(Reuters) - Exxon Mobil on Friday beat Wall Street's third quarter profit estimate, boosted by strong oil output in its first full quarter that includes volumes from U.S. shale producer Pioneer Natural Resources. Oil industry earnings have been squeezed this year by slowing demand and weak margins on gasoline and diesel. But Exxon's year-over-year profit fell 5%,... Continue Reading →

Hess posts quarterly profit beat as Guyana oil output stays strong

(Reuters) - Hess Corp beat estimates for third-quarter profit on Wednesday, helped by higher oil production in Guyana. The Guyana assets are at the center of an ongoing dispute between oil giants Chevron and Exxon that has delayed Chevron's $53 billion takeover of Hess. Hess agreed to the buyout last October, but the deal has been challenged by... Continue Reading →

TechnipFMC posts solid Q3 2024 results, citing strong execution and growth prospects

(oilnow.gy) TechnipFMC reported third-quarter 2024 revenues of US$2,348.4 million, with a net income of US$274.6 million, or US$0.63 per diluted share. Adjusted net income, which accounts for after-tax charges, was US$280.5 million, or US$0.64 per share. Key factors impacting adjusted net income included a US$60.6 million non-cash tax benefit and an $8.4 million after-tax foreign... Continue Reading →

Omni Táxi Aéreo selected by Equinor Brasil to serve offshore contract in the Santos Basin

(TN) Omni Táxi Aéreo, an affiliate of the Omni Helicopters International (OHI) Group, has been selected by Equinor Brasil to operate a new contract, providing aerial support for offshore activities in the Bacalhau field, located in the Santos Basin. The region, which is currently under development, will receive one of the largest FPSOs in the... Continue Reading →

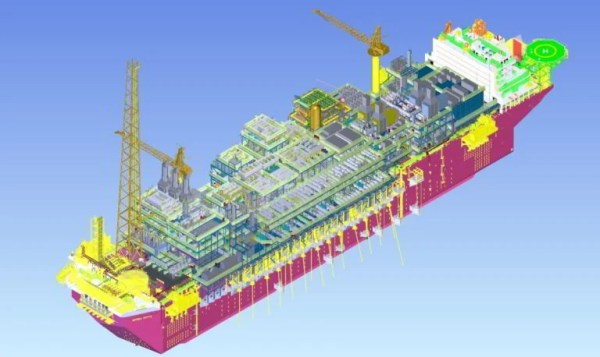

One of the largest investments in Guyana’s history on track for 2025 start-up

(oilnow.gy)Guyana is set to witness the startup of its fourth oil development, Yellowtail—one of the largest investments ever made in the country. Priced at US$10 billion, this project is spearheaded by ExxonMobil and its Stabroek Block partners Hess and CNOOC. The Yellowtail project will feature the ONE GUYANA floating production storage and offloading (FPSO) vessel,... Continue Reading →

Jaguar FPSO to follow Liza Unity model – SBM Offshore CEO

(oilnow.gy) SBM Offshore’s Chief Executive Officer, Øivind Tangen confirmed that the upcoming Jaguar floating production storage and offloading vessel (FPSO) will be executed with the same team and expertise that handled the Liza Unity FPSO. “We inherently bring all the learnings from [Liza] Unity and the execution of [Liza] Unity into that project,” said Tangen said in an... Continue Reading →

Modec announces progress on Guyana bound FPSO Errea Wittu

Japan’s Modec has made further progress in the construction of a hull for a floating production, storage and offloading unit (FPSO) that will be deployed at ExxonMobil’s fifth oil development in the Stabroek block, offshore Guyana. The company announced the completion of the hull assembly of the FPSO Errea Wittu, 40 days ahead of schedule.... Continue Reading →

Deepwater Investments Outpacing Shale

By Alex Kimani (oilprice.com) Over the past two decades, the shale revolution largely pushed aside interest in the exploration and development of offshore hydrocarbons. The combination of hydraulic fracturing and horizontal drilling enabled the United States to significantly increase its production of oil and natural gas from tight oil formations, with the Shale Patch accounting for 36% of... Continue Reading →

Guyana among key threats to OPEC’s dominance, says IEA

(oilnow.gy) Guyana is emerging as a significant threat to OPEC’s dominance, according to the International Energy Agency’s (IEA) 2024 World Energy Outlook, released on October 16. The IEA predicts that OPEC’s market share will drop from its current 34% to 33% by 2030, its lowest level since the 1980s, before rebounding to 40% by 2050. ... Continue Reading →

Investments in the global FPSO sector grew 50% in 2023 and is expected to continue to rise in 2024

(PN) The FPSO market saw a 50% increase in investments — from US$6 billion to US$9 billion — related to the surface capital of new projects in 2023, a trend that is expected to continue in 2024. The data was presented this week by Rystad Energy. This growth is largely concentrated in South America, especially... Continue Reading →