(Reuters) - Italian energy group Eni said on Monday it signed a memorandum of understanding (MoU) with Argentine state-run oil producer YPF on its possible participation in an liquefied natural gas (LNG) project in Argentina. The Argentina LNG project aims to develop the onshore "Vaca Muerta" gas field and supply international markets by exporting up to... Continue Reading →

YPF CEO Says Vaca Muerta Profitable Even at $40 Oil

(oilprice.com) Despite the recent slump in international oil prices, YPF CEO Horacio Marín remains confident in the resilience of Argentina’s energy sector—particularly the viability of Vaca Muerta. Speaking to Infobae en Vivo, Marín stressed that YPF can sustain profitable operations even if crude prices drop to $40 or $45 per barrel. “We made ourselves resilient at... Continue Reading →

Sempra to sell Mexico energy assets, stake in infrastructure unit

(Reuters) - Utility firm Sempra will sell some energy infrastructure assets in Mexico and a minority stake in Sempra Infrastructure to fund its five-year capex plan of $56 billion, it said on Monday. In February, the company had forecast a five-year capital plan of about $56 billion, a 16% increase from its prior plan, with over... Continue Reading →

NOCs and the Evolving Energy Landscape in Latin America

(oilprice.com) Latin America has long been a dominant force in the global energy market, built on vast oil and gas reserves. While the world increasingly eyes renewable sources of energy for the future, hydrocarbons remain the bedrock of economic stability for the region. As energy demand evolves, national oil companies (NOCs) must not forsake oil,... Continue Reading →

As US investment declines, China and India are rapidly expanding their presence across Latin America’s key industries.

(gfmag.com) With US investment in Latin America shrinking, China and India are seizing the opportunity to expand their economic reach in the region. The US remains the largest foreign investor, but its stake dropped nearly 10% in 2023 alone, to 38% of the $224.6 billion total, according to the UN Economic Commission for Latin America... Continue Reading →

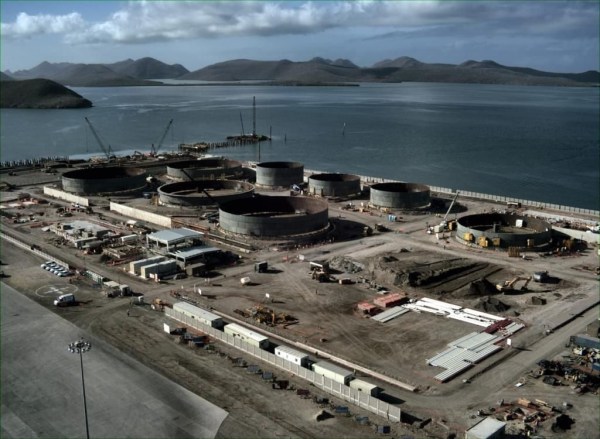

Colombia upping regasification ante to tackle looming gas shortage

(offshore-energy.biz) Colombia’s state-owned oil and gas company Ecopetrol has handed out a contract to compatriot Puertos, Inversiones y Obras (PIO) to provide regasification services in the country’s Pacific Coast area. The new infrastructure will entail receipt and storage facilities in Buenaventura and a regasification facility with a 60 million cubic feet per day (mcfd) capacity... Continue Reading →

Supply Chain Regrouping as Trump’s Stand on Offshore Wind Takes Toll

(Reuters) Companies that committed to investments in U.S. offshore wind infrastructure and supply chains are scrapping their plans as the projects they were meant to serve face huge setbacks, including President Donald Trump's plan to end federal support. The pullback reflects the trickle-down effect of a dramatic downturn in the U.S. offshore wind industry over... Continue Reading →

UK Opens Incentive Scheme for Offshore Wind Farms

(Reuters) Britain opened an incentive scheme on Thursday for offshore wind projects, seeking to persuade developers to provide the investment to meet an ambitious goal of decarbonising the country's energy system by 2030. The scheme, called the 'Clean Industry Bonus', will provide successful bidders with an initial 27 million pounds ($33.5 million) in funding for... Continue Reading →

Norway’s wealth fund sticks to investments in renewables despite market setbacks

(Reuters) - Norway's $1.8 trillion wealth fund, the world's largest, remains committed to investments in renewable assets despite recent market setbacks and will seek opportunities in both the listed and private markets, a senior fund official said on Thursday. Renewable energy assets have significantly underperformed in the market in 2024, with some previous investor favourites... Continue Reading →

Global energy transition investment exceeded $2 trln last year, report shows

(Reuters) - Global investment in low-carbon energy transition exceeded $2 trillion for the first time last year, a report by BloombergNEF showed on Thursday. WHY IT'S IMPORTANT Countries around the world are investing in and developing cleaner sources of power and infrastructure to meet climate targets under the Paris Agreement but many experts say the... Continue Reading →