(OE) Cadeler and Eneti have officially completed their merger, creating a leading offshore wind installation company. The New York- and Oslo-listed group will be named Cadeler and be headquartered in Copenhagen, Denmark, with offices across the world in Denmark, U.K., U.S., Taiwan, and Japan. Mikkel Gleerup, CEO of Cadeler, said, “This marks a historic moment... Continue Reading →

PXGEO Acquires Ampseis

(OE) Marine geophysical service provider PXGEO on Wednesday announced it has acquired one hundred percent of the share capital of rival AmpSeis, developer of what is said to be the industry's most advanced ocean bottom node. PXGEO described the acquisition as a step forward in its strategy to be the technology leader in the ocean... Continue Reading →

UK’s OEG to Buy Bluestream Offshore

(OW) OEG Energy Group (OEG) has signed a Sale and Purchase Agreement (SPA) to acquire Dutch subsea and topside services specialist Bluestream Offshore. The acquisition is expected to increase OEG’s subsea and topside capabilities while expanding its operating footprint to be able to pursue further opportunities in the growing offshore renewable industry. Bluestream has a... Continue Reading →

Occidental Petroleum Jumps into Acquisition Mode

(Reuters) Occidental Petroleum said on Monday it would buy energy producer CrownRock in a cash-and-stock deal valued at $12 billion including debt, expanding in the lucrative Permian basin. Investors are pressing oil and gas producers to expand their inventories following Exxon Mobil's $60 billion deal for Pioneer Natural Resources and Chevron's $53 billion agreement for Hess in October. Occidental will finance the purchase of... Continue Reading →

Chevron Boosts Project Spending by 11% for 2024

(Reuters) Oil major Chevron Corp said on Wednesday that it expects to spend between $18.5 billion and $19.5 billion next year on new oil and gas projects, an 11% increase on this year. Its 2024 budget and that of rival ExxonMobil reflect the industry's continuing rebound after pandemic-influenced pullbacks, recent acquisitions and carbon reduction initiatives. Exxon plans... Continue Reading →

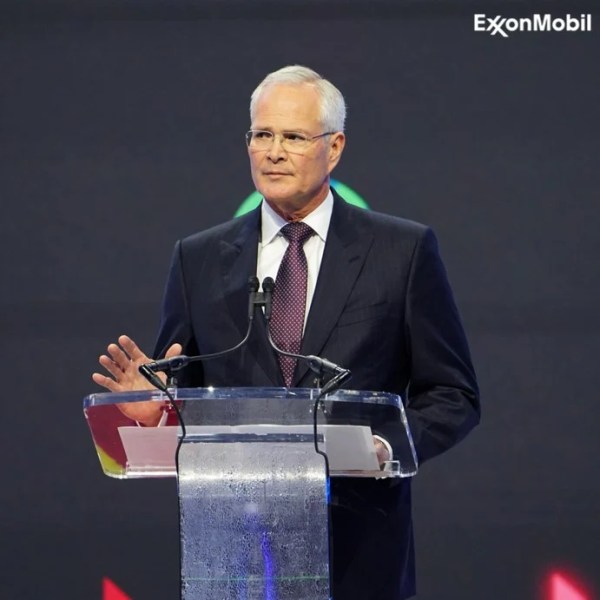

Exxon’s CEO sets ambitious agenda on tight timeline

(Reuters) - Exxon Mobil (XOM.N) CEO Darren Woods' first five years at the oil company were marred by missed oil production targets, an investor rebellion and the company's biggest-ever financial loss. Redemption came this year when - aided by a share price pumped up by high oil prices - he clinched a $60 billion deal to buy shale rival... Continue Reading →

TGS and PGS shareholders back merger to create ‘premier energy data’ player

(OET) Norway-headquartered seismic company PGS has made progress in its merger with TGS after shareholders of both companies threw their support behind the merger in a bid to establish a stronger and more diversified geophysical company and data provider to the energy value chain. Back in September 2023, TGS and PGS announced their agreement on principal terms... Continue Reading →

Fincantieri Set to Acquire Remazel Engineering

(OE) Fincantieri has set the main terms and conditions for the acquisition of 100% of the shares of Remazel Engineering S.p.A. from Advanced Technology Industrial Group S.A. Remazel is a leader specialized in the design and supply of highly customized and complex topside equipment. The transaction enables Fincantieri to acquire highly specialized capabilities in the... Continue Reading →

Bekaert acquires the majority shares of Flintstone Technology Ltd. to further strengthen its offering in offshore mooring solutions

Bekaert today announces the acquisition of 75% of shares in Flintstone Technology Ltd. Flintstone, based in Dundee Scotland, provides mooring technology solutions, systems design and testing capabilities for the global offshore energy markets. It offers a range of products and services including connectors and tensioners for permanent mooring. Bekaert’s ambition is to be the leading... Continue Reading →

Brazil’s Vibra rejects ‘unjustifiable’ Eneva merger proposal

(Reuters) - Brazilian fuel distributor Vibra (VBBR3.SA) on Tuesday rejected the merger proposal it received from energy firm Eneva (ENEV3.SA), saying the exchange ratio of the offer was "unjustifiable," while leaving the door open for new offers. On Sunday, Eneva had sent an unsolicited offer to Vibra proposing a stock-for-stock merger of equals. Vibra said its board of directors... Continue Reading →