(Reuters) Australia's top oil and gas explorer Woodside Energy posted a 37% drop in annual underlying profit on Tuesday, as lower realised prices for its products offset higher sales and production. Oil and natural gas prices softened in 2023, as slowing global growth and a weaker-than-expected economic recovery in China weighed on demand. "Compared with 2022, 2023 full-year... Continue Reading →

Energos Celsius FSRU Reaches Its Final Destination in Brazil

Energos Celsius floating storage and regasification unit (FSRU), on a long-term for New Fortress Energy (NFE), has arrived to NFE’s LNG terminal in Barcarena in Brazil’s Pará state. The FSRU Energos Celsius was built by Seatrium and delivered to NFE in December 2023, which then departed from Singapore to Brazil. The FSRU has a nominal regasification... Continue Reading →

Exxon considering Guyana offshore gas production after 2029

(Reuters) - An Exxon Mobil-led consortium is considering its first offshore natural gas production in Guyana, close to the country's maritime border with Suriname, an executive at the U.S. oil and gas group said on Wednesday. Exxon (XOM.N), opens new tab, Hess Corp (HES.N), opens new tab and CNOOC (0883.HK), opens new tab are under pressure from Guyana to develop... Continue Reading →

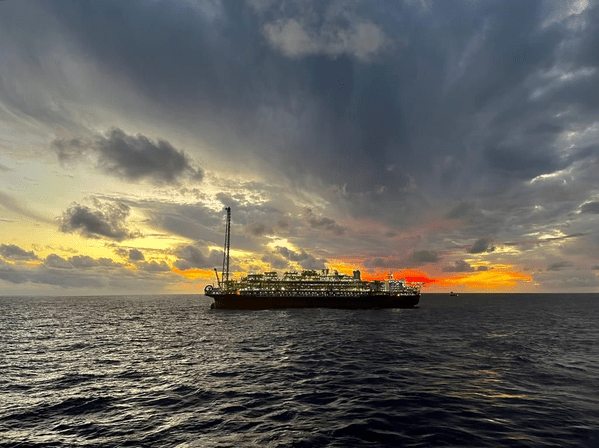

Petrobras highlights on production and sales in 4Q23

In 2023, we delivered an excellent upstream operational performance, meeting all production forecasts for the year. Total annual production of oil and natural gas, of 2.782 MMboed, was 3.7% above the production of 2022. Our good results were made possible mainly by the start-up of FPSOs Almirante Barroso, Anna Nery and Anita Garibaldi, as well... Continue Reading →

Shell’s Profit Drops 30% from Previous Year

(Reuters) Shell on Thursday reported a 2023 profit of $28 billion, a 30% drop from the previous year's record as energy prices and demand cooled, but still allowing the firm to increase its dividend by 4% and extend share repurchases. The British company's payouts to shareholders reached around $23 billion in 2023, over 10% of... Continue Reading →

Baker Hughes Beats Profit Estimates

(Reuters) U.S. oilfield technology firm Baker Hughes beat Wall Street estimates for fourth-quarter profit on Tuesday, powered by strong demand for its services and equipment from LNG producers, as well as offshore and international markets. The company concludes fourth-quarter reports from the world's top oilfield services providers. International demand also helped rivals SLB and Halliburton beat estimates amid slowing activity in... Continue Reading →

Petronas seeks fiscal incentives to develop Suriname gas project

(Reuters) - Suriname should boost incentives for energy companies looking to develop oil and gas discoveries, said Zamri Baseri, head of Malaysia's Petronas (PETRA.UL) in the South American country. Baseri did not specify the incentives his company is looking for, but lower royalties and taxes, or commercial incentives often hasten investment decisions by energy companies.... Continue Reading →

Wison New Energies starts pre-FEED work for two FLNG projects in Nigeria

(OET) China-based provider of clean energy services Wison New Energies, formerly known as Wison Offshore & Marine, has initiated the design validation and pre-FEED phase for two floating LNG (FLNG) projects in Nigeria. Following the signing of the contract and disbursement of mobilization funding, Wison New Energies officially commenced the pre-FEED phase for two 3... Continue Reading →

Mexico Pacific and ExxonMobil sign additional LNG offtake agreement

(OET) LNG project developer Mexico Pacific has signed a third long-term sales and purchase agreement (SPA) with ExxonMobil LNG Asia Pacific for an additional 1.2 million tonnes per annum (mtpa) of LNG from Train 3 of Mexico Pacific’s Saguaro Energia project located on the west coast of Mexico. With this agreement, ExxonMobil exercised the option... Continue Reading →

BlackRock has set out a deal to buy Global Infrastructure Partners (GIP) for around $12.5 billion.

(EV) BlackRock will pay $3bn in cash, with around $9.48bn in 12 million BlackRock shares. GIP is an investor in a number of infrastructure assets, including a wide array of energy projects around the world. BlackRock said GIP had more than $100bn in assets under management (AUM). After closing, the investor would have around $150bn... Continue Reading →