Feb. 20 (Reuters) General licenses for oil and gas exploration in Venezuela issued by the U.S. this month will allow Shell to progress with its Dragon gas project, a company spokesperson told Reuters on Thursday. The project, envisioned to produce gas from a field in Venezuelan waters with 4.5 trillion cubic feet of reserves, has... Continue Reading →

TotalEnergies halves buybacks as low oil, gas prices weigh on profits

Feb 11 (Reuters) - TotalEnergies will halve share buybacks in the first quarter, it said on Wednesday, as low oil and gas prices negated soaring fourth-quarter profit from refining fuels and proceeds from renewable assets stake sales. The French oil major's fourth-quarter adjusted net income fell to $3.8 billion (3.2 billion euros) from $4.4 billion a... Continue Reading →

Petrobras’ Oil and Gas Production Grows 11% and Reaches 3 Million Barrels in 2025

Feb. 10 - Petrobras' total oil and natural gas production exceeded the upper limit of its target by 2.8 percentage points (+4%), reaching 2.99 million barrels of oil equivalent per day (boed), representing an 11% increase compared to 2024 production. In 2025, Petrobras achieved its best result in the last ten years by adding 1.7... Continue Reading →

Norway’s Equinor plans sharp increase to international oil and gas output by 2030

Feb 10 (Reuters) - Equinor's international oil and gas portfolio will return to growth in the next few years as the Norwegian energy group targets sharply increased output abroad by 2030, its head of foreign operations told Reuters. After recent divestment of onshore assets in Argentina, Equinor now produces oil and gas in seven countries outside Norway, down... Continue Reading →

Shell needs big discovery or deals as oil, gas reserves dwindle

Feb 9 (Reuters) - Shell needs an acquisition or exploration breakthrough to make up for an expected production shortage of 350,000-800,000 barrels of oil equivalent per day by 2035 due to maturing fields unable to meet its output targets, the company and analysts say. For years, oil majors have been restrained in topping up reserves,... Continue Reading →

Vaca Muerta expected to lift Argentina energy surplus to new record in 2026

Feb 5 (Reuters) - Argentina could surpass last year's record energy trade surplus in 2026, supported by infrastructure that has improved the country's capacity to ship oil and gas from the Vaca Muerta shale formation, analysts said. The 2026 energy trade surplus could range from $8.5 billion to $10 billion, and would depend mainly on... Continue Reading →

Shell misses profit expectations, but keeps buyback pace

Feb 5 (Reuters) - Shell missed fourth-quarter profit expectations on Thursday with an 11% drop to the lowest level since early 2021 amid weaker oil prices, but kept its bumper share buyback programme. Shareholders of oil majors have become used to huge buybacks, but lower oil and gas prices ahead of an expected crude and liquefied... Continue Reading →

Exclusive: Shell considers exit from Argentina’s Vaca Muerta shale play, sources say

Jan 22 (Reuters) - Oil major Shell is considering a sale of its assets in Argentina's Vaca Muerta shale play and has approached potential buyers in recent weeks to gauge their interest, three sources familiar with the matter told Reuters. Shell is open to selling some or all of its interests in the highly sought shale... Continue Reading →

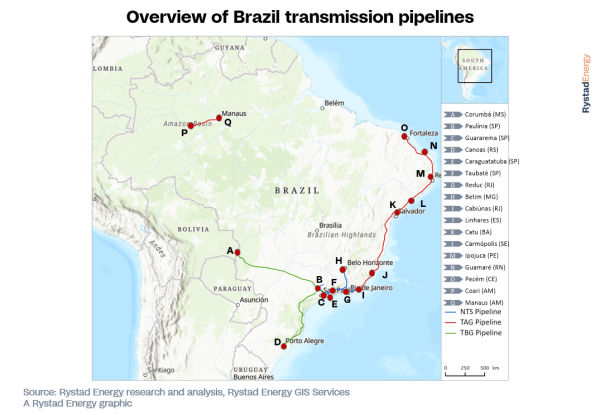

Inside Brazil’s Plan to Integrate Pre-Salt Gas and Diversify Supply

By Rystad Energy Jan. 19 (oilprice.com) The country faces the challenge of reinforcing its pipeline network to absorb growing pre-salt gas while managing declining imports from Bolivia. Although higher volumes of Argentine gas are expected to reach Brazil via Bolivia over the medium to long term, network upgrades will be required to ensure security of supply... Continue Reading →

Trinidad awaits field plan to green-light Shell’s Aphrodite gas project

Dec 10 (Reuters) - Trinidad and Tobago's government is waiting for a development plan from energy producer Shell to push forward the Aphrodite offshore gas project, documents seen by Reuters showed. Shell said in June that it had made a positive final investment decision on the discovery, which is expected to produce first gas in 2027 and have... Continue Reading →