energy for its ultra-deepwater Trion development project, offshore Mexico. SLB will oversee the delivery of 18 ultra-deepwater wells using an integrated services approach and AI-enabled drilling capabilities to improve operational efficiency and well quality. The full... Continue Reading →