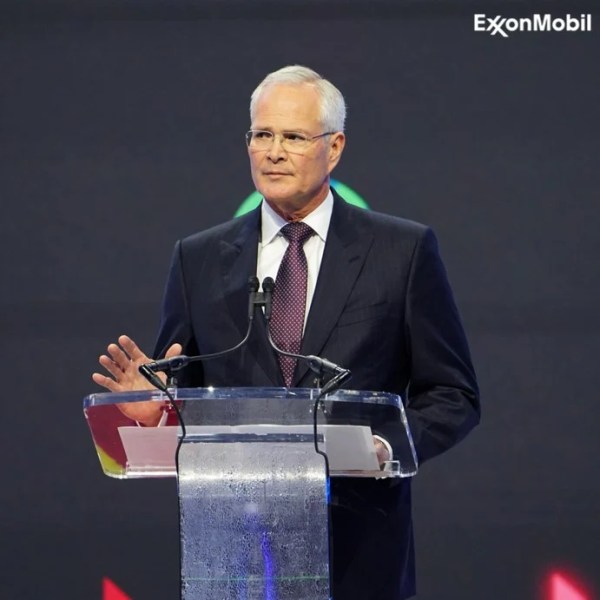

(OET) U.S.-headquartered energy giant ExxonMobil is taking several steps to slash its greenhouse gas emissions. The oil major’s CEO believes that renewables are not up to the task of handling emissions on their own, thus, the use of other technologies is seen as key to curbing emissions during the transition to a low-carbon and green... Continue Reading →

Octopus makes first investment in German offshore wind

(Reuters) - Britain's Octopus Energy said it has made its first investment in German offshore wind under plans to scale up its renewables activity in the world's third-largest market. Octopus Energy Generation has taken a 5% stake in Butendiek, an 80-turbine offshore wind farm 32 kilometres west of the island of Sylt in the North... Continue Reading →

Colombia to Take Offshore Wind Farm Bids in August 2024

(Reuters) Colombia will receive offers for offshore wind blocks in August 2024, according to a timeline published by the government on Friday, following a presentation it gave to private companies and European government representatives. The government of President Gustavo Petro, Colombia's first leftist leader, has said he intends to wean the Andean country off its... Continue Reading →

With $64.5 billion merger in the works, ExxonMobil set on reinforcing US energy security and curbing emissions

(OET) U.S.-headquartered energy giant ExxonMobil is in the process of expanding its footprint in the U.S. even further, thanks to a definitive agreement to acquire Pioneer Natural Resources in an all-stock transaction, which has an implied total enterprise value, including net debt, of approximately $64.5 billion. The oil major believes that this deal will strengthen the... Continue Reading →

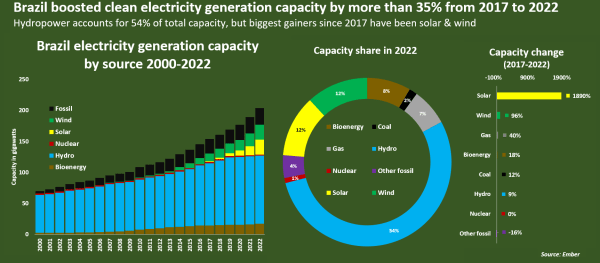

Brazil set to widen lead as cleanest major power sector

(Reuters) - Brazil generated nearly 93% of its electricity from clean sources during the first nine months of 2023, up more than 2 percentage points from the same period in 2022 and the largest clean-power share among major economies. France has historically boasted the cleanest power sector among top economies, but has lost ground to... Continue Reading →

Petrobras on reserves of the Equatorial Margin

Petróleo Brasileiro S.A. – Petrobras, in relation to media reports on the existence of reserves of 5.6 billion barrels of oil in blocks of the equatorial margin in the Amazon region of Amapá, clarifies that the company does not inform or make public the volumetric potential in exploratory areas. As disclosed on 05/18/2023, Petrobras is... Continue Reading →

Britain’s Octopus Energy to invest $20B Globally in Offshore Wind by 2030

(Reuters) Renewables investor Octopus Energy Generation plans to invest $20 billion in offshore wind by 2030, aiming to boost energy security and reduce dependence on fossil fuels, it said on Monday. The firm, part of Octopus Energy Group, said the investment will generate 12 gigawatts (GW) of renewable electricity each year, enough to power 10... Continue Reading →

Danish Green Energy Investor CIP Secures $6B for New Fund

(Reuters) Danish green investment company Copenhagen Infrastructure Partners (CIP) has raised 5.6 billion euros ($6.13 billion) for its latest fund and expects to meet its full 12 bln euro target amid undiminished global investor appetite, it said on Monday. The investors necessary to meet the overall target for its fifth flagship fund - Copenhagen Infrastructure... Continue Reading →

The World Needs 200,000 More Offshore Wind Turbines – Where Will They All go?

(OE) To reach net zero, the world may need as many 200,000 offshore wind turbines generating 2,000 gigawatts (GW) of energy. To put this in context, by the end of 2022, 63 GW of offshore wind capacity had been installed worldwide. Within the next 28 years, the offshore wind energy sector needs to expand so that it is capable of producing... Continue Reading →

Oil giants drill deep as profits trump climate concerns

(Reuters) - Oil and gas companies have intensified the hunt for new deposits in a long-term bet on demand, as they reinvest some of the record profits from the fossil fuel price surge driven by the Ukraine war, according to data and industry executives. The exploration revival - on the part of European majors in... Continue Reading →