Norway's Equinor has submitted a bid for ‘shovel-ready’ Empire Wind 1 offshore wind project to New York’s expedited fourth wind solicitation. If awarded, Empire Wind 1 is expected to provide first power in 2026, and will be able to deliver renewable power to more than half a million New York home, according to Equinor. Already several years into development,... Continue Reading →

Milei Suspends Plan to Privatize Argentina State Oil Company YPF

(Bloomberg) -- The privatization of state-run oil company YPF SA is no longer included in sweeping reforms that President Javier Milei is trying to get approved by Argentina’s congress, according to a summary of the legislation circulated by the government Monday. The so-called omnibus bill, currently up for debate in the lower house, was changed... Continue Reading →

Guyana Expects $2.4 Billion in Oil Revenue in 2024 as Output Rises

(Reuters) Guyana said it expects to receive some $2.1 billion from oil exports and $320 million from royalties this year as crude production continues to rise, an increase from the $1.62 billion received in 2023. The South American nation's gross domestic product is expected to increase by 34.3% in 2024, the fifth consecutive year of... Continue Reading →

Angola’s OPEC exit opens way for more Chinese investment

(Reuters) - Angola's decision to leave the Organization of the Petroleum Exporting Countries could open the way for Beijing to increase investment in the country's oil and other sectors, as part of a deepening of decades-old ties. Angola said on Thursday it was leaving OPEC, effective from Jan. 1, following a row with the producer group... Continue Reading →

Argentina will not face $16.1 billion YPF judgment in US while it appeals

(Reuters) - Argentina persuaded a U.S. judge not to enforce a $16.1 billion judgment arising from the government's 2012 seizure of majority control in oil company YPF (YPFD.BA) while the cash-strapped country appeals the judgment. In a decision on Tuesday, U.S. District Judge Loretta Preska in Manhattan agreed to suspend enforcement until Dec. 5 without requiring Argentina... Continue Reading →

Argentina’s presidential candidates face $12 billion energy subsidy conundrum

(Reuters) - Argentina has a $12 billion energy conundrum: what to do about state subsidies that keep prices at a minimum for two-thirds of consumers, a popular measure that is straining state coffers and a deal with the International Monetary Fund (IMF). Those subsidies, that keep energy bills at under 15% of normal, will play... Continue Reading →

Argentina braces for election with economy in ‘intensive care’

Unfortunately it is a perpetual rerun of the same movie... (Reuters) - As Argentina prepares for a crunch presidential election, the old adage rings true: 'it's the economy, stupid'. Inflation is at 138%, net reserves of foreign currency are in the red, savers are ditching the peso, and a recession is looming. The country goes... Continue Reading →

Biden selects 7 hydrogen hubs across 16 states for $7 billion in US grants

(Reuters) - President Joe Biden will announce in Philadelphia on Friday the recipients of $7 billion in federal grants for the development of regional hydrogen hubs, advancing a key part of his administration's broader plan to decarbonize the U.S. economy. Seven proposed hubs spanning 16 states from Pennsylvania to California were selected in the program,... Continue Reading →

Petrobras Estimates 5.6 Bln Barrels of Oil in Equatorial Margin Block -minister

(Reuters) Studies by Brazilian state-run oil company Petrobras show that a single oil block of Amapa's equatorial margin could total more than 5.6 billion barrels of oil, the country's mines and energy minister said on Friday. Alexandre Silveira's remarks come as the oil giant bids to drill a well at the mouth of the Amazon... Continue Reading →

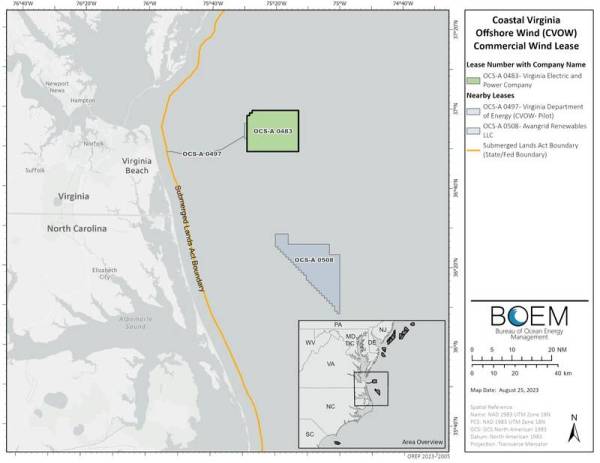

U.S. BOEM Completes Environmental Review of Coastal Virginia Offshore Wind Project

(OE) The U.S. Bureau of Ocean Energy Management (BOEM) said Monday it had completed its environmental review of the proposed 3GW Coastal Virginia Offshore Wind (CVOW) commercial project, which BOEM estimates could power about 1 million households, if approved. “The completion of our environmental review marks another step towards a clean energy future—one that... Continue Reading →