SBM Offshore confirms it has completed the transactions related to the Share Purchase Agreements announced on September 6, 2024 with its partner MISC Berhad for: i) the acquisition of MISC Berhad’s entire effective equity interest in the lease and operating entities related to the FPSO Espirito Santo in Brazil; and ii) the full divestment to MISC Berhad... Continue Reading →

Brava Energia on the process of possible sale of onshore and shallow water assets

BRAVA ENERGIA S.A. (“BRAVA” or “Company”) (B3:BRAV3), pursuant to CVM Resolution No. 44, following the material facts disclosed on December 27, 2024 and January 10, 2025, hereby informs its investors and the market in general that, in a meeting held on January 23, 2025, the Board of Directors deliberated on the qualified bidders for the... Continue Reading →

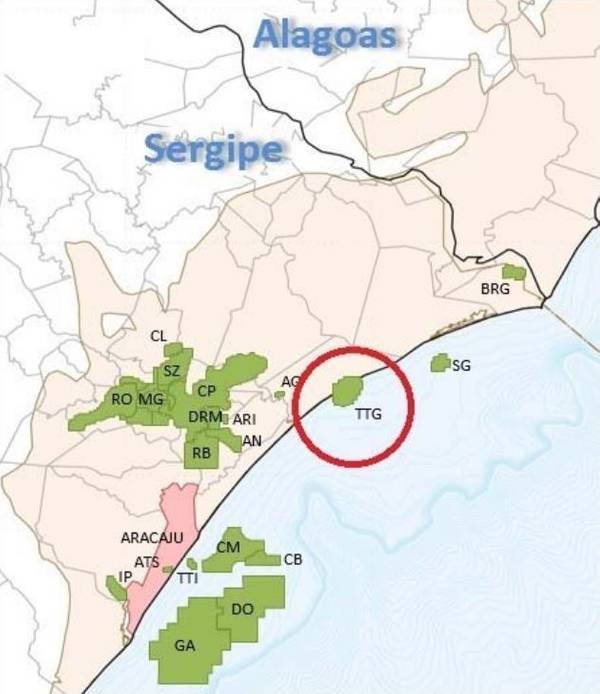

Petrobras begins the Binding Phase of the Tartaruga Field in the Sergipe-Alagoas Basin

Petróleo Brasileiro S.A. - Petrobras, further to the notice disclosed on November 27, 2024, hereby announces the start of the binding phase for the total transfer of its 25% minority interest in the exploration, development, and production of oil and natural gas in the Tartaruga Field, located in the municipality of Pirambu-SE, in shallow waters... Continue Reading →

GeoPark terminates acquisition of Repsol’s Colombian oil and gas assets

(Reuters) - GeoPark will not go ahead with its planned $530 million acquisition of Spain-based Repsol's oil and gas production assets in Colombia, the company said on Tuesday. The acquisition, announced in November, included Repsol's oil extraction operation in central Colombia and a 25% stake in SierraCol Energia Arauca. The termination comes after Repsol's partner in SierraCol exercised its... Continue Reading →

ExxonMobil Braces for Lower Quarterly Earnings Statement

(Reuters) Exxon Mobil signaled on Tuesday that sharply lower oil refining profits and weakness across all its businesses would reduce its fourth-quarter earnings by about $1.75 billion from the prior quarter. The oil major also said in an SEC filing that upstream asset sales would benefit results by about $400 million, but overall impairments would... Continue Reading →

Hexicon Signs Second Credit Facility Extension to Support Company During Planned Divestments

(offshoreWIND.biz) Swedish floating wind developer Hexicon has extended a credit facility the company secured earlier to provide support during a period of planned divestments until 30 June 2025. For financing, which amounts to SEK 75 million (approximately EUR 6.6 million), Hexicon signed an agreement with Wallstreet Aktiebolag, part of the Wallenius Group, and a group... Continue Reading →

Brava Energia shares soar on potential asset sales, oilfield resumption

(Reuters) - Shares of Brazilian energy company Brava Energia (BRAV3.SA), opens new tab soared on Friday after it received approval from the country's oil regulator to resume output at a key oilfield and said it was in talks with banks to prepare for potential asset sales. Brava's shares rose as much as 11.5%, making it the top... Continue Reading →

Petrobras informs about termination of divestment contract for Uruguá and Tambaú fields

Petróleo Brasileiro S.A. - Petrobras, following up on the communications of September 8, 2021, October 27, 2021, March 29, 2023 and December 21, 2023, and as a result of the failure to complete the acquisition of FPSO Cidade de Santos by Enauta Energia S.A. (according to the decision communicated by that company on July 1,... Continue Reading →

Brava Energia hiring of a financial advisor to support the Company in evaluating potential partnership transactions or asset sales.

BRAVA ENERGIA S.A. (“BRAVA” or “Company”) (B3: BRAV3), pursuant to CVM Resolution No. 44, hereby informs its investors and the market in general that the Board of Directors recommended, on December 17, 2024, the hiring of a financial advisor to support the Company in evaluating potential partnership transactions or asset sales. The analysis of potential... Continue Reading →

Iberdrola Sells Share of Windanker Offshore Wind Farm to Kansai

(OE) Japan’s Kansai Electric Power has signed a share purchase agreement with Iberdrola to take part of 315 MW Windanker offshore wind project, being built in the German Baltic Sea. The Japanese electric company will co-invest in the asset through its subsidiary Windanker Investco, reaching a 49% stake, while Iberdrola will retain control with the... Continue Reading →