(PN) Brazil is expected to receive around R$10 billion in investments this year in oil and gas blocks that are in the exploration phase. The data was presented by the National Petroleum Agency (ANP), in the Annual Exploration Report (available on the ANP website). Of this amount, the offshore environment will receive R$9.50 billion, of... Continue Reading →

BP notifies ANP discovery of oil signs in the Pau Brasil block

(PN) British oil company BP has notified the National Petroleum Agency (ANP) about the discovery of oil signs in the pioneer well of the Pau Brasil block, in the pre-salt layer of the Santos Basin. As we reported, the well (which received the technical name 1-BP-12D-RJS) is located in a water depth of 2,283 meters... Continue Reading →

Namibia: The Newest Most Promising Deepwater Rig Demand Hotspot

Teresa Wilkie, Contributor Research Director of RigLogix at Westwood Global Energy.. (OE) Over the past few years the Namibian Orange Basin has emerged as an exciting new oil province and subsequently a provider of significant new demand and future demand potential for deepwater drilling rigs. According to Westwood’s Wildcat, “the Upper and Lower Cretaceous plays opened in... Continue Reading →

New drilling technology to put billions of barrels of oil in reach, analysts say

(Reuters) - An oil production breakthrough that producers say can safely tap ultra-high pressure fields could put up to 5 billion barrels of previously inaccessible crude into production, analysts said. Chevron on Monday disclosed it had pumped first oil from a field at 20,000 pounds per square inch pressures, a third greater than any prior well. Its... Continue Reading →

Report: ‘Big 3 offshore drillers’ reporting increasing day rates, ‘robust’ outlook

By Bruce Beaubouef, Managing Editor (Offshore-mag.com) The “Big 3” offshore drillers – listed as Transocean, Noble Corp., and Valaris by Evercore ISI – are all reporting “strong offshore fundamentals and a robust outlook” that will likely stretch out to 2030, according to a recent report by the oilfield marketplace consulting firm. Evercore based its analysis... Continue Reading →

Occidental Petroleum and Ecopetrol to Drill World’s Deepest Offshore Oil Well

(Oilprice.com)U.S. shale producer Occidental Petroleum Corp. (NYSE:OXY) and Colombia's integrated energy company Ecopetrol S.A. (NYSE:EC) are planning to drill an offshore oil well off Colombia's waters in seas roughly 3,900 meters (close to 13,000 feet) deep before the year is out, Bloomberg has reported. Dubbed Komodo-1, the ultra-deepwater well will qualify as the deepest offshore oil well in the world, beating... Continue Reading →

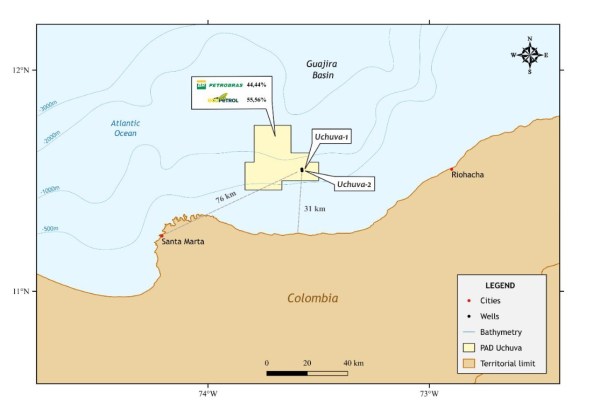

Petrobras confirms gas discovery in Colombia

Petrobras, following up on the release disclosed on 07/29/2022, informs that it has achieved the main target of the Uchuva-2 well, confirming the extent of the gas Discovery made in 2022 with the drilling of the Uchuva-1 well. This well adds relevant information for the development of a new frontier of exploration and production in... Continue Reading →

BW Energy updates offshore Brazil, Gabon workover programs

Production from the Golfinho license in the Espírito Basin offshore Brazil has been impacted recently by reduced gas-lift compressor uptime from the GLF-28 well, operator BW Energy said in an update. However, the well is now back online following ROV intervention, with a program underway to improve reliability. During August, the company plans a 12-day shutdown on... Continue Reading →

Archer Acquires Argentinian Managed Pressure Drilling Firm

(OE) Oilfield services firm Archer has entered into an agreement with Air Drilling Associates to acquire its managed pressure drilling (MPD) subsidiary ADA Argentina. ADA provides MPD services to Archer's largest customers in the Vaca Muerta basin in Argentina. MPD is an adaptive drilling process used to precisely control the annular pressure profile throughout the... Continue Reading →

Valaris Nets $715M in Rig Contract Awards and Extensions in Last Three Months

(OE) Offshore drilling company Valaris has secured approximately $715 million in new contracts and extensions since its last fleet status report issued three months ago. Contract backlog of $715 million excludes lump sum payments such as mobilization fees and capital reimbursements, according to Valaris, which marked contract backlog increase to approximately $4.3 billion from approximately... Continue Reading →